NCCS which stands for “New Consumer Classification System” replaces the old IRS system used for consumer classification. It is important for a marketer to understand NCCS and at least be aware of the basics of NCCS.

Simply put, Consumer Classification means segmenting the consumers on the likelihood of them buying products at different price points.

Like IRS, NCCS also uses income and education level of the chief wage earner as a basis for segmentation. However, IRS faced the problem of identifying income and then verifying it.

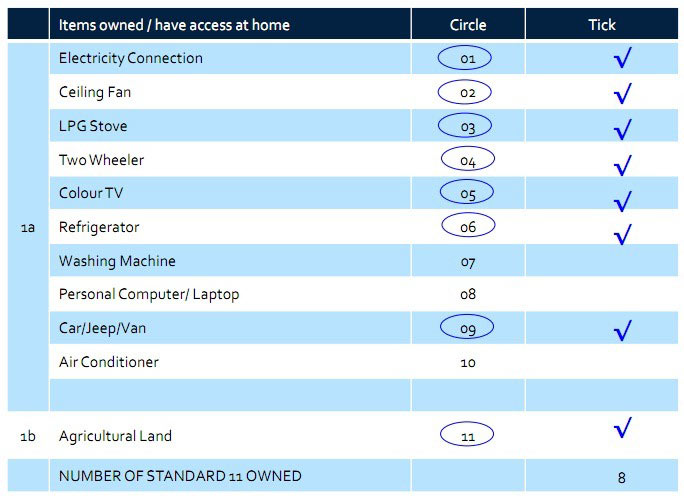

There were chances of people both understating and overstating the income. Also, there were genuine cases where the families being reported forgot to mention certain sources of income. NCCS overcame this drawback by using durable ownership as a proxy for income.

More the ownership, higher the income. The major difference between methodology of NCCS and IRS is the way income classification is done.

Other differences being while SEC was Urban only NCCS covers the entire strata. This has to do with limited or no need of rural segmentation at the time when SEC was launched.

Rural SEC was launched but used a methodology which was different from Urban or original SEC. Parameters like type of house were used in Rural SEC.

The table below should give you a good idea on the methodology of NCCS.

(Credit: Afaq)

The list of durables considered for NCCS reporting are:

Comparing NCCS and IRS, NCCS provides a better scientific methodology for consumer affordability classification. Second advantage of NCCS is that it is based on consumption and not income. This not only takes care of wrong reporting, consumption is more valuable a media planner or an advertiser. Consumption captures income of the household and more importantly the propensity of a household to spend.

Got specific questions related to NCCS? Will be happy to answer.