It’s been six months and the uncertainty over Covid-19 is still there. People are trying hard to adjust to the new normal by staying home more and adopting the digital way of life. On and off lockdowns in hotspots have only added to the chaos. However, in the last month, we have experienced a ray of hope with news of the rapid development of vaccines. Also, it is that time of the year when celebrations and shopping take the center stage and the entire nation is painted in the color of festivity. With IPL 2020 commencing just before the festive season, there is another reason for brands and advertisers to smile.

However, with this hope comes a doubt- is it worth your money to advertise during the upcoming IPL season? With Covid-19 induced lockdown affecting companies’ cash flow adversely, this is a very pertinent question at the moment. And though it is very difficult to have an answer to this question without acknowledging the risk involved, we would try our best to weigh all the available opinions and facts around the situation.

Summarizing the article into 7 learnings that we would detail out in the article:

Key takeaways from our previous article: Advertising after lockdown: Where would advertisers’ money go?

In the month of April 2020, we published this popular article of ours- Advertising after lockdown: Where would advertisers’ money go? in which we discussed about the advertising landscape after the lockdown was lifted. Some of the key takeaways from the article were:

- This snapshot from a Kantar report tries to answer the question- whether brands should stop advertising? According to the report, only 8% of consumers think that brands should stop advertising. The report concludes that even if a brand chooses to stop campaigns for any reason, the period between the two campaigns should not be more than six months. This also indicates that if brands have stopped advertising at the time of lockdown, now is the best time to resume advertising, before the festive clutter kicks in.

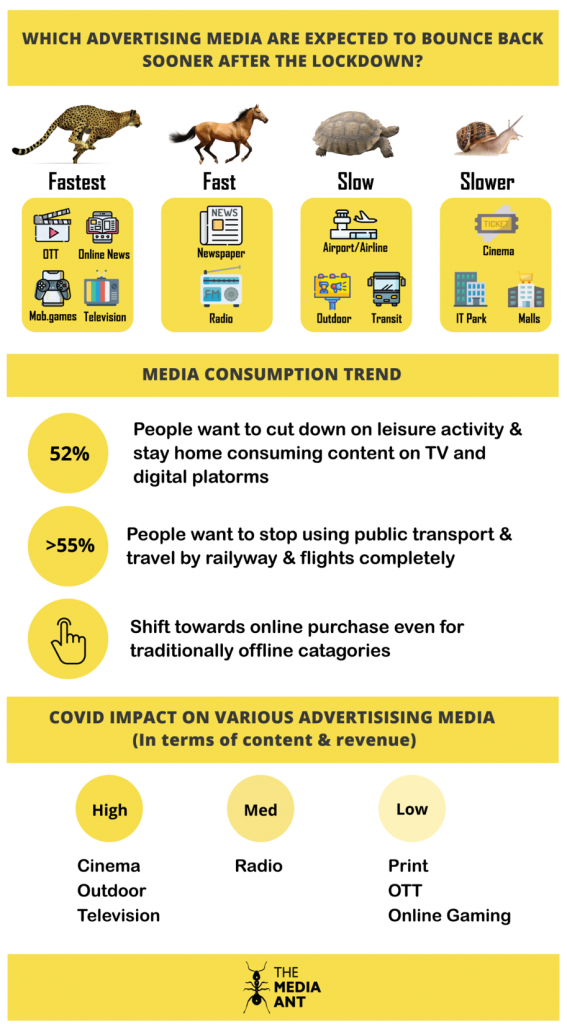

- Also, the media consumption across verticals is not expected to be similar as even after lockdown, people are expected to spend maximum time at home and avoid going out as much as possible. Following is a summary of all the media that was expected to bounce back at the earliest:

What does the latest Covid-19 Consumer Insights reports say?

Following are some of the key pointers from the latest survey by EY in their report “Life in a pandemic” released in July 2020:

- About 70% of people are fearful of the Covid-19 situation. The two prominent emotions about the near future for them are uncertainty and peace which shows that though people are uncertain about the Covid-19 situation, many of them have adopted it as the new normal.

- Online classes and assignments have been helping 80% of the students stay in touch with their courses and almost half of the students plan to continue with online education even after the pandemic.

- People are focusing more on being in touch with family, friends, and community through social media and audio/video calls.

- People have become extremely health-conscious with 80% of respondents improving their eating habits, 56% engaging in housework, and 33% doing workouts.

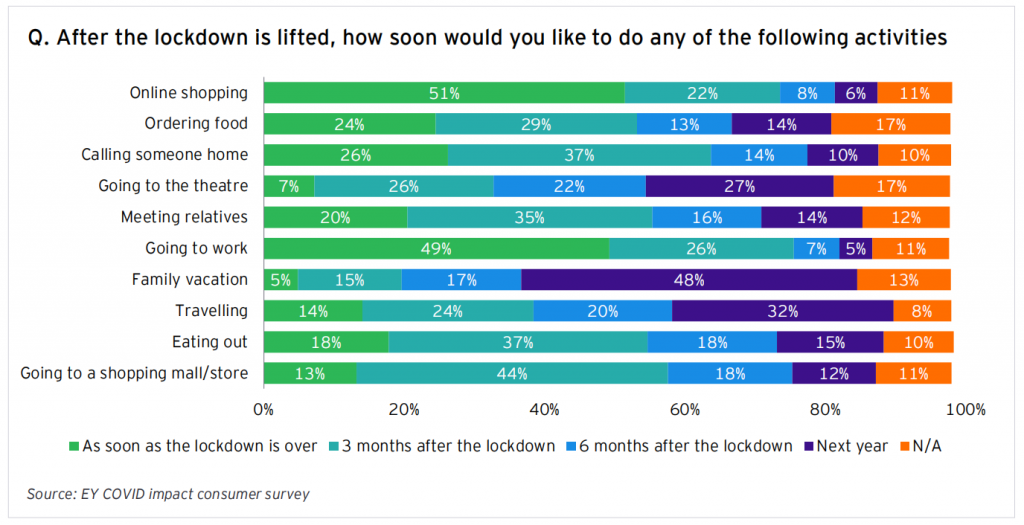

- When asked about what are the activities people would like to do as soon as lockdown is over, online shopping and going to work emerged as the top answers.

- Most people now are comfortable with spending on online services which is likely to continue even after the pandemic is over. There is an increase in demand for products in the area of fitness, education, and utilities like banking, groceries, and bill payments.

In High Demand: What and Where?

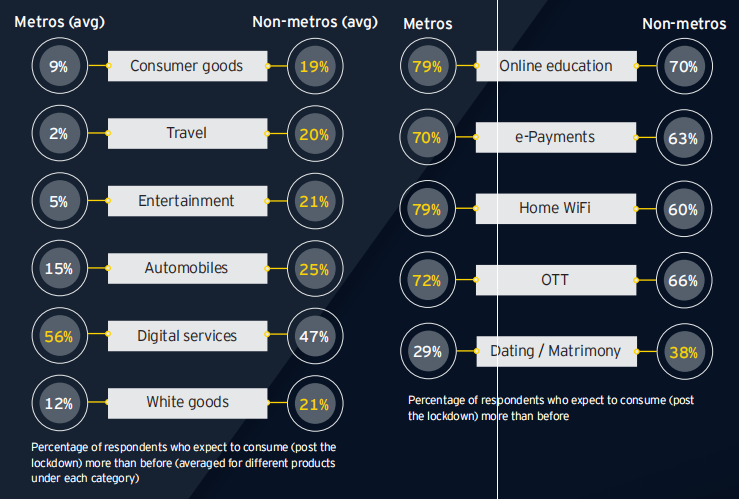

A recent report (July 2020) by EY titled “Will non-metro markets propel India’s recovery?” talks about how non-metros are the source of growth in the near future. To summarize it in one image:

Following are some of the observations from the report:

- Non-metros have registered higher demand for consumer goods than metros- mobile phones, apparel, cosmetics, white goods, kitchen appliances.

- Non-metros are the ones missing outdoor activities more than their metro counterparts- business travel, vacations, restaurants, shopping malls, public transport, beauty parlors, and spas.

- Non-metros are more willing to purchase their own vehicles like cars, scooters, and bikes

- In terms of digital services, while demand for online groceries and e-learning is higher in metro cities, non-metro cities are binging on matrimonial and dating apps.

Pitch Madison Report 2020: Mid-Year Review

Very recently, Pitch Madison Advertising Report 2020 Mid Year Review was published. It majorly talked about the ground realities of Covid-19 effect of advertising in the first half of 2020. As we can see in the graph below, print, radio, cinema and outdoor have experienced a drop in adex of more than 50% as compared to last year. For television, the drop is about 43% and the share of advertising pie has dropped to 38% from 40% last year which doesn’t seem to be significant. For newspaper the share has dropped from 30% to 25%. This drop in share of TV and newspapers have translated into an increase in share of digital from 20% to 30%.

In terms of the most active product categories in terms of advertising across television and digital, almost all categories saw a dip in adex but the following categories did comparatively well through Covid-19:

- On Television: FMCG, E-commerce, Corporate branding, Education showed a dip lesser than 40%

- On Digital:

- E: E-commerce, Entertainment, Edu-tech

- F: Food tech, Fintech, FMCG

- G: Gaming, Groceries & Govt

- H: Health Tech & Health Care

The Media Ant Experience: The shift in client mix

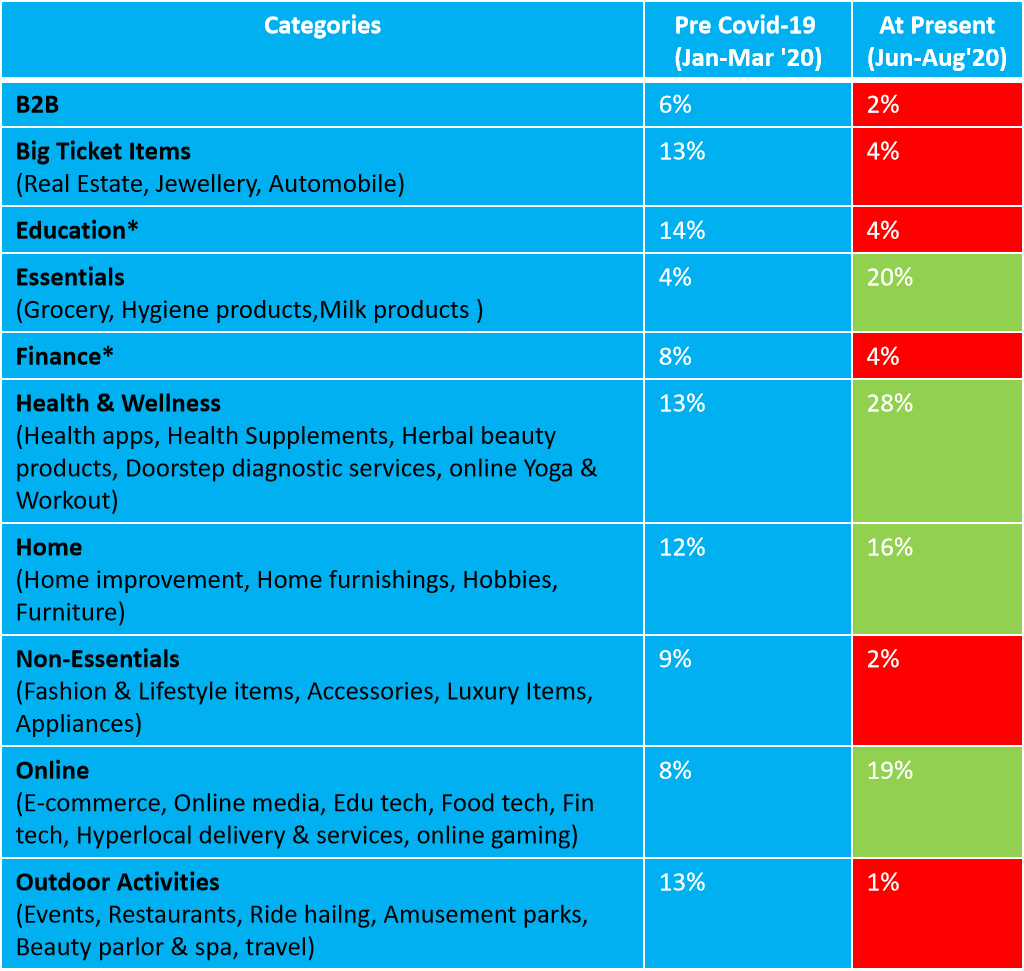

To verify the effect of Covid-19 on our business, we did an analysis on our client mix and found a significant change in the share of business categories (of our clients).

*Seasonal effect

Categories explained below:

- B2B: This refers to B2B advertisements for products like industrial equipment, raw materials, logistics, services, co-working space, etc. With a number of businesses facing temporary shut-downs and cash-flow adversely affected, advertising in B2B sectors faced a major dip.

- Big Ticket Items: With the lockdown came to a slump in the economy and temporary shut down of a number of businesses that left people worried about their livelihood. This has impacted the purchase of big-ticket items like real estate and automobiles.

- Education: Education involves advertisements from traditional educational institutions like schools and colleges. Two major reasons for this drop are: the pre-COVID period refers to Jan-Mar months which coincide with the admission period and also, education depends on print and outdoor majorly for advertising, both of the mediums were adversely affected during the lockdown.

- Essentials: People have opted to stay at home and follow precautions. They use this time to cook their own food, follow hygiene measures, consume health supplements and natural products to boost their immunity. Hence, the demand for grocery items, food items, natural products, hygiene products has remained very high.

- Finance: While the majority of advertisers pre-COVID-19 focused on the tax season, another reason for the drop is people refraining from investing due to uncertainty about the market.

- Health & Wellness: If there is a clear winner this season, it’s healthy. Whether it’s health supplements, herbal products, testing at home or online Yoga and workout, people, as well as advertisers, have shown a thumbs up to the category.

- Home: With people forced to spend a lot of time at home, requirements like setting up a home office, adding more comfortable furniture, adopting a new hobby, etc have driven the demand.

- Non-essentials: With steady income being affected and most people staying home, consumers chose to hold back from purchasing non-essential items like fashion and lifestyle products, make-up, and other luxury items.

- Online: With more and more people staying home and cut off from popular media like newspapers, radio, and TV (due to lack of fresh content), people spent more time on digital platforms for reading, watching videos, playing games, and also for doing everyday shopping and transactions. There was a remarkable jump in demand for the digital substitution for physical services like hyperlocal delivery apps, e-commerce apps, food tech (food delivery and grocery delivery apps), edutech (online education) and fintech (digital payments as well as digital investment platforms), health tech (health apps, online workout, and yoga, online doctor consultation), online media (OTT platforms, digital news platforms), online gaming and social sharing and communication (video calling, chatting, content sharing).

- Outdoor activities: Restrictions on the movement of people have directly impacted several businesses like restaurants, events, beauty parlors and spas, amusement parks, hotels, and travel agencies.

Festive Season Consumer Behaviour: Normal vs Pandemic

In this section, we will discuss people’s sentiments and shopping behaviour during the festive season and would borrow some insights from other countries’ experience about how Covid-19 affected the shopping behavior during Ramadan 2020 festive season.

Following are a few leanings from Festive Shopping Index 2019, an annual consumer behavior survey report co-created by Litmus World and Retailers Association of India:

- In 2019, about 89% of consumers planned to shop during the festive season.

- The top categories that were in high demand during the festive season were: Apparel & fashion (71%), Home appliances and electronics (49%), Mobile phones (40%), Home furniture (19%), Jewellery (19%), and Holidays (16%).

- About 30% of consumers had budgeted more than INR 30,000

- About 76% of consumers were planning to make purchases online.

- Here is the complete report:

As we can conclude from the report above, festive season is the period when most people make big purchases. For most brands, festive season accounts for about 35-40% of the total annual sales. After a dull H1 due to Covid-19 induced lockdowns, brands have their hopes latched on the festive season. But would consumer spending happen? While it is too early to gauge consumer sentiments towards festive period so early here’s what we learned from Arab consumers during Ramadan 2020: (based on an article on Communicateonline.me, link in references)

- While anxiety was there (33%), optimism (43%) and peace (32%) were the dominant sentiments, that also correlated well with the festive season.

- Ramadan for people was more about spirituality than traditional rituals this year and it reflected on shopping behavior as well.

- Over 66% of consumers had to cut expenses and prioritize needs vs wants. As a result, consumer shopping priorities shifted from high-value luxury items, cars, apparel, and beauty products to groceries and other household basics.

Consumer sentiments in the next 3 months: A V-shaped recovery on cards?

According to Investopedia, in a V-shaped recovery, after the economy suffers a sharp economic decline, it then quickly and strongly recovers. Such recoveries are generally spurred by a significant shift in economic activity caused by rapid readjustment of consumer demand and business investment spending.

Although this situation is unprecedented and it’s difficult to predict how the near future is going to shape up, we have some insights from other countries who have been previously hit with a crisis

The graph above shows how countries facing crisis in the past showed a recovery having a steep fall followed by a steep rise due to steady recovery, situation getting better and even due to festive seasons. With positive news about vaccine doing rounds, the market sentiments are expected to be positive for India too. Recently, 15th Finance Commission Chairman NK Singh gave a statement that India will see a sharp V-shaped recovery in the third and fourth quarter of the current fiscal though the FY21 GDP growth would ultimately be in negative territory.

Is advertising in IPL 2020 on Hotstar platform worth a try?

In the beginning of the article, we asked a question if advertising on IPL 2020 is a good idea for advertisers. After going through several reports and learnings, we think that advertising is IPL 2020 is definitely worth trying for certain brand categories and on certain platforms. While festive season brings out celebrations and generousity among people, this year is different. People are wary of spending on big ticket items and the same is expected to reflect on the advertising but on the other hand, for several brands on an advertising break, this is the right opportunity to make a comeback. While the answer for these brands is still blurry, it couldn’t have been more clearer for essentials and online categories.

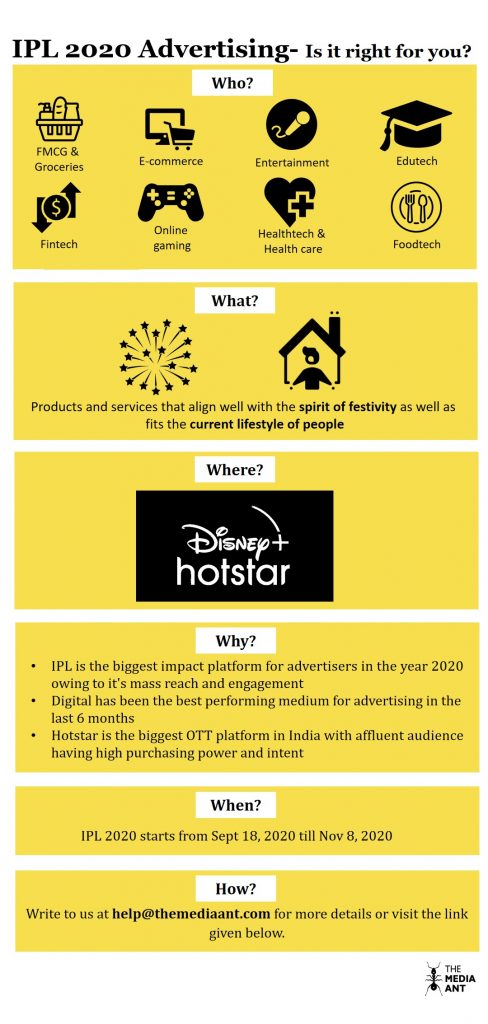

For the past two years, IPL live streaming on Hotstar has been met with a lot of applaud and appreciation. You can read more about IPL 2020 advertising on Hotstar, by visiting this link. Combining the article learnings with our own experience, here’s an infographic that would help you decide whether to participate in IPL 2020 advertising on Hotstar or not.

Advertising budget starting from INR 1 lakh and CPM for a 10-sec mid-roll video ad costs INR 180. Visit the link to know more.

Reference:

https://www.ey.com/en_in/consulting/what-are-the-new-ways-of-living-life-in-a-pandemic