Introduction

In the realm of sports, gender parity has long been an elusive goal, with a historical imbalance that has persisted for generations. However, in recent years, there has been a seismic shift in the landscape of women’s sports. The emergence of women’s football leagues, events like the Women’s Indian Premier League (IPL), and the Women’s World Cup has marked a significant step towards bridging the gender gap in the sporting arena.

Yet, while the world of women’s sports continues to evolve, there’s another crucial aspect that often goes unnoticed – the realm of sports consumption amongst genders. In this article, we will take a deep dive into the gender dynamics of sports audiences in India, and determine if it is time for brands to change their paradigm when it comes to sports advertising.

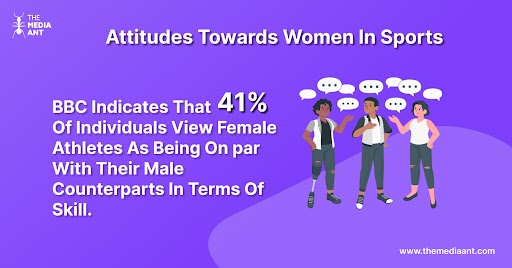

Attitudes towards Women in Sports

New research by BBC indicates that 41% of individuals view female athletes as being on par with their male counterparts in terms of skill. Nevertheless, a significant portion of Indian respondents, approximately one-third, hold the belief that female athletes do not measure up to male athletes.

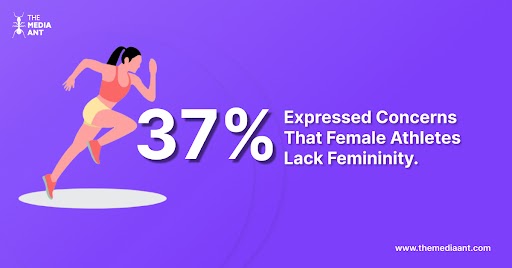

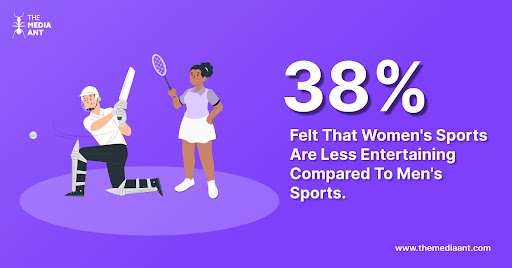

In addition, 37% of those surveyed expressed concerns that female athletes lack femininity, while 38% felt that women’s sports are less entertaining compared to men’s sports.

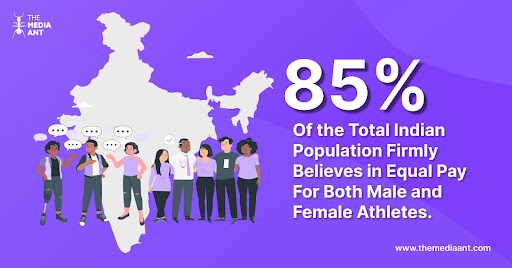

Interestingly, a substantial majority, comprising 85% of the Indian population surveyed, firmly believes in equal pay for both male and female athletes.

In the past few years the women’s cricket team has gained massive popularity after their successes, names like Smriti Mandhana, Harmanpreet Kaur and Mithali Raj are definitely becoming household names. Of course, who can forget the emergence of biopics of sportswomen, from Mary Kom to Shabash Mitthu, female athletes are gaining the deserved limelight.

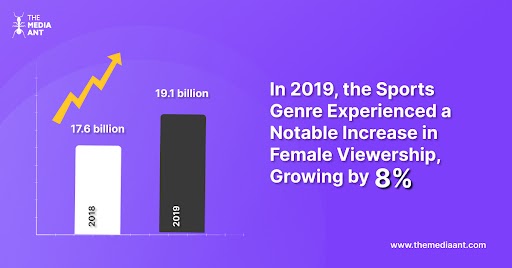

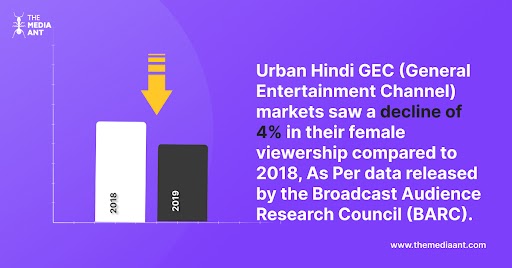

However, in 2019, the sports genre experienced a notable increase in female viewership, growing by eight percent from 17.6 billion impressions in 2018 to 19.1 billion impressions. During the same period, urban Hindi GEC (General Entertainment Channel) markets saw a decline of four percent in their female viewership compared to the previous year, as per data released by the Broadcast Audience Research Council (BARC).

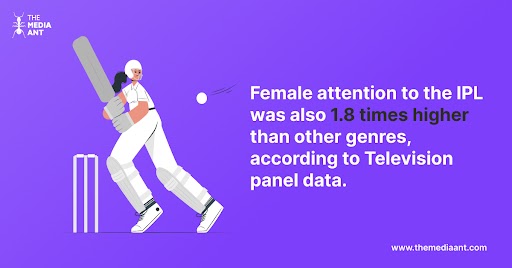

Female viewers also played a significant role in driving the record TV viewership of the Indian Premier League (IPL) during its thirteenth edition in September the previous year. Data reveals a 21 percent surge in female viewership compared to the previous edition, with a TVR (Television Rating) of 5.4 among women, up from 4.3 in 2019. The level of female attention to the IPL was also 1.8 times higher than other genres, according to Television panel data.

Gender Divide in Sports Viewership

Regarding women’s sports, only 34% of India’s population reported consuming any news related to it, with just 18% claiming to have attended women’s sports events in person, whereas the equivalent figure for men’s sports is 24%.

- The engagement with women’s sports has gained momentum in recent times, with 42% of individuals having watched it for the first time during the latter half of 2019.

- The primary source of women’s sports consumption in India is television news channels and sports channels, rather than the internet.

- Approximately 50% of the Indian population believes that there is excessive coverage of women’s sports, and 57% of those who follow women’s sports feel that there was an increase in coverage in 2019 compared to 2018.

- The T20 challenge in 2019 is noted as the most-watched women’s sporting event in India.

Consumption of Women’s Sports

According to a report by YouGov, which analyzed 18 global markets, urban Indian sports enthusiasts (those who follow at least one sport) exhibit a strong inclination towards watching women’s sports over men’s. More than a third (34%) of sports fans worldwide expressed a preference for women’s sports. In India, an almost equal proportion of male and female sports fans favor women’s sports over men’s (51% females, 49% males).

However, when examining the data by age, the younger generation demonstrates significantly more interest in women’s sports compared to other age groups, with over half (56%) of individuals aged 18-24 expressing this preference. The ‘Women in Sport Report 2021’ also revealed that globally, football is the top preferred women’s sport, followed by badminton, basketball, and tennis.

In India, half of adult sports enthusiasts (50%) show a strong passion for women’s football and the FIFA Women’s World Cup. In contrast, among British sports fans, only 16% share the same level of enthusiasm for these aspects.

Women Viewership shows steady growth. But are brands ready?

Women centric brands advertising in sports:

As per a 2022 TAM Sports research, the list of top ten brands who advertised during Olympics didn’t include even one female centric brand. In fact, 43% of the viewership in the Indian Premier League 2020 comprised women, as per BARC. So the shift in brand profile advertising in sports is obvious, here are a few successful examples:

Niine: The development has not only resulted in an increase in advertisements targeting female audiences but also inspired brands to utilize it as a platform for promoting their campaigns. A striking example of this was Niine Hygiene and Personal Care, which seized the cricket arena to introduce its groundbreaking ‘RuneForNiine’ campaign, raising awareness about menstrual hygiene. The Rajasthan Royals cricket team proudly sported the brand logo on their purple jerseys, making history as the first Indian sports team sponsored by a feminine hygiene products brand.

Lotus Herbal: In 2019, Indian cosmetic brand Lotus leveraged the IPL to launch its exclusive range of sports sunblock. Dr. Ipsita Chatterjee, Head of Innovation, Development, and Brand Strategy at Lotus Herbals Pvt. Ltd., highlighted how their focus remains primarily on women as their core target group, but exposure via IPL and other sporting events has expanded their reach to men as well.

Generic brands advertising in women’s sports:

Fast-moving consumer goods (FMCG) brands also capitalized on the festive season through IPL, one of India’s most prominent marketing platforms. Brands like Mondelez, Adani Fortune, Nestle, Unilever, Coca-Cola, Pepsi, and Colgate recognized the opportunity offered by the league to reach a diverse family audience. One of the unique aspects of the IPL is its status as a family viewing program, providing brands the chance to connect not only with one segment of the audience but also with other members who may influence purchasing decisions.

Brands like Dream11, Ashok Leyland, Puma, Sonata Software, actively engaged in Women’s IPL. In fact, brands that were already associated with a franchise’s IPL team have also picked up sponsorship spots for its women IPL team.

Powerade launched the #PowerHasNoGender campaign, starring MS Dhoni, aimed at promoting women in sports. Adidas also embraced a similar concept with their “Faster Than” campaign, which featured Himanshi Goyal and Nishrin Parikh.

Notably, we have witnessed several female sports stars becoming brand ambassadors, with Bhavani Devi, India’s first-ever fencer and a member of the Tokyo Olympics contingent, already representing a consumer packaged goods brand. This trend signifies a positive shift toward women-centric brands actively participating in sporting events.

The increased recognition of the female audience has been fueled by the growing popularity of women’s sports, which have proven their ability to attract substantial viewership over the years. Dr. Chatterjee also mentioned their involvement in women-centric sports events, such as Pinkathon in 2019, and expressed the brand’s intention to focus more on women-centric sports events in the future, recognizing them as a significant part of their strategy.

The Future of Women Viewers in India

This hidden facet, integral to the growth and recognition of female athletes, is currently undergoing a transformation of its own. As attitudes and perceptions evolve, it becomes increasingly clear that the future of sports consumption and, subsequently, the future of sports, is undeniably leaning towards the ‘woman.’ This shift heralds a brighter, more equitable future for athletes and fans alike.

It’s also important to acknowledge that this shift isn’t just about women; it’s about inclusivity and equality in sports. The increasing recognition of the female audience coincides with the growing popularity of women’s sports and female athletes becoming household names.

As we look ahead, it’s evident that the future of sports in India is leaning towards greater gender inclusivity. This transformation holds the promise of a more equitable and exciting sporting landscape, where athletes and fans, regardless of their gender, can thrive and enjoy the games they love. The evolution of sports consumption signifies a brighter future for the sports industry and a step closer to achieving true gender parity in the realm of athletics.