Does TV advertising interest and intimidate you at the same time?

On one hand, the nationwide reach of television presents a wonderful opportunity for branding and on the other, choosing the right strategy and campaign measurement poses a major concern While the credibility and upliftment promised by TV advertising are unparalleled, the budget becomes a constraint.

While everyone agrees television advertising is effective, a few pertinent questions that we receive from our clients are:

- Will television advertising work for my brand?

- Can my brand afford television advertising?

- Which channels should I choose to reach my target audience?

- Which time band would work the best for me?

- How to evaluate my TV advertising campaign?

In this series, we would make an earnest effort to simplify television advertising and answer the most common questions on television advertising in India.

In case you want us to answer your query on television advertising, you can send your query to the mail id help@themediaant.com or add your query to the comments section.

In the first article of the series, we would cover some useful facts and figures about television viewership and advertising in India, curated from reports by leading bodies like BARC, TAM, and EY. In this article, we would talk about:

- Key facts about television viewership in India

- Growth of television viewership in 2019 based on

- Channel genre

- State

- Language

- TV viewership trends across geography

- TV advertising in India: Jan 2020 to Jun 2020

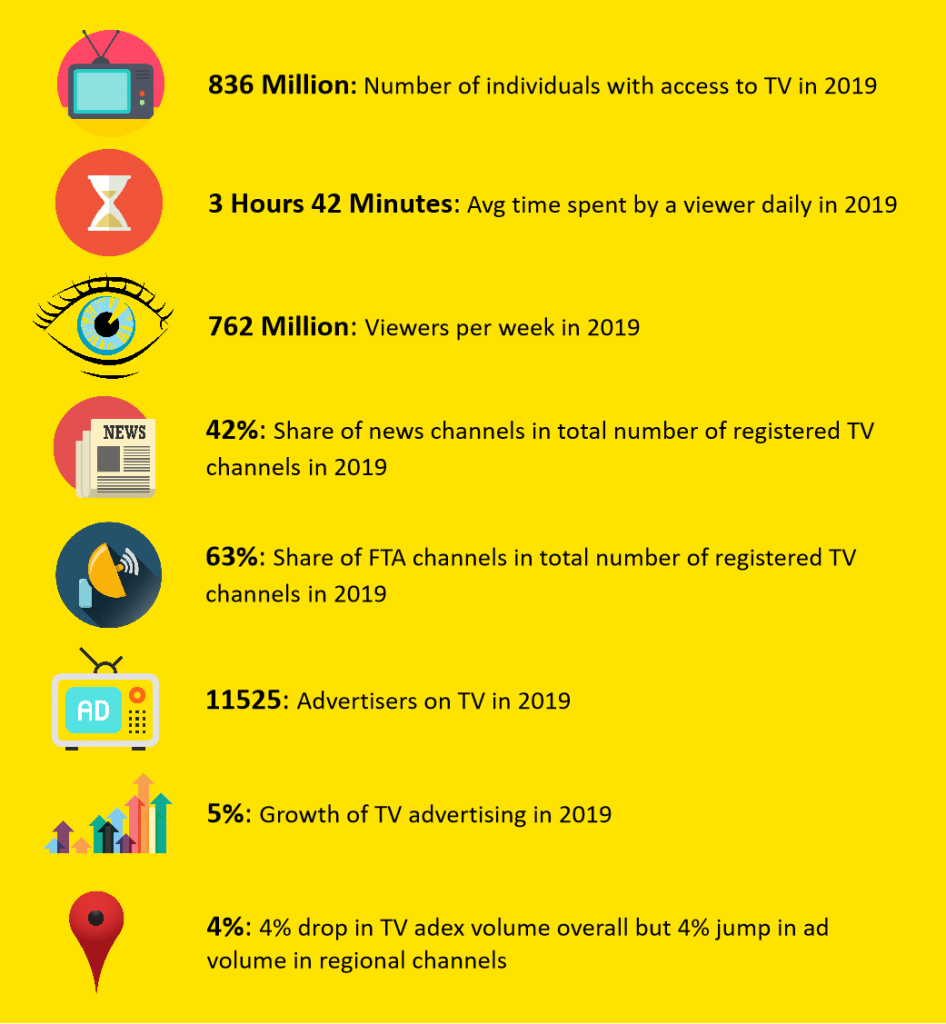

Key Facts About Television Viewership In India

Growth of Television Viewership over last 4 years- Channel Genre-wise

Channel genres play a major role when deciding which television channels one should advertise because viewers of particular channel genres often demonstrate similar demographics and behavior.

For example, the most common viewers of music channels are teenagers and youth. News channels are preferred mostly by the male population and so on.

GECs command over 50% of the total viewership followed by movies. This means entertainment overall accounts for about 75% of TV viewership. In 2019, news, music & youth and sports channels witnessed significant growth due to events like general elections, IPL, ICC World Cup, etc.

In the last 4 years, the sports genre has witnessed a very high growth in terms of total minutes consumed. This can be attributed to the increasing popularity of local sports events like IPL, KPL, ISL as well as wider acceptance for sports other than cricket.

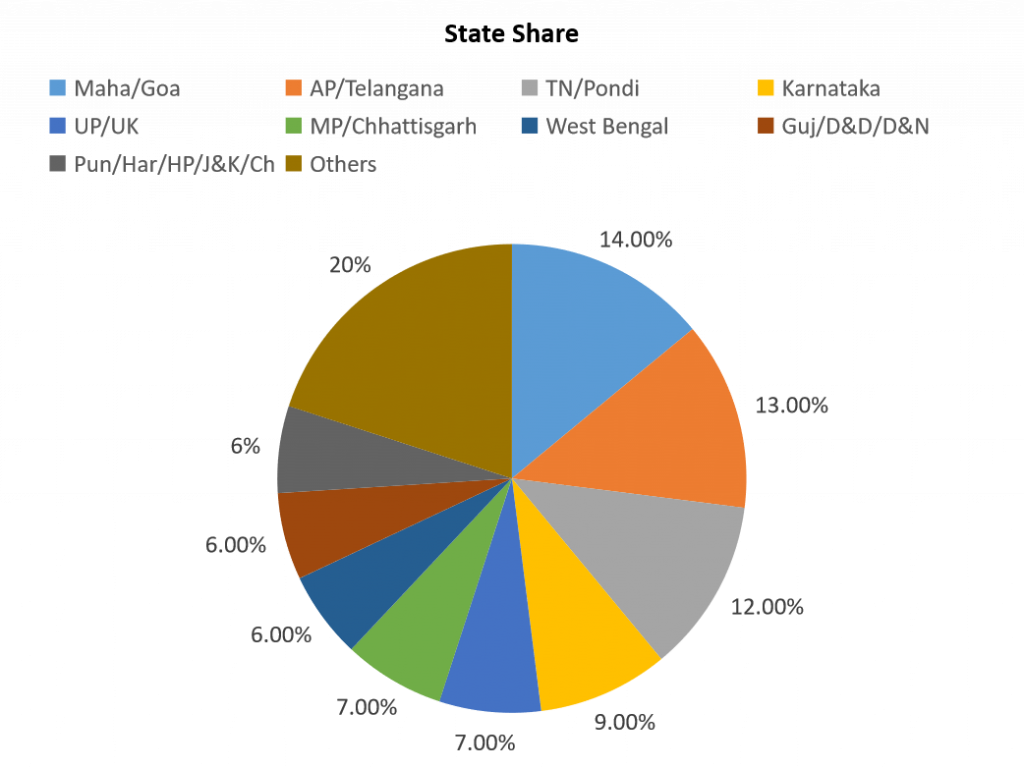

Growth of Television Viewership Over last 4 years- State-Wise

State-wise distribution of television viewership is an important piece of information for TV advertisers- both local and national brands. Brands often design their advertising campaigns keeping one or more regions in focus- advertising budget and communication are customized to suit the target markets.

Hence, when selecting the medium and channels, it is important to know the market penetration and share of the channels. Market-wise share of channels would be discussed in later articles but in the graphs above, we can see share and growth of television viewership by state/regions.

Share-wise, the southern part of India as well as the state of Maharashtra contribute the highest ~48% together. In terms of growth, North Eastern states including Assam and Sikkim have shown tremendous growth followed by MP/Chhattisgarh, Gujarat, and Odisha. According to the BARC Universe update of 2018, all these states have TV penetration between 45% and 59%.

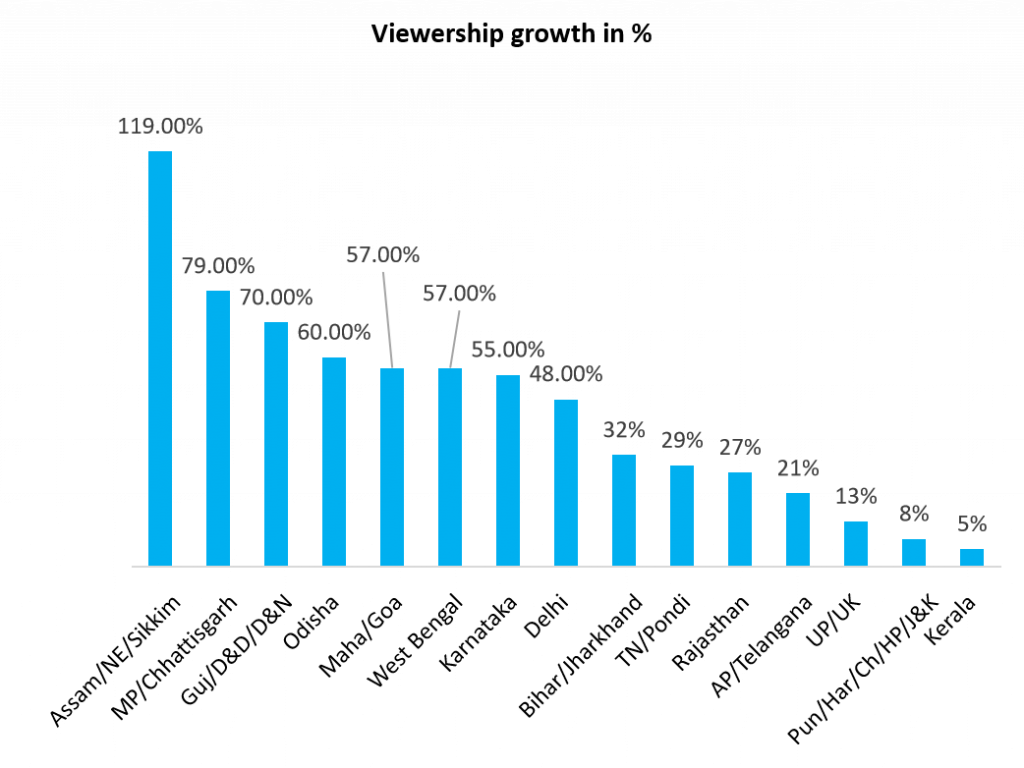

Growth of Television Viewership over last 4 years- Language-Wise

Over the last few years, demand for regional language content has increased steeply. Except Hindi, Tamil, Telugu and Malayalam which currently hold more than 70% of the TV viewership share, all other regional channels have exhibited a growth of more than 50%.

Two of the most noteworthy developments are the rise of Bhojpuri due to emergence of several Bhojpuri channels and the fall of English due to launch of Hindi and other regional sports channels and shift of the viewers to OTTs.

TV Viewership Trends Across Geography

(Viewership share is in terms of viewing minutes in their respective markets, 2+)

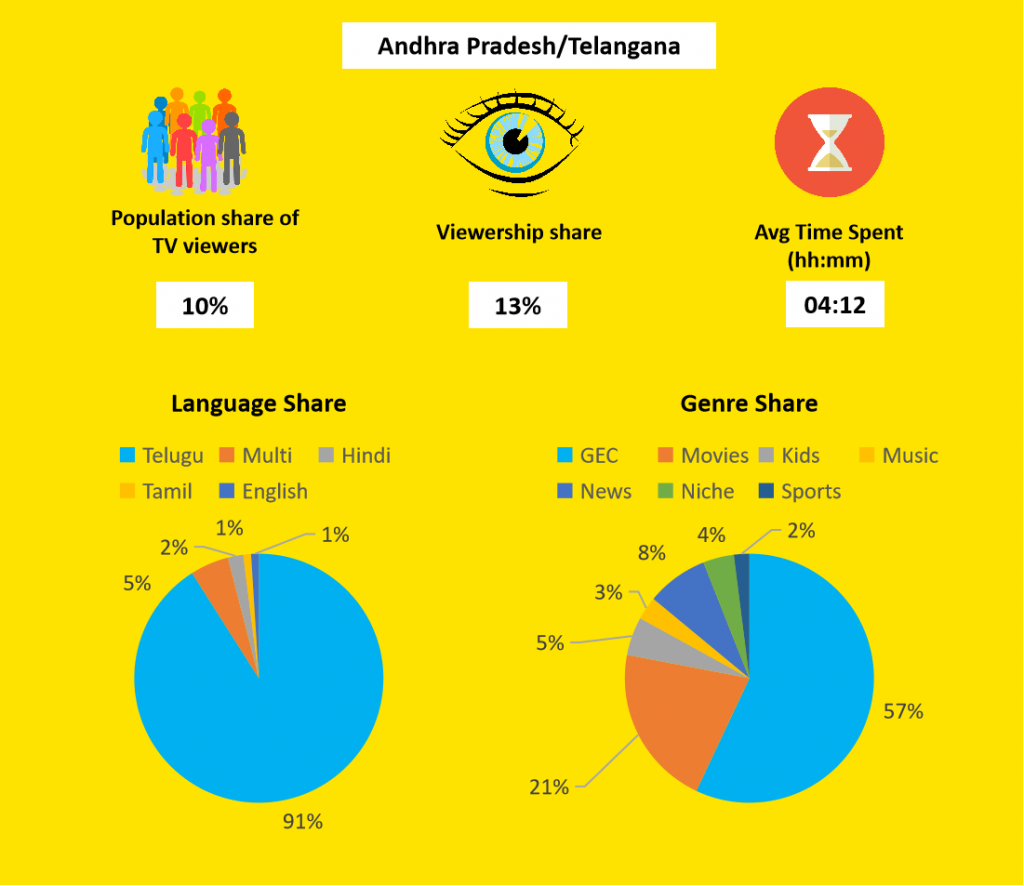

Andhra Pradesh/Telangana

Andhra Pradesh/Telangana are mature markets with more than 91% TV penetration. Population-wise they form 10% of total TV viewers in India but have a 13% viewership share. Despite the high level of urbanization and migrant population, 91% of content consumption happens in Telugu followed by Hindi (2% only). In terms of genre, GEC and movies are the primary crowd-pullers with a 78% share. News and kids genre follow with 8% and 5% viewership share respectively.

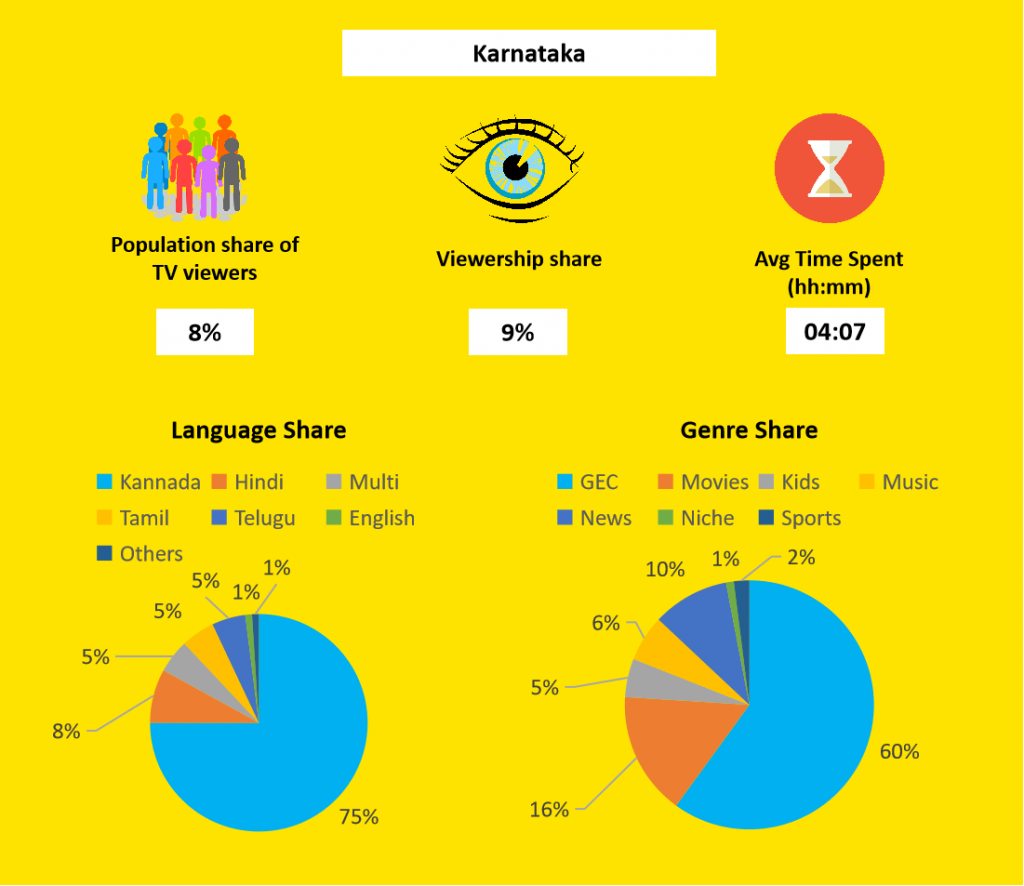

Karnataka

Karnataka has more than 91% TV penetration. Population-wise it forms 8% of total TV viewers in India but has a 9% viewership share. Karnataka has a large number of migrant populations hence language-wise, the viewership is distributed among several languages. 75% of content consumption happens in Kannada followed by Hindi (8%), Tamil (5%), and Telugu (5%). In terms of genre, GEC and movies are the primary crowd-pullers with 76% share. News and music genres follow with 10% and 6% viewership share respectively.

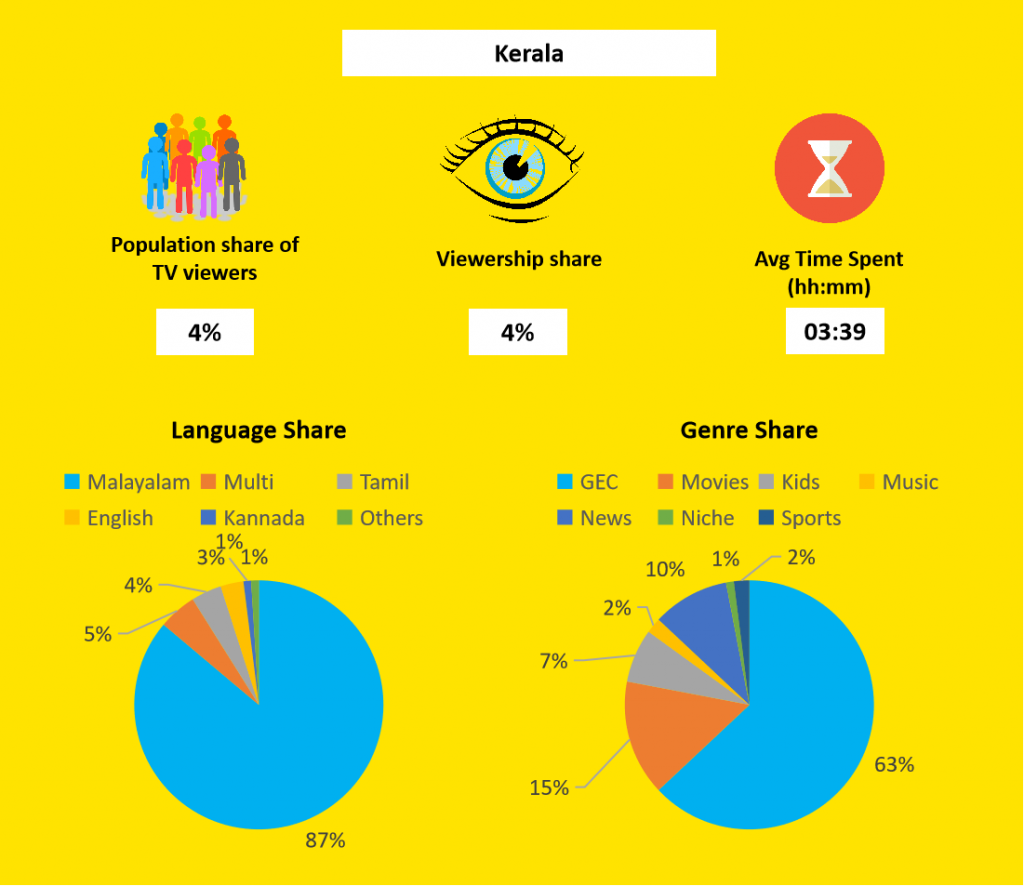

Kerala

Kerala has more than 91% TV penetration. Population-wise it forms 4% of total TV viewers in India but has a 4% viewership share. 87% of content consumption happens in Malayalam followed by Tamil (4%) and English (3%). In terms of genre, GEC and movies are the primary crowd-pullers with a 78% share. News and kids genre follow with 10% and 7% viewership share respectively.

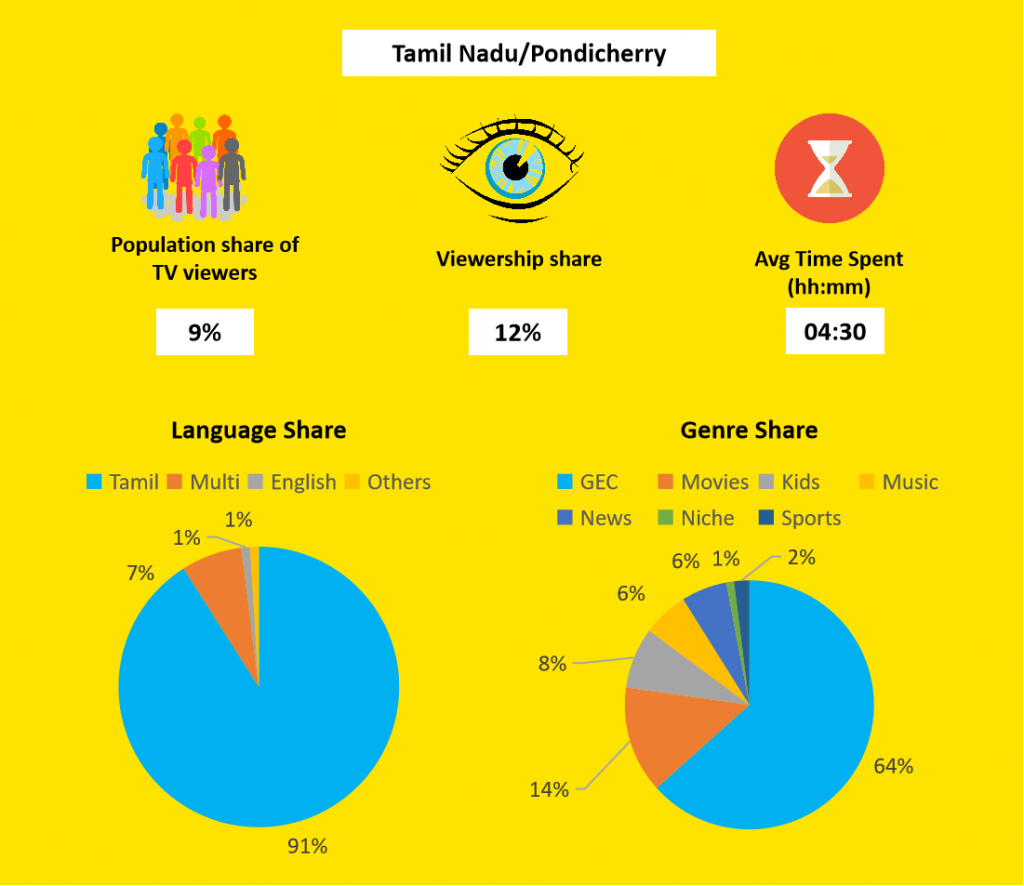

Tamil Nadu/Pondicherry

Tamil Nadu/Pondicherry has more than 91% TV penetration. Population-wise it forms 9% of total TV viewers in India but has a 12% viewership share. 91% of content consumption happens in Tamil. In terms of genre, GEC and movies are the primary crowd-pullers with a 78% share. Kids, news, and music genre follow with 8%, 6%, and 6% viewership share respectively.

Delhi

Delhi has more than 91% TV penetration. Population-wise it forms 3% of total TV viewers in India and has a 3% viewership share. 83% of content consumption happens in Hindi. In terms of genre, GEC and movies are the primary crowd-pullers with 67% share. News and kids genre follow with 12% and 10% viewership share respectively. In terms of genre, Delhi shows a change in pattern as compared to the southern states. The share of viewership in terms of GECs is lower while that of movies, news, and sports is higher.

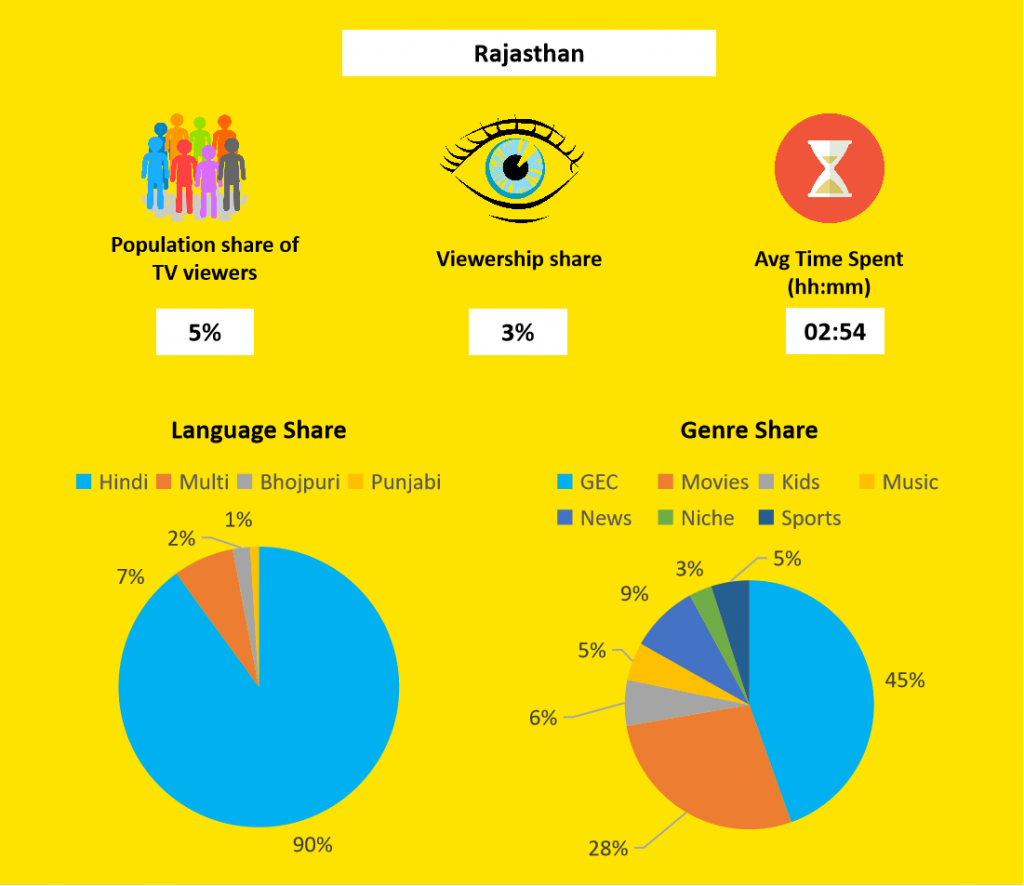

Rajasthan

Rajasthan has TV penetration in the range of 45%-59%. Population-wise it forms 5% of total TV viewers in India but has a 3% viewership share. 90% of content consumption happens in Hindi. In terms of genre, GEC and movies are the primary crowd-pullers with 73% share. News, kids, and sports genre follow with 9%, 6%, and 5% viewership share respectively.

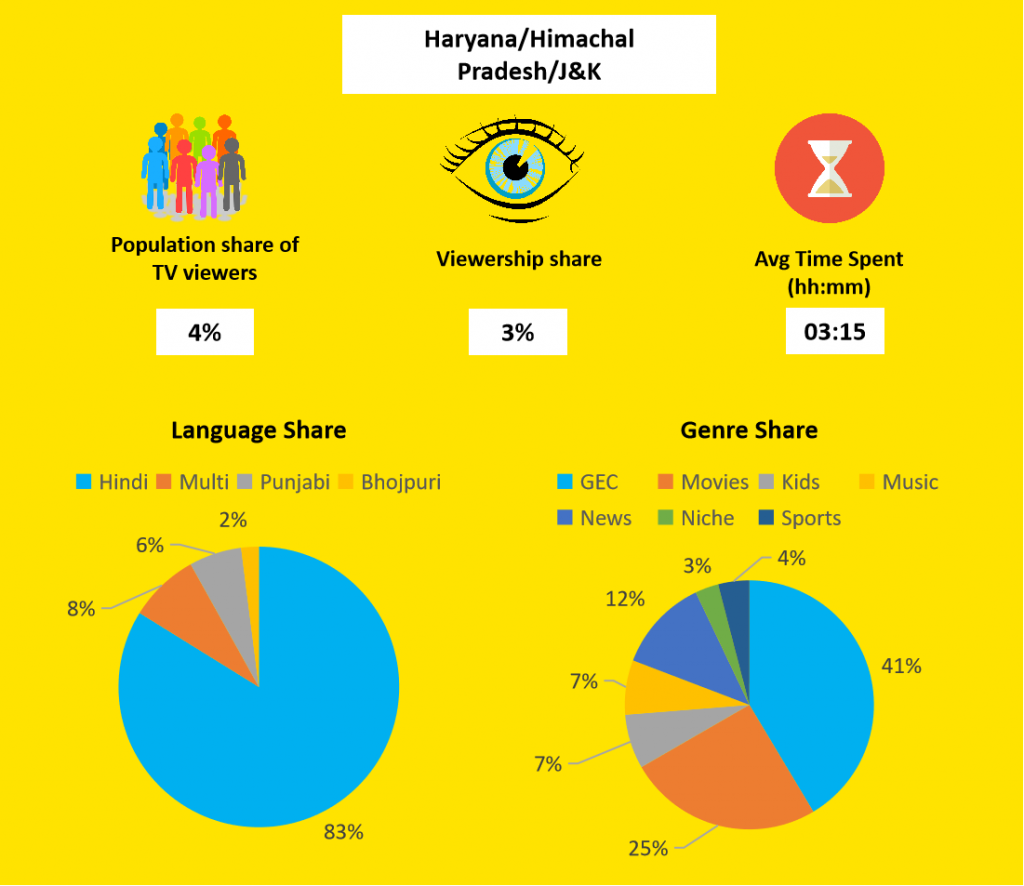

Haryana/ Himachal Pradesh /Jammu & Kashmir

Haryana/Himachal Pradesh/J&K has TV penetration in the range of 80-90%. Population-wise it forms 4% of total TV viewers in India but has a 3% viewership share. 83% of content consumption happens in Hindi. In terms of genre, GEC and movies are the primary crowd-pullers with 66% share. News, kids, and music genre follow with 12%, 7%, and 7% viewership share respectively.

Madhya Pradesh/ Chhattisgarh

Madhya Pradesh/Chhattisgarh has TV penetration in the range of 45%-59%. Population-wise it forms 8% of total TV viewers in India but has a 7% viewership share. 86% of content consumption happens in Hindi. In terms of genre, GEC and movies are the primary crowd-pullers with a 74% share. News, music, and kids genre follow with 8%, 6%, and 5% viewership share respectively.

Uttar Pradesh/ Uttarakhand

Uttar Pradesh/Uttarakhand has TV penetration in the range of 30%-45% only. Population-wise it forms 10% of total TV viewers in India but has a 7% viewership share. 84% of content consumption happens in Hindi. In terms of genre, GEC and movies are the primary crowd-pullers with 72% share. News, music, and kids genre follow with 10%, 6%, and 6% viewership share respectively.

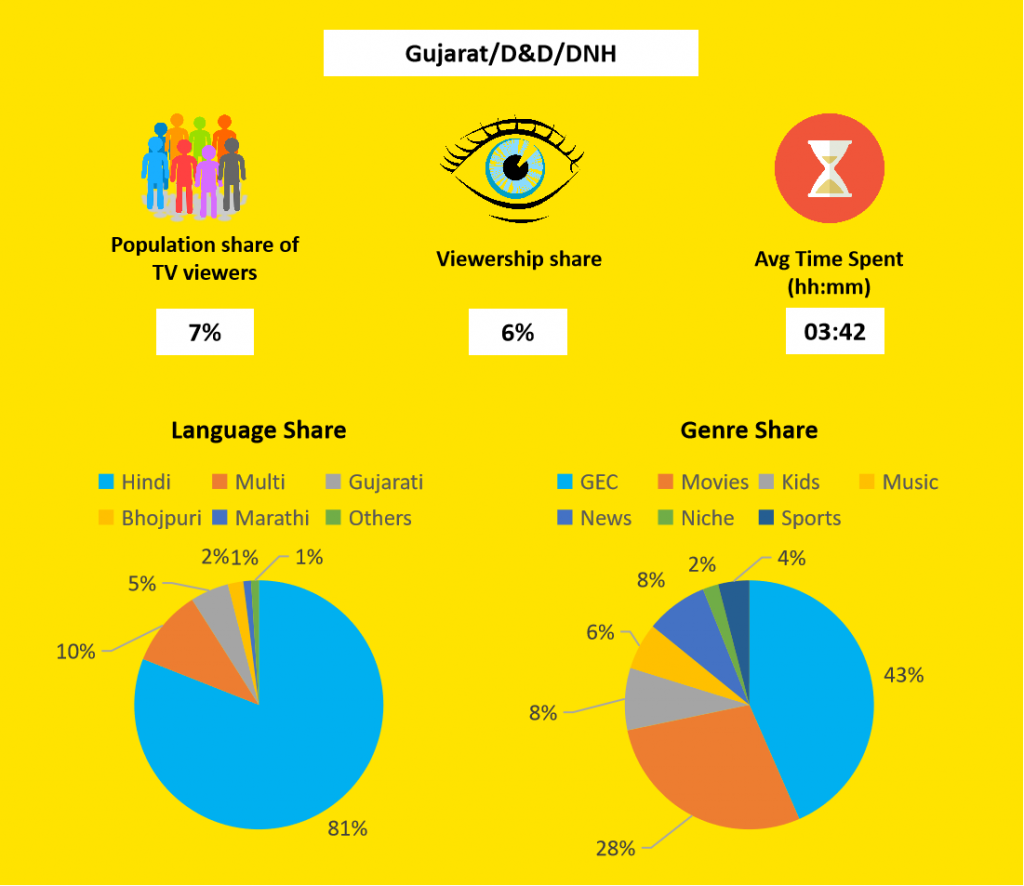

Gujarat/ Daman & Diu/ Dadar & Nagar Haveli

Gujarat/D&D/DNH has TV penetration in the range of 80-90%. Population-wise it forms 7% of total TV viewers in India but has a 6% viewership share. 81% of content consumption happens in Hindi. In terms of genre, GEC and movies are the primary crowd-pullers with 71% share. News, kids, and music genre follow with 8%, 8%, and 6% viewership share respectively.

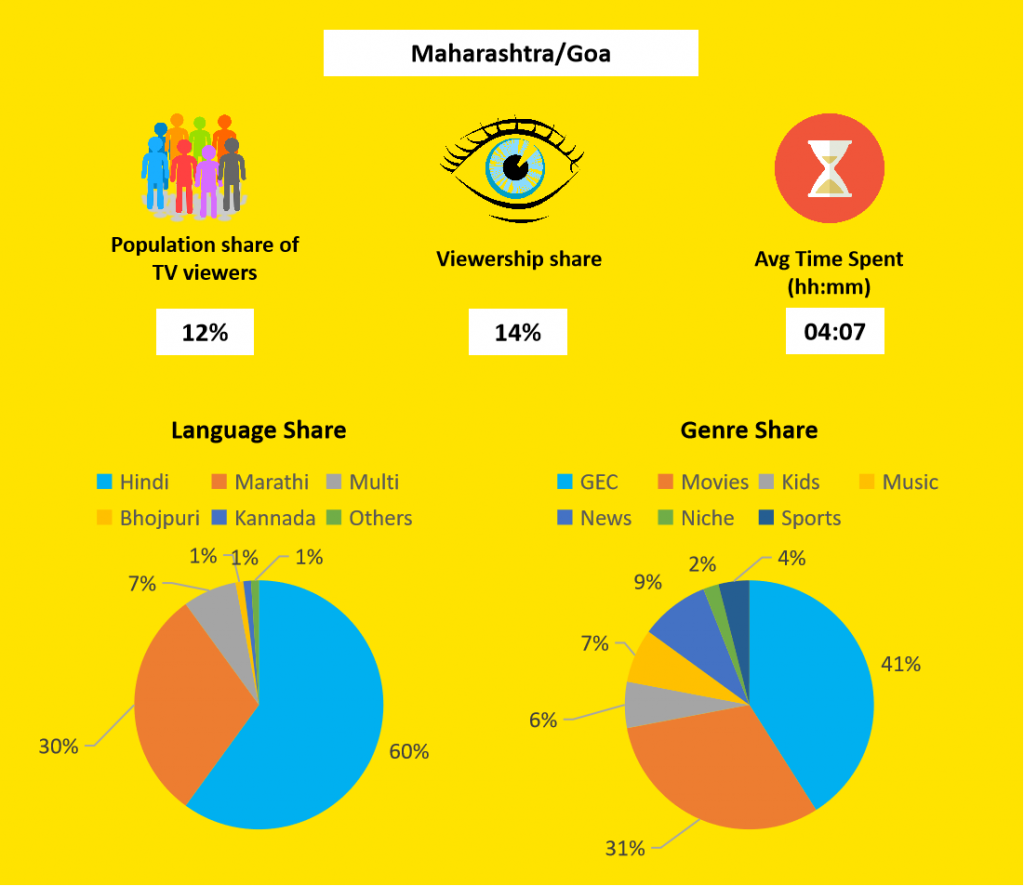

Maharashtra/ Goa

Maharashtra/Goa has TV penetration in the range of 60-79%. Population-wise it forms 12% of total TV viewers in India but has a 14% viewership share. 60% of content consumption happens in Hindi followed by Marathi (30%). In terms of genre, GEC and movies are the primary crowd pullers with 72% share. News, music and kids genre follow with 9%, 7% and 6% viewership share respectively.

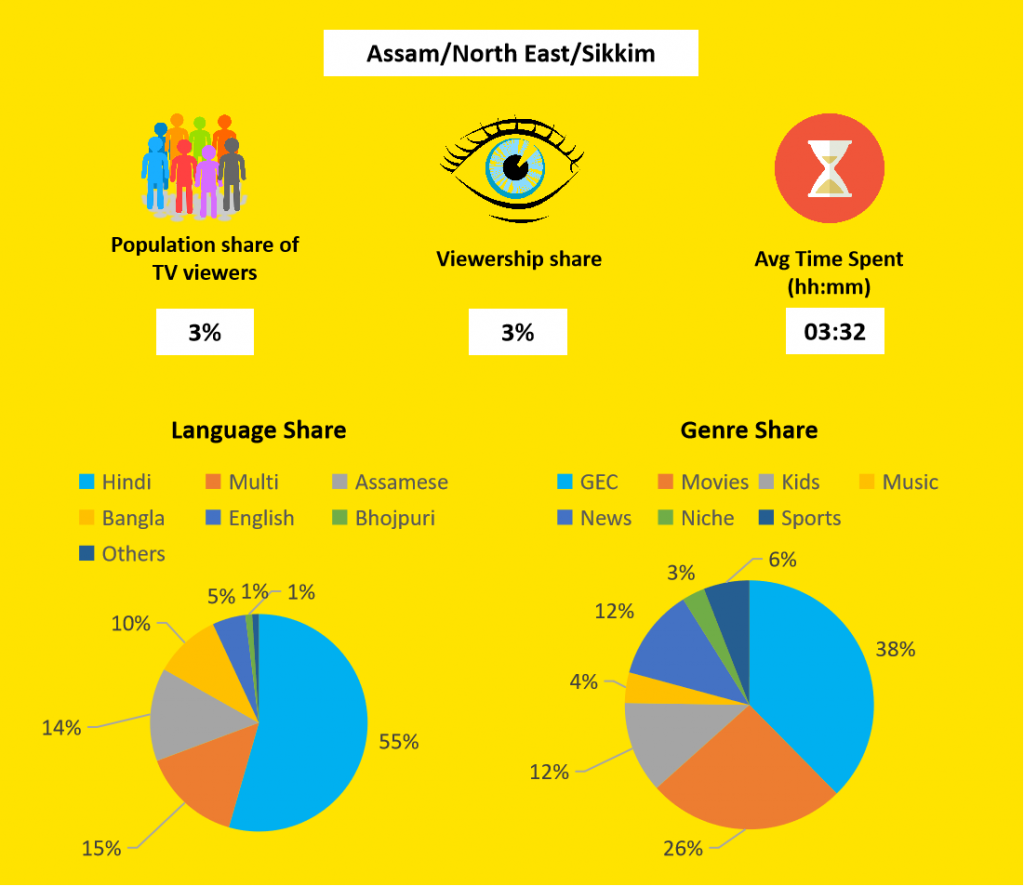

Assam/ North East/ Sikkim

Assam/North East/Sikkim has TV penetration in the range of 45-59%. Population-wise it forms 3% of total TV viewers in India but has a 3% viewership share. 55% of content consumption happens in Hindi followed by Assamese (14%) and Bangla (10%). In terms of genre, GEC and movies are the primary crowd-pullers with 64% share. News, kids, and sports genre follow with 12%, 12% and 6% viewership share respectively.

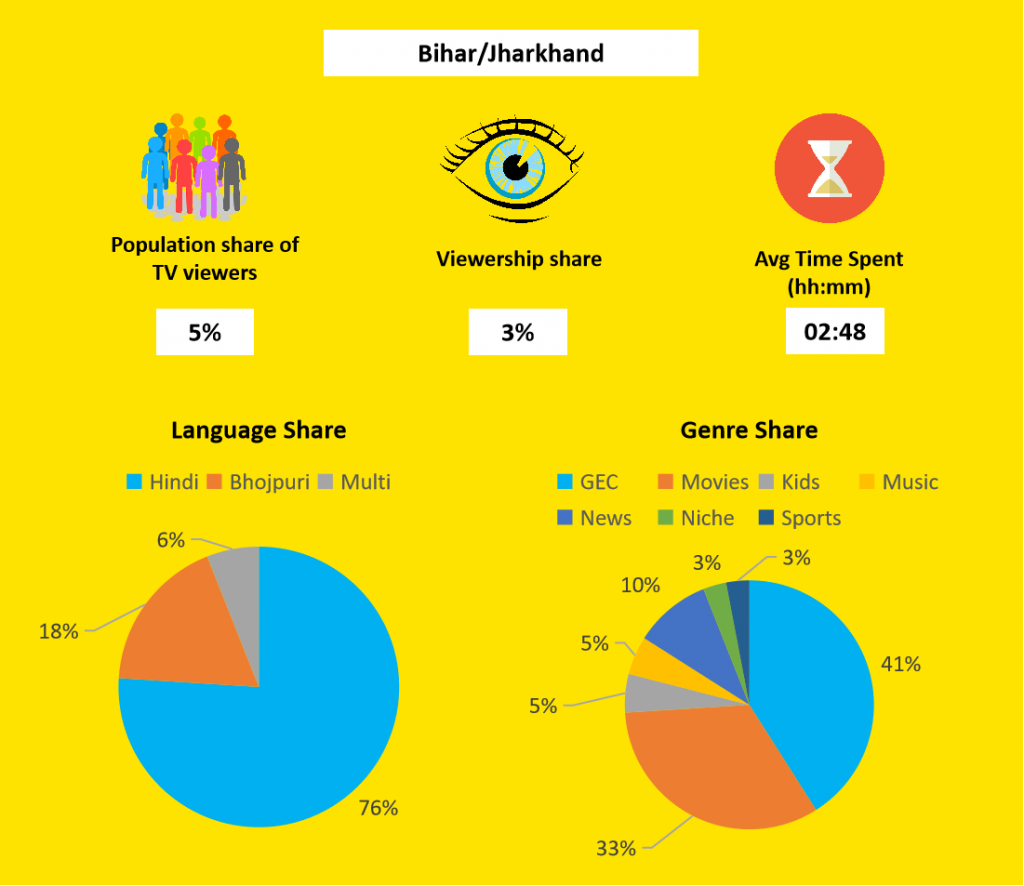

Bihar/ Jharkhand

Bihar/Jharkhand has a very low TV penetration at below 30%. Population-wise it forms 5% of total TV viewers in India but has a 3% viewership share. 76% of content consumption happens in Hindi followed by Bhojpuri (18%). In terms of genre, GEC and movies are the primary crowd-pullers with a 74% share. News, kids, and music genre follow with 10%, 5%, and 5% viewership share respectively.

Odisha

Odisha has a TV penetration between 45% and 59%. Population-wise it forms 3% of total TV viewers in India but has a 3% viewership share. 54% of content consumption happens in Oriya followed by Hindi (35%). In terms of genre, GEC and movies are the primary crowd-pullers with a 74% share. News, kids, and music genre follow with 10%, 5%, and 5% viewership share respectively.

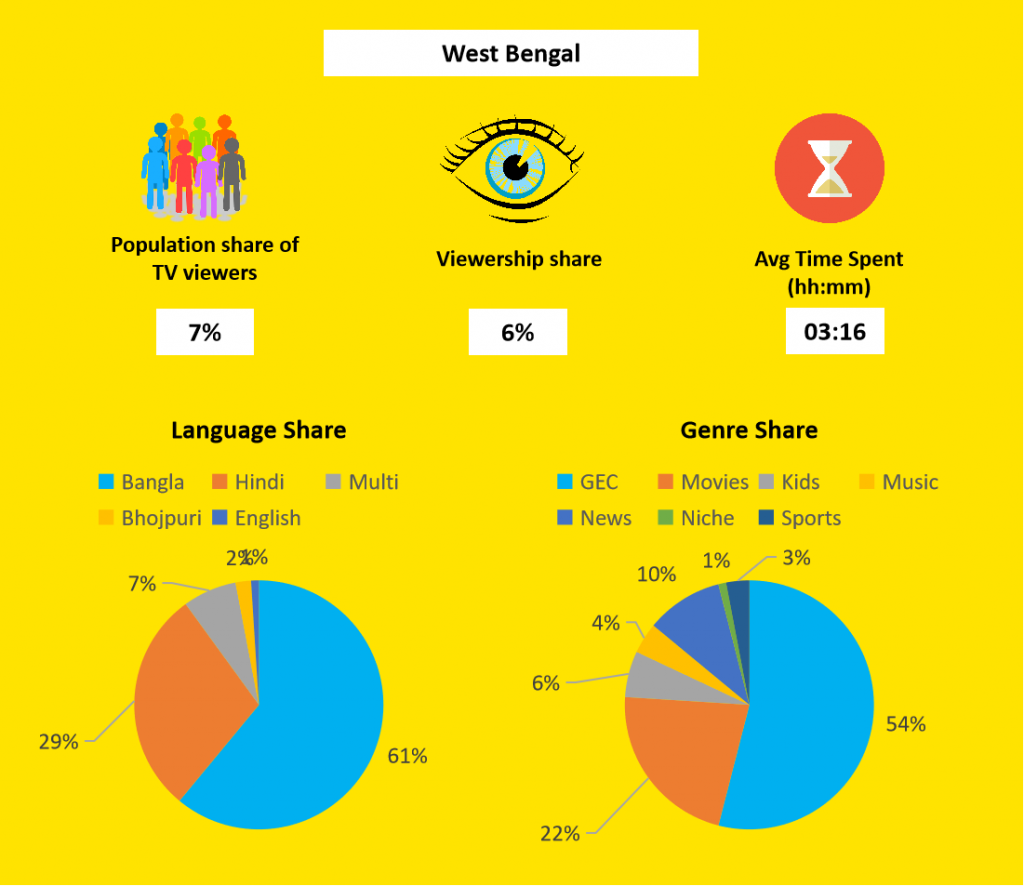

West Bengal

West Bengal has a TV penetration between 45% and 59%. Population-wise it forms 7% of total TV viewers in India but has a 6% viewership share. 61% of content consumption happens in Bangla followed by Hindi (29%). In terms of genre, GEC and movies are the primary crowd-pullers with 76% share. News, kids, and music genre follow with 10%, 6%, and 4% viewership share respectively.

TV viewership across Geography: Insights

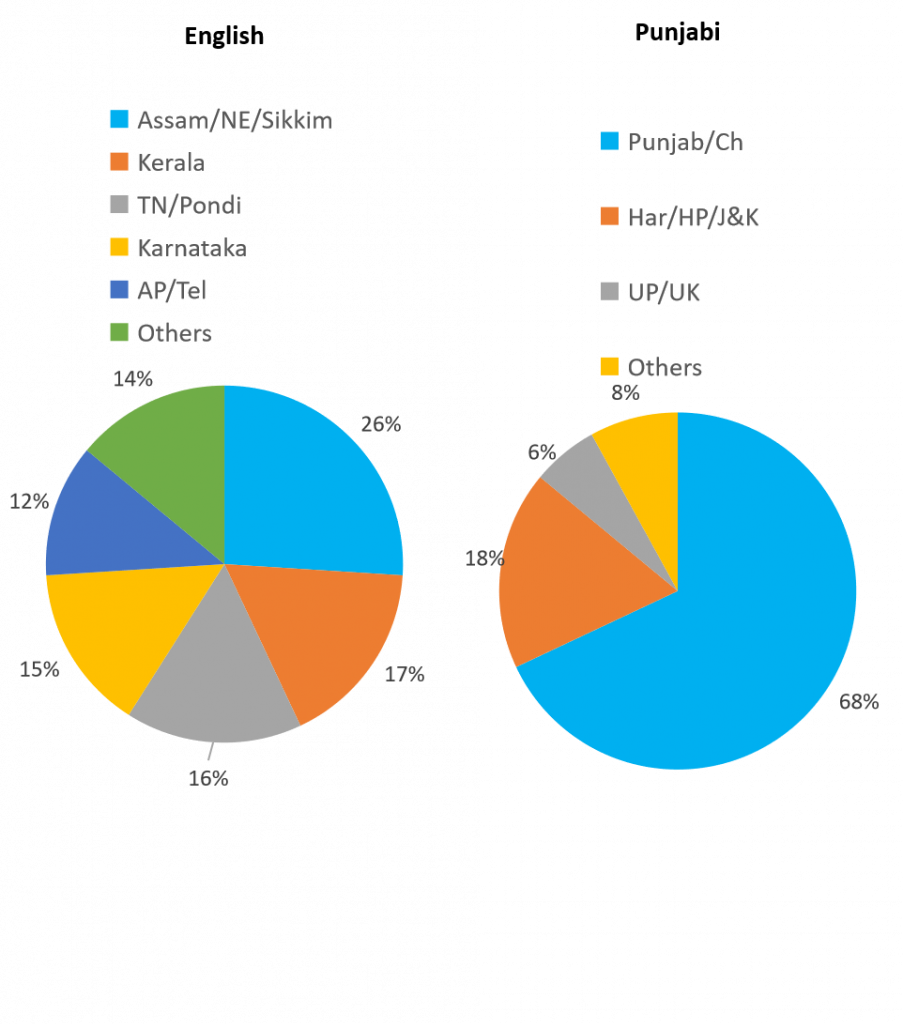

- While regional languages like Telugu, Tamil, Kannada, Malayalam, Gujarati, Marathi, Assamese, Bangla and Oriya account for more than 90% viewership in their respective states, consumption of languages like Hindi, Bhojpuri, Punjabi and English is distributed across states.

- In terms of state-wise share of genres in comparison to the individual state share of viewership,

- The southern states of Andhra Pradesh/Telangana, Karnataka, and Tamil Nadu/Pondicherry showed a preference for GEC content.

- Kids genre was very popular in Tamil Nadu/Pondicherry, Delhi, Gujarat/D&D/DNH, and Assam/North East and Sikkim regions.

- People in Madhya Pradesh/Chhattisgarh, Uttar Pradesh/Uttarakhand, Maharashtra/Goa and Bihar/Jharkhand showed a higher inclination towards the movies and music genre.

- There was a high inclination towards sports genre in Assam/North East/Sikkim, Maharashtra/Goa, Gujarat/D&D/DNH, Uttar Pradesh/Uttarakhand and Rajasthan.

Some more interesting trends in television viewership

- People prefer news in regional languages: As seen in the table below, most regional markets prefer local language news channels.

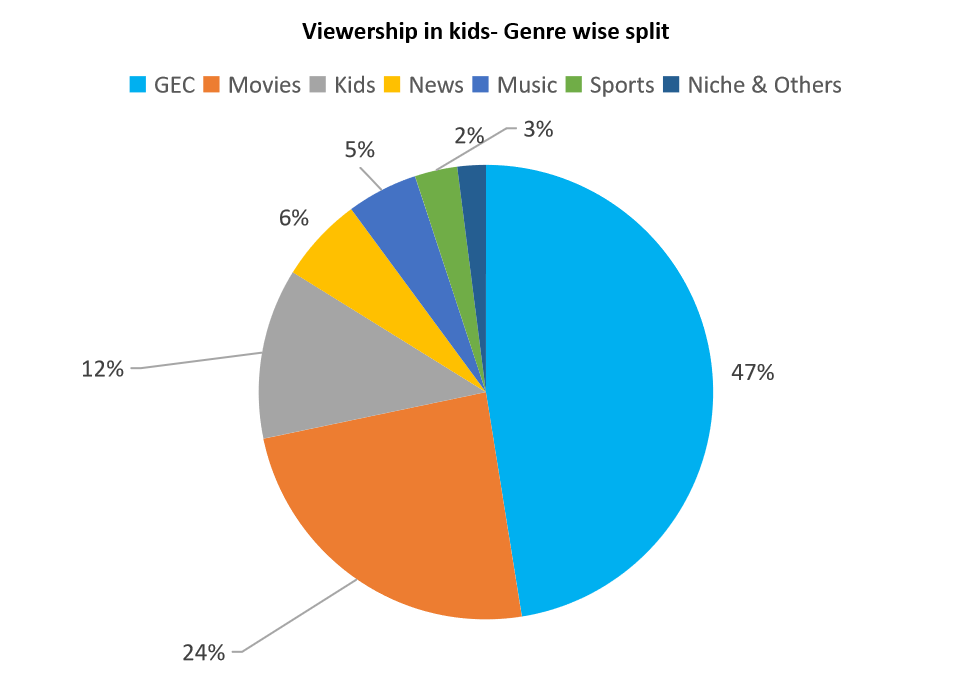

- Children watch other genres more than the kids genre:

- Cricket still rules the TV when it comes to sports; Kabaddi and wrestling follow

TV Advertising in India: Apr 2020- Jun 2020

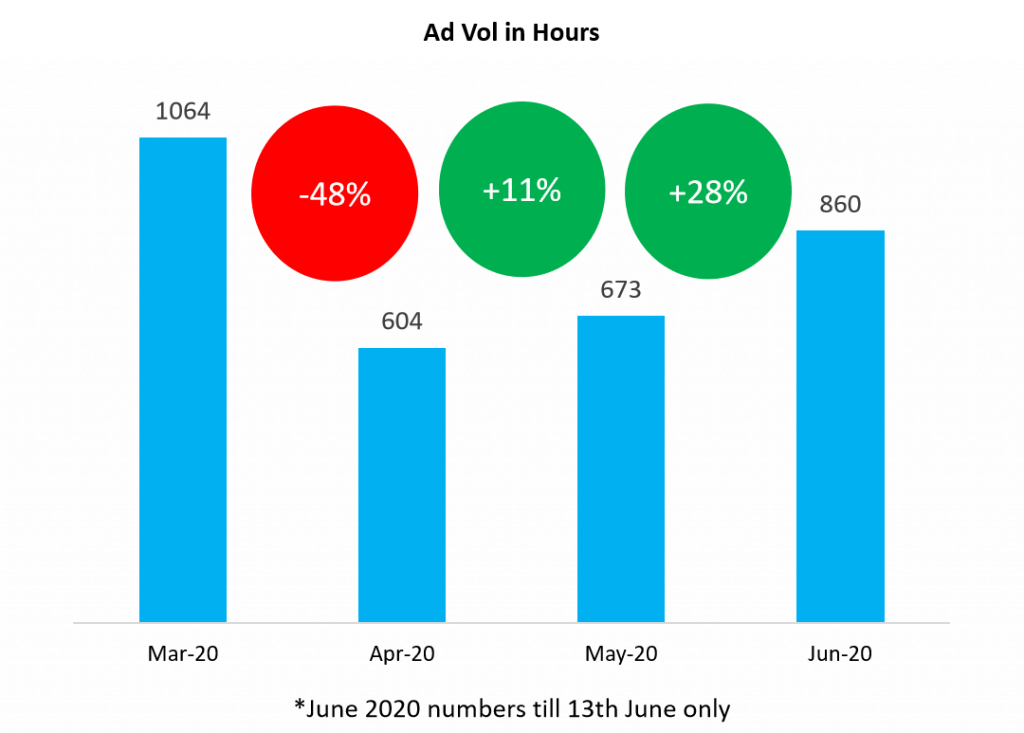

With Covid-19 forcing the entire nation to shut down in the last week of March 2020, advertising took a big hit. Economy and consumer sentiments were adversely affected. Even now, when we are in the middle of Unlock 2.0, many advertisers are still skeptical about whether it is the right time to advertise. Especially, in case of television, where most channels are still struggling for fresh content, whether to advertise or not is the most important question. In this section, we would discuss on some of the major findings from TAM report on TV advertising for the last 3 months ie. April 2020 to June 2020. This roughly coincides with the lockdown period.

TV Adex trends: May 2020 vs Jun 2020

Television is one of the media that bounced quickly after a setback due to lockdown. Although television industry is still grappling with the lack of fresh content due to restrictions on shooting activities due to lockdown, television advertising has been witnessing a steady growth during the lockdown period. One of the reasons is people spending more time at home as a precaution against spreading of Covid-19. Following is a graph showing avg ad volumes/day during the month of March (before the lockdown) followed by ad vol/day during the month of April, May and June 2020.

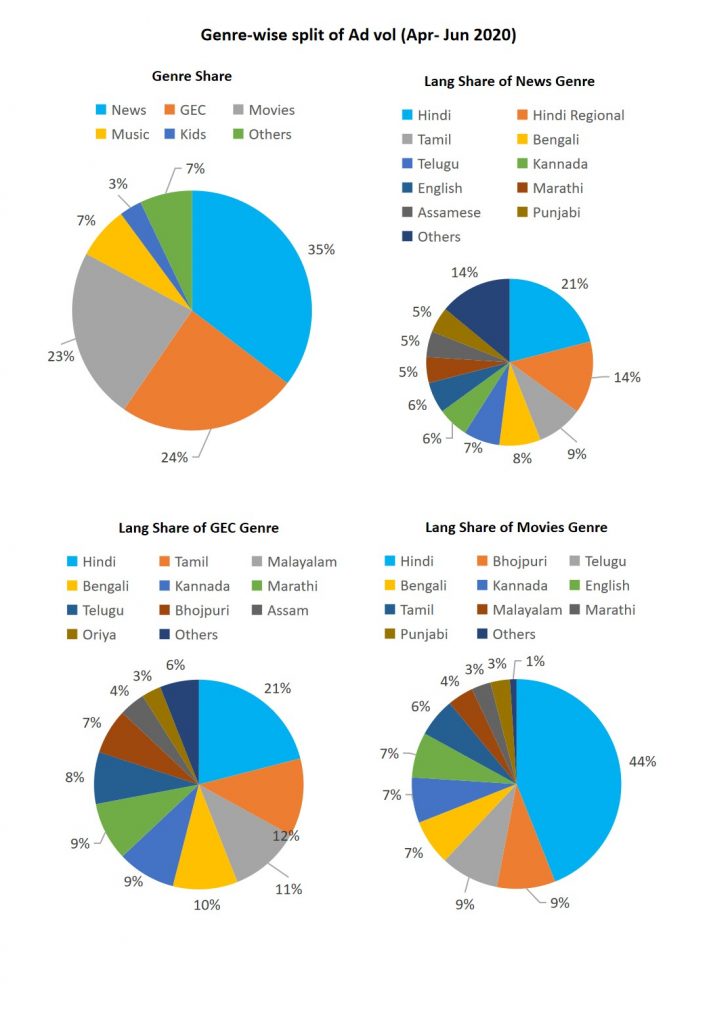

The charts above show some very interesting information. In the previous section, we discussed the language share by viewership as follows:

When compared to the ad vol data for Apr-Jun 2020, some of the observations were:

- Even though the Bhojpuri language only contributes to 2% of total viewership, in the last 3 months, Bhojpuri language channels attributed to 7% and 9% ad volume in GEC and movie genres respectively.

- The Bengali language too contributed 8%, 10%, and 7% to news, GEC and movie genre respectively despite having a lower share in viewership.

- Telugu having a 12% viewership share contributed only 7%, 8%, and 9% to ad volumes in news, GEC, and movies genre.

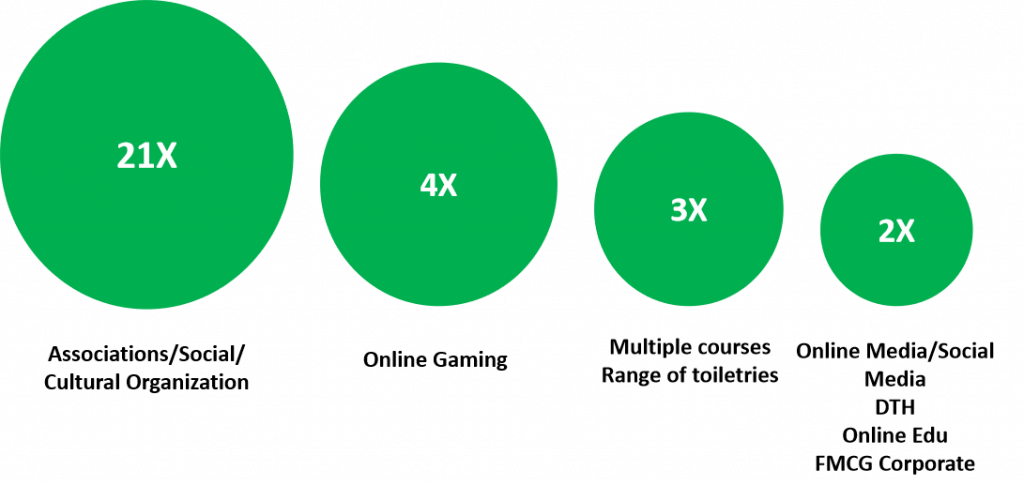

Top categories that saw maximum growth in ad-volume during the lockdown

Genre-Wise Distribution Of Advertising Categories

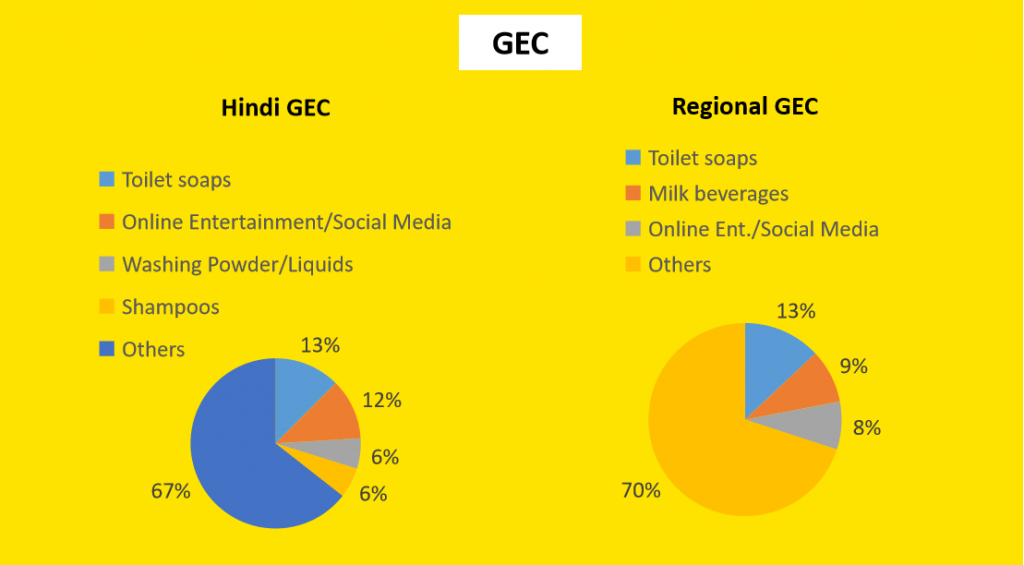

- Though both Hindi and regional GECs receive the maximum ads from FMCG brands, Hindi GECs being the bigger market has more number of national players. This can be attributed to the higher share of online entertainment/social media ads on Hindi GEC and a higher percentage of milk beverages ads on regional GECs.

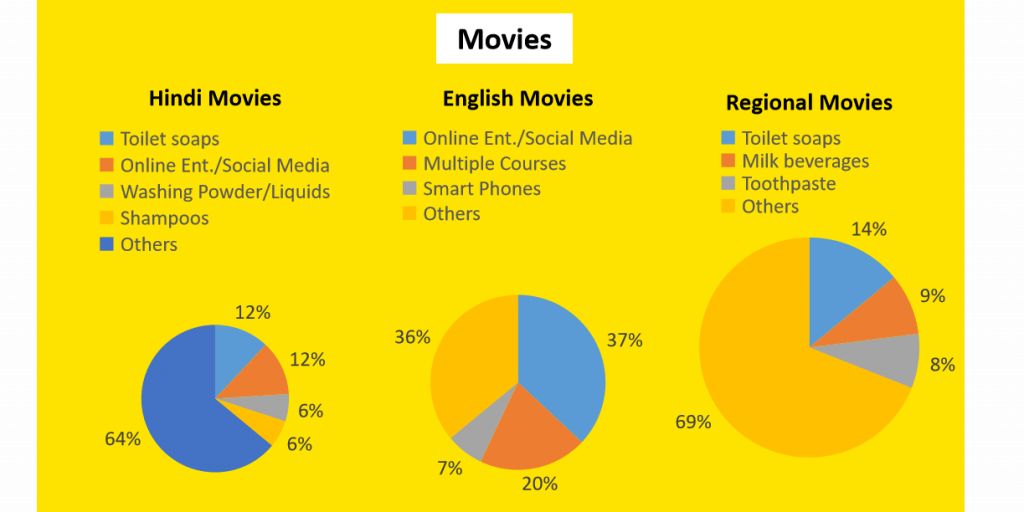

- Advertising in movies genre follow the same pattern as GEC except English movies which is mostly prefered by English speaking premium population. Hence, the top categories advertising on the English movies genre are online entertainment/social media, education and premium products like smartphones.

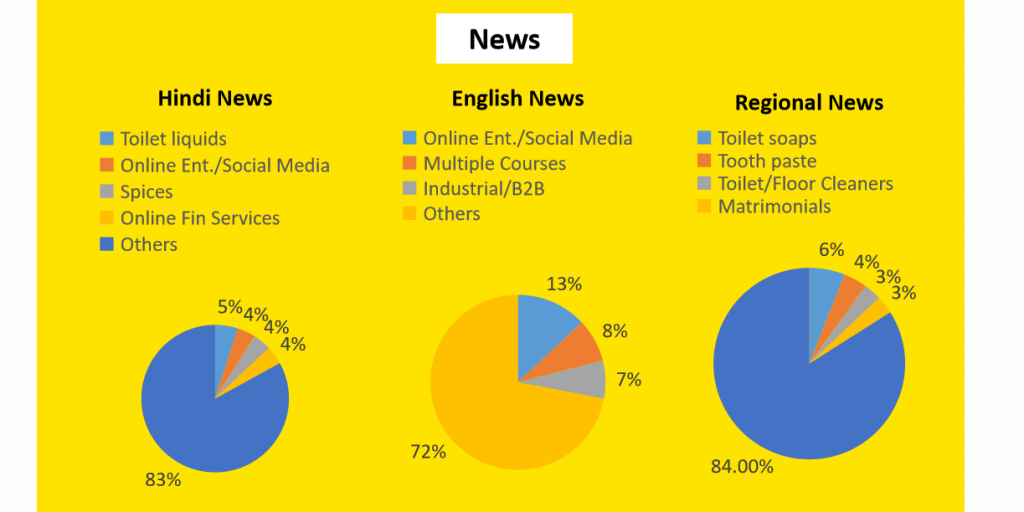

- Advertising on news channels in the last quarter saw no clear top player and was distributed across categories except English news which like English movies, saw online entertainment and education as top contributors. While Hindi news saw online financial services as a top advertiser, regional news had matrimonial brands as one of the major contributors.

Intrigued? Let us help you out

There are a number of myths related to television advertising. From the assumption that television advertising is very expensive to the assumption that television ads cannot be planned and measured. Through our article series, we want to shatter the myths one by one.

This article was based on reports from BARC and TAM. In this article, we came across several insights from television advertising. Similar insights can be used while planning a television campaign.

In our next few articles, we would understand the terminologies required to understand television advertising planning and some popular strategies to approach planning a television campaign.

In case you would like to get data-backed planning for your television campaign or would like to understand how to evaluate a television campaign, write to us at Help@TheMediaAnt.com.