The convergence of two of India’s most influential streaming platforms has set the stage for a digital revolution in sports broadcasting and advertising. In late 2024, Reliance’s Viacom18 (parent company of JioCinema) and Disney’s Star India (parent company of Disney+ Hotstar) joined forces to form the joint venture JioStar. With the digital arm rebranded as JioHotstar in February 2025, this merger not only consolidated vast content libraries and a massive user base but also redefined the advertising landscape ahead of the highly anticipated IPL 2025 season.

The Landmark Merger: Creating a Goliath of OTT Platforms

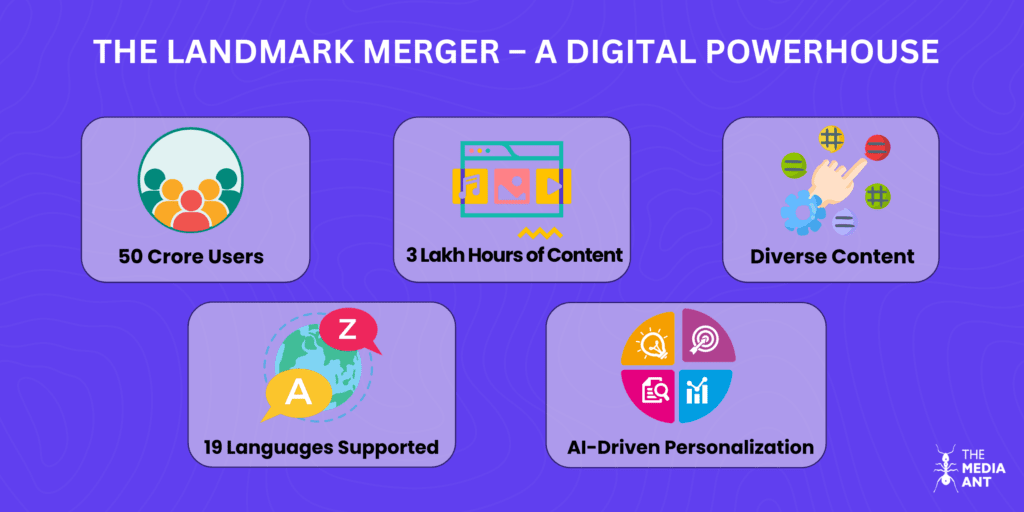

The merger instantly created one of India’s largest OTT platforms by pooling over 50 crore users and nearly 3 lakh hours of content. JioHotstar now seamlessly integrates offerings from Bollywood blockbusters and Disney entertainment to electrifying live sports. The platform supports streaming in 19 languages and uses AI-driven recommendations to personalize content, setting a new benchmark in user engagement and digital entertainment in India.

Digital Streaming Rights and the IPL 2025 Revolution

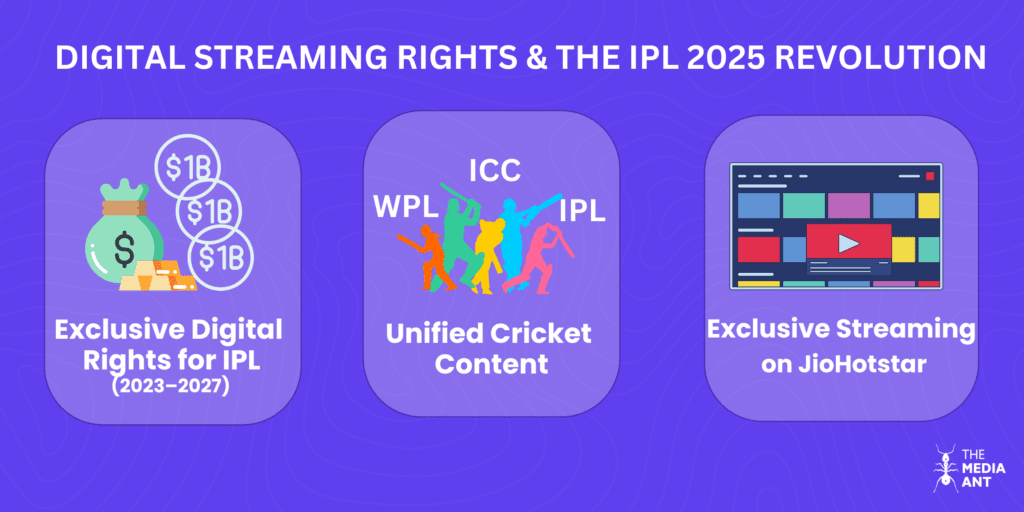

A key driver behind the merger was the strategic acquisition of exclusive digital rights for premium cricket. JioCinema had secured IPL streaming rights for the period 2023–2027 in a landmark $3 billion deal, while Disney’s Star India previously managed TV broadcast rights. Now, under JioHotstar, all premium cricket properties—including IPL, ICC tournaments, and the Women’s Premier League—are unified on one digital platform. This consolidation means that IPL 2025 will stream exclusively on JioHotstar, reinforcing the platform’s role as the digital home for India’s most-watched sports events.

Transitioning from Free Streaming to a Hybrid Subscription Model

Historically, JioCinema offered free IPL streaming to build a wide audience. However, the merger marks a significant shift in monetization strategy. With IPL 2025, the days of completely free streaming are over. JioHotstar now adopts a hybrid model where fans can watch a few minutes for free before a paywall kicks in. New subscription plans start at ₹149 for a mobile-only, ad-supported package for three months, or ₹499 per quarter for an ad-free, multi-device experience. This move is aimed at creating a more controlled and sustainable revenue stream while still engaging a massive user base.

Looking Ahead: IPL 2025 and Beyond

As IPL 2025 approaches, JioHotstar is set to lead the digital transformation of sports broadcasting in India. The exclusive streaming of IPL on this robust platform not only signals a new era for cricket fans but also opens up fresh avenues for advertisers to reach their target demographics. With its massive user base, state-of-the-art streaming technology, and innovative monetization strategies, JioHotstar is well-positioned to challenge global digital giants and redefine how live sports are consumed and monetized in India.

By merging content, technology, and premium sports rights, JioHotstar stands at the forefront of India’s digital media revolution. The shift from free-to-air streaming to a hybrid subscription model represents not just a strategic business move but a transformative moment for both advertisers and consumers in the rapidly evolving OTT landscape.

New Ad Formats & Targeting in IPL 2025: A Speculative Outlook

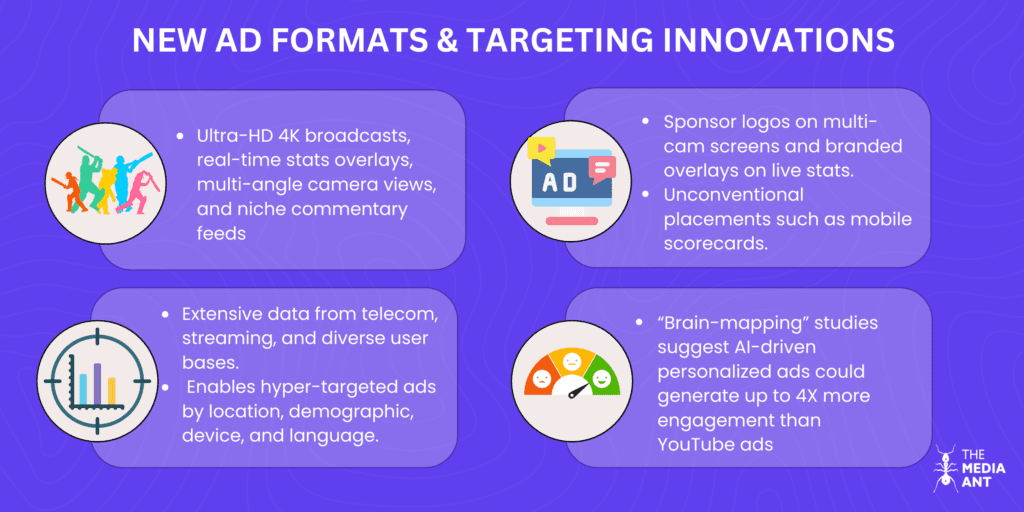

The JioCinema–Hotstar merger is expected to revolutionize digital advertising during IPL 2025 by merging cutting-edge ad technologies from both platforms. Speculations suggest that JioHotstar’s focus on an “elevated streaming experience”—featuring ultra-HD 4K broadcasts, real-time stats overlays, multi-angle camera views, and even niche commentary feeds—will not only enhance viewer engagement but also unlock novel advertising opportunities. For instance, advertisers might soon be able to place sponsor logos on multi-cam screens or branded overlays on live stats, effectively turning every pixel into revenue

Moreover, reports indicate that the platform is exploring ad placements in unconventional spaces such as mobile scorecards. This approach could enable brands to reach viewers in ways traditional TV never could, with every aspect of the stream becoming a potential ad slot.

In addition to innovative formats, JioStar’s extensive data trove—sourced from telecom, streaming, and Hotstar’s diverse user base—has already empowered hyper-targeted advertising. Advertisers can target users by location, demographic, device, or even preferred language, offering a granularity that conventional TV lacks. For example, a food delivery app could serve interactive, regional ads during match timeouts, targeting only Hindi-speaking viewers in select cities.

Speculative studies, including a JioStar “brain-mapping” analysis, claim that these AI-driven, personalized ad experiences could generate up to four times the engagement compared to YouTube ads by closely tracking viewers’ focus and memory responses.In short, if these speculations hold true, IPL 2025’s digital ad ecosystem will be more interactive and personalized than ever, ranging from choose-your-angle ad experiences to programmatic ad serving meticulously tailored to each viewer’s profile.

Ad Pricing Shifts: Impact on IPL 2025 Digital Advertising Rates

The JioHotstar merger has redefined IPL 2025 as a premium advertising property, and early indications suggest that digital ad rates are set to rise significantly. Speculations point to a 25–30% YoY increase in digital ad prices compared to IPL 2024, driven by the unified platform’s massive reach and the strategic removal of free streaming options (thestreaminglab.com, exchange4media.com).

Premium Inventory and Rate Benchmarks

JioHotstar is leveraging its superior technology and audience scale to justify premium pricing.

- Connected TV Ads: Ads on smart TVs—considered premium inventory—are reportedly priced at around ₹8.5 lakh for a 10-second spot. This figure is based on speculative reports published on exchange4media.com.

- Standard Digital Video Ads: Mid-roll or pre-roll ads on mobile and web platforms are estimated at approximately ₹315 CPM, as cited in industry reports from exchange4media.com and thestreaminglab.com.

- Display Banner Ads: Conventional display ads are reported to command around ₹75 CPM (exchange4media.com).

- High-Impact Integrations: Product placement ads (PPL) within the live stream could cost roughly ₹1.6 lakh per 10-second slot, according to exchange4media.com.

Disclaimer:

The ad rate figures above have been compiled from various speculative articles on IPL 2025 ad rates—such as reports from exchange4media.com, thestreaminglab.com, and business-standard.com—available at the time of writing. These numbers are estimates and may not reflect the final IPL 2025 ad rates. For the most current and verified information, please refer to The Media Ant IPL 2025 Advertising section.

Regulatory Considerations and Market Negotiations

These rate hikes are partly a result of the shift from free viewing to a hybrid subscription model, which positions the platform as a premium digital destination. Although India’s antitrust regulator has cautioned against “unreasonable” price hikes, the merger has seen an approximate 25% increase implemented (reuters.com). Despite these elevated rates, industry insiders suggest that media buyers anticipate negotiations could eventually soften the rates as the buying season progresses.

What It Means for Advertisers

For brands, this translates into higher budget requirements to secure a substantial digital presence during IPL 2025. However, the premium is justified by the enhanced targeting capabilities and superior engagement metrics that JioHotstar promises. Advertisers can now tap into hyper-targeted campaigns—such as interactive, region-specific ads—to reach viewers more effectively than ever before.

In summary, while the merger sets a new benchmark in digital advertising by enabling advanced, personalized ad formats, it also signals a shift toward higher ad spends for those wishing to capture the attention of IPL’s vast and engaged audience.

Implications for Brands & SMBs: Navigating Opportunities and Challenges in IPL 2025

The JioHotstar merger creates a unified digital platform with access to over 600 million viewers, fundamentally altering the advertising landscape for both large brands and small-to-medium businesses (SMBs). While the platform’s vast reach and advanced targeting capabilities offer huge potential, the higher ad rates and fierce competition for premium slots also present new challenges.

For Big Brands: Broad Reach at a Premium

Large advertisers in sectors like tech, fintech, and e-commerce will benefit from the unparalleled access to a unified digital audience. Despite the higher pricing—reflecting a 25–30% YoY increase compared to IPL 2024—the exclusive digital feed and premium inventory, especially during marquee matches, make it hard to resist. Top sponsors are expected to secure their spots despite costlier packages, as the unparalleled engagement of IPL continues to justify a robust return on investment. However, the challenge remains in balancing these higher costs with the measurable outcomes promised by advanced targeting.

For SMBs: A Gateway to IPL Advertising

Historically, IPL advertising was largely dominated by deep-pocketed brands. Now, with JioHotstar’s self-serve ad tools and flexible formats, SMBs gain an affordable entry into the high-engagement world of IPL. Entry packages allow smaller brands to experiment with pre-roll video slots or in-stream banners at lower budgets. Additionally, granular geo-targeting capabilities enable a Chennai bakery, for example, to advertise specifically on Tamil commentary feeds, ensuring that ad spend reaches the intended local audience efficiently.

Enhanced Tracking and Accountability

A significant advantage of the merged platform is improved measurement and transparency. JioHotstar’s partnership with Nielsen for third-party digital ad ratings addresses long-standing concerns about streaming metrics. This collaboration provides independent data on reach, frequency, and campaign impact, similar to traditional TV ratings. Such enhanced tracking not only validates the higher ad rates but also helps advertisers fine-tune their strategies based on real-time performance insights.

Regional Viewership & Language-Based Advertising

The digital boom has ushered in a transformative era for IPL viewership, marked by an explosion of regional audiences. During the 2023–24 seasons, JioCinema offered IPL broadcasts in 12 languages—including Bhojpuri, Punjabi, Marathi, Gujarati, Bengali, Tamil, Telugu, Kannada, and even Haryanvi—broadening IPL’s appeal and adding an estimated 35–40 million new viewers from regions that had been traditionally hard to reach. Fans from states like Bihar, Odisha, and the Northeast, who previously lacked access to native-language sports commentary, could now follow the action in their dialects.

Expanding Multilingual Reach

With the merger, the new JioHotstar platform has amplified this multilingual strategy, boasting streaming in over 19 languages as a core strength. This evolution is expected to further boost regional viewership in IPL 2025 as JioStar leverages both Star Sports’ regional channels and the unified digital service. Dedicated regional feeds on TV—covering languages like Tamil, Telugu, Kannada, and Bengali—combined with digital streams that offer language-specific commentary, effectively blanket all audiences across India. For instance, the Bhojpuri commentary feed introduced in 2023 became a runaway success, often drawing millions of concurrent viewers during matches featuring Bihar’s favorite teams.

Tailored Advertising Through Language

This regional expansion has paved the way for a new era of language-based advertising. Brands now have the opportunity to tailor their ad messaging to specific language feeds, making campaigns more relevant and emotionally engaging for regional audiences. For example, a small business in Tamil Nadu can run ads in Tamil during Chennai Super Kings matches, forging an immediate connection with local viewers—a strategy that previously yielded impressive results for a local sweets brand.

Large national brands are also customizing creatives by language, leading to regional sponsorships such as a Bengali radio sponsor for the Bengali feed or a local real estate firm targeting the Kannada stream. JioHotstar’s advanced ad tech facilitates this micro-targeting by leveraging viewer data to identify regional tuning patterns and dynamically inserting ads based on geography—an approach not possible with traditional TV, where a Tamil ad would be broadcast nationally.

Shifting Viewership Patterns

The merger is likely to shift regional viewership patterns further. Loyal fan bases in cities like Chennai, Bangalore, and Hyderabad are increasingly opting for broadcasts in their native languages. This trend may drive the development of more localized content, such as regional pre-match shows or celebrity commentators, boosting engagement in these markets. As a result, IPL advertising revenue is becoming more geographically diversified. For instance, a Tamil Nadu-based brand, which could never justify an all-India TV ad buy in the past, can now invest in Tamil digital ads during the limited matches featuring CSK teams.

Additionally, while Hindi has traditionally dominated IPL commentary, the digital parity achieved by JioHotstar has seen languages like Tamil, Telugu, and Kannada gain significant traction. Advertisers targeting the Hindi belt will continue to find substantial audiences on both Star Sports Hindi and the Hindi feed on JioHotstar, but the increasing share of non-Hindi viewership underscores IPL’s evolution into a truly pan-Indian property. Advertisers can also benefit from cost-effective regional packages that reach concentrated, receptive audiences without the expense of a national buy.

multi-angle viewing—the higher costs mean advertisers must carefully consider their ROI. Big brands might need to adapt their strategies from blanket reach campaigns to more precise, performance-driven initiatives. At the same time, SMBs have the opportunity to leverage cost-effective, hyper-targeted ad tools that can deliver measurable results without overspending.

Viewership Trends and Audience Behavior

TV vs. Digital Consumption

The JioCinema–Hotstar merger has now unified IPL’s television and digital broadcasts under a single network, potentially altering how fans split their viewing habits. Over the past two seasons, IPL viewership experienced a dual boom, with record-breaking numbers on both TV and streaming. In 2024, free streaming on JioCinema helped digital reach around 550–600 million viewers—a 38% increase from approximately 449 million in 2023—while TV viewership on Star Sports also grew, reaching 546 million compared to 505 million the previous year. Combined, IPL 2024’s total audience was estimated at 650–700 million, indicating that free digital access expanded the overall viewer base rather than simply cannibalizing traditional TV audiences.

Anticipated Shifts for IPL 2025

For IPL 2025, the dynamics are expected to change due to the merged platform and the introduction of a digital paywall. With free online streaming no longer available, some casual viewers who previously enjoyed free content on JioCinema might revert to watching IPL on TV via Star Sports, which remains free beyond basic cable or DTH subscriptions. Meanwhile, the digital audience on JioHotstar is likely to become more consolidated and engaged, consisting largely of paying subscribers and serious fans.

Integrated Viewing Strategy and Advertising Impact

The merger enables a complementary viewing strategy that leverages the strengths of both platforms. For example, there could be initiatives encouraging second-screen engagement—TV broadcasts might remind viewers about exclusive interactive options on the JioHotstar app, such as additional camera angles and real-time stats. Unified ad sales across both mediums allow JioStar to optimize total viewer consumption rather than choosing between TV or digital. This integration is expected to lead advertisers to adopt an integrated approach by buying spots on both Star Sports and JioHotstar, ensuring they capture the complete IPL audience regardless of viewing preference.

Evolving Audience Behavior

Early indications suggest that while digital viewership might dip slightly due to the subscription barrier, any loss may be balanced by an uplift in TV ratings. Data from other events has shown that connected TV streaming is on the rise—connected devices like smart TVs have already witnessed a surge during major events such as the 2023 Cricket World Cup, a trend that continued into IPL 2024. With targets set to reach 40 million smart TV devices and 420 million smartphones during IPL 2025, the overall digital turnout is expected to remain robust.

In summary, the merger is likely to result in a more balanced distribution of viewers between TV and digital. Traditional TV might regain some share, particularly among rural and older demographics, while digital audiences could become more urban and premium-focused. Ultimately, by combining viewership metrics and advertising packages across both platforms, JioStar aims to maximize total IPL consumption and provide advertisers with a comprehensive, integrated opportunity to engage fans. As audience behavior evolves, serious fans are expected to subscribe for a richer, multi-angle streaming experience, while casual viewers may stick with conventional TV broadcasts or highlights.

Lessons from WPL 2024: A Stepping Stone to IPL 2025 Success

While the initial reception to WPL 2025 might appear modest, the experience from WPL 2024 provides a valuable launchpad for advertisers gearing up for IPL 2025. Despite lower-than-expected traditional ad fill rates and revenue in 2024, the season offered key insights that can be spun positively for IPL advertising.

Early Engagement and Building Momentum

Advertisers have a unique opportunity to start early with WPL to build brand recall before the IPL fever kicks in. By investing in WPL, brands—especially smaller advertisers—can secure WPL spots at more attractive rates in a relatively uncluttered environment. This early presence not only tests creative messaging and engagement strategies but also helps in creating a seamless transition into the IPL season. Essentially, WPL serves as a “trial run” that enables advertisers to fine-tune their campaigns and gain first-mover advantage, setting a strong foundation for the massive digital audience expected during IPL 2025.

A Digital-First, Clutter-Free Platform for SMBs

For small and medium businesses (SMBs), WPL offers a distinct advantage. With fewer competing brands and a less saturated ad inventory compared to IPL, SMBs can benefit from a clutter-free advertising space. The digital viewership of WPL—resonating strongly with the digitally savvy audience—provides a focused platform where localized and language-based campaigns can be tested at lower costs. This targeted approach allows SMBs to connect emotionally with regional audiences and optimize their ad spend without the noise typically found during IPL broadcasts.

Leveraging Digital Innovation for Long-Term Growth

The integrated JioHotstar platform, which now houses both WPL and IPL content, offers advanced ad tech and robust data analytics. Early experiments in WPL have revealed opportunities for innovative ad formats and dynamic, hyper-targeted campaigns. For example, advertisers can now experiment with interactive, language-specific ad placements that are tailored to regional audiences—a strategy that has already shown promise in WPL. These learnings are expected to transfer directly to IPL 2025, where improved targeting and measurement tools (backed by third-party analytics) will ensure that ad spend is closely aligned with actual engagement and ROI.

A Strong Companion to IPL

Ultimately, while WPL’s early performance might not match IPL’s marquee appeal, it is rapidly emerging as a strong companion property. The lessons learned from WPL—such as the need for consistent promotion, broader venue distribution, and integrated cross-promotion—are already being incorporated into the strategy for IPL 2025. Advertisers who invest in WPL now can leverage the combined strength of the JioHotstar ecosystem, ensuring a unified and powerful reach across both men’s and women’s cricket. This integrated approach not only maximizes overall viewership but also delivers a more balanced and effective advertising portfolio across the season.

In summary, WPL 2024 has provided a critical testing ground that, despite early challenges, has paved the way for a more innovative, targeted, and engaging advertising strategy for IPL 2025. Brands—both large and small—stand to benefit from this gradual buildup, where early digital engagement in WPL can amplify their impact when the IPL season arrives, creating a comprehensive, data-driven, and highly effective sports advertising ecosystem.

Overall Market Implications Post-Merger

The consolidation of JioCinema and Hotstar has transformed India’s sports advertising landscape into a behemoth that attracts advertisers from every sector. With IPL 2025 streaming exclusively on JioHotstar digitally (and Star on TV), all brands—big and small—are now channeling their budgets through one integrated pipeline. This unified approach simplifies media buying by offering one-stop deals across TV and OTT, but it also intensifies competition for a limited pool of premium ad slots. Early reports suggest that JioHotstar’s IPL ad inventory is almost fully booked well in advance, with coveted slots during playoffs and India rivalry matches commanding a premium due to fierce bidding.

The massive reach—projected to exceed 600 million viewers across devices —has opened the doors to new advertiser categories, including gaming, fintech, ed-tech, and regional brands, alongside traditional FMCG and automotive giants. This surge in demand has bolstered JioStar’s confidence to raise rates by roughly 25%, and top-tier sponsors have already signed up for costlier packages to secure visibility.

A notable trend is the shift in ad spend from digital giants like YouTube and Meta to JioHotstar, as brands are enticed by claims of “4X more engagement” on IPL ads. This competition isn’t limited to brands alone—it’s also a battle between platforms, with JioHotstar emerging as a potent challenger that may well redistribute the digital ad market, leaving non-IPL digital publishers to contend with a tighter ad landscape.

However, this gold rush comes with its challenges. Higher ad rates and ROI pressures mean that brands must justify their elevated investments with tangible results. If the digital audience contracts behind the new paywall, some advertisers might feel the pinch. Additionally, a crowded ad environment—with potentially 250+ advertisers vying for attention—forces brands to innovate in creative execution and frequency management, especially in co-viewing settings. Smaller advertisers, while benefiting from unified media buying, face a learning curve when navigating digital metrics and self-serve ad tools.

Despite these challenges, the merger is set to expand overall digital sports ad spend. The convenience of integrated TV + OTT buys is prompting larger 360-degree deals that combine on-air sponsorship, on-ground activations, and in-app ads, further driving up the value of deals. Moreover, new entrants—particularly SMBs and regional players—are contributing incremental advertising, ensuring that IPL 2025’s ecosystem remains dynamic and diverse.

Ultimately, the JioHotstar merger has not only won the battle for consumer attention but is also redefining the monetization game in digital sports. With unprecedented reach and engagement potential, IPL 2025 promises to be a thrilling campaign for advertisers—provided they can navigate the higher costs, competition, and complexity of this newly integrated platform. This new era is poised to reshape advertising investment patterns in India, setting a precedent that could eventually influence the broader digital media landscape.