In our article Advertising after lockdown: Where would advertisers’ money go? published in April 2020, based on industry insights and our website traffic, we made some predictions regarding bounce-back of the top media platforms. It’s been six months to that and the festive season being around the corner, it is important to re-look at the state of advertising in order to make the most effective choice. Hence, in this article, we will look at the various media platforms from the perspective of advertising.

The year 2020 for advertising

Covid-19 was an unprecedented blow to adex in India but much before that, the signs of a slow-down were visible in the second half of 2019 itself. According to the Pitch Madison Advertising 2020 Mid Year Review report, adex decreased by 8% in 2020 Q1 while it dipped by 65% in 2020 Q2 owing to the complete lockdown in most parts of the country.

However, since the time the lockdowns were lifted in phases, several categories recorded a jump in sales due to pent-up demand and the onset of the festive season. The adex for the second half of the year is expected to recover in 2020 H2 and grow by 60-72%.

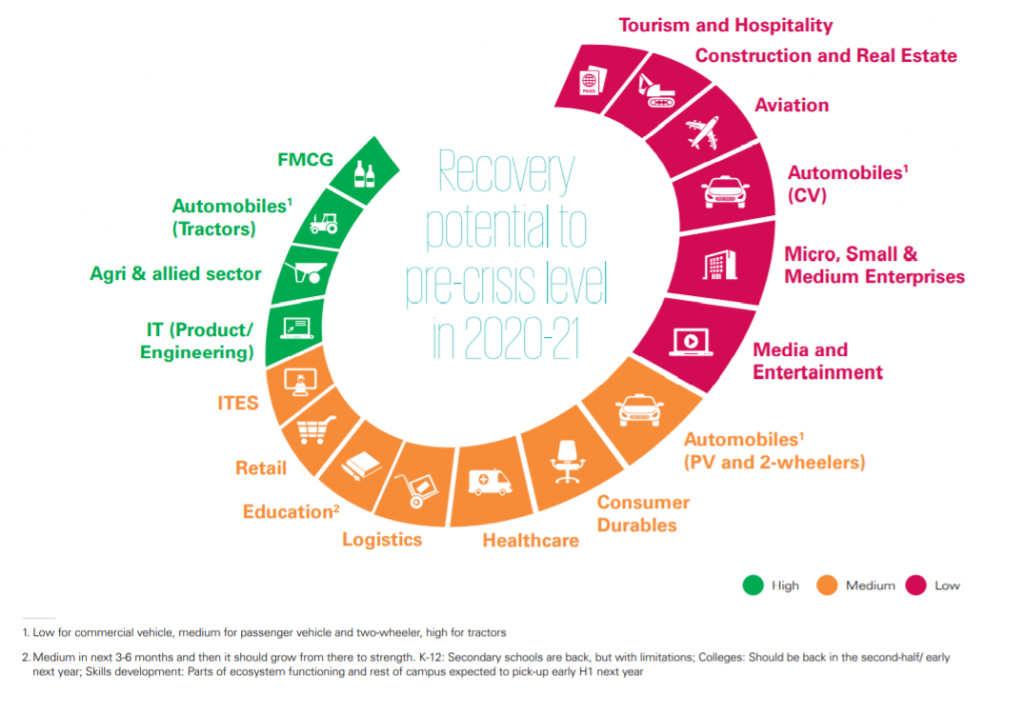

Here is a snapshot from the latest Media and Entertainment 2020 report by KPMG that exhibits recovery potential of various sectors to pre-crisis level in 2020-2021.

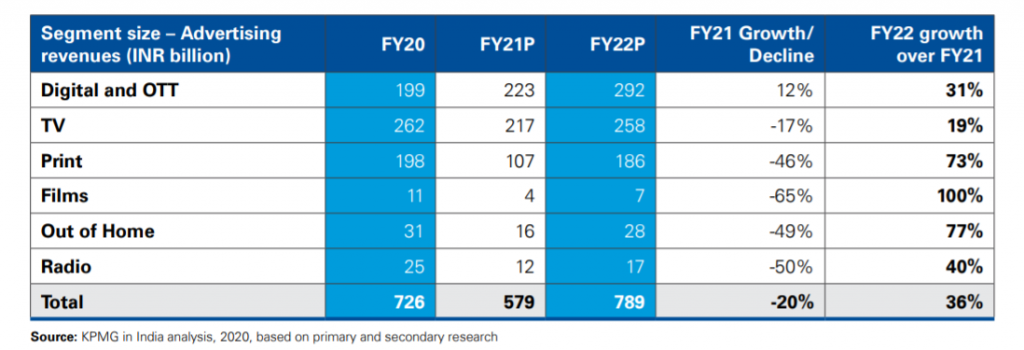

As we can see in the image above, media and entertainment too falls in the category of low recovery although within the M&E sectors, individual platforms had different experience. For example, digital flourished while cinema perished during the pandemic-induced lockdown. In fact, as per the KPMG report, advertising sector would take at least a year to revive completely. Following is an estimation of the growth of various advertising media over the next one year.

In the next sections, we would see how each of these segments have been performing since the pandemic hit the country.

Digital Advertising

It has been more than six months that lockdowns were imposed in the entire nation and people were asked not to venture out. Offices were closed, markets shut down. Only neighborhood stores and home delivery services were open. This gave a strong nudge to people to adopt digital services, be it digital payments, e-commerce, or hyperlocal delivery apps. Not only this, due to disruption in newspaper supply and lack of fresh content on television, people spent more time on OTT as well as online gaming platforms. On the work front too, with the majority of the workforce working from home, online communication platforms and tools witnessed a strong surge. Following is a snapshot from Comscore report Covid-19 and its impact on Digital Media Consumption in India which has some interesting insights on digital media consumption in India during the month of April 2020, when the country was under total lockdown.

As seen in the infographic above, digital consumption across categories increased during the lockdown. But did it sustain even after the lockdowns were lifted? The following charts from the latest report by Nielsen + Barc titled Deep dive into content & advertising consumption as ‘originals’ return on TV show that although the recent bans placed on some popular apps had an adverse effect on the time spent across user groups but the overall engagement of digital medium is in upward trajectory.

The above is a chart showing the daily time spent on smartphone since pre-covid period to week of 15th August. As we can see during the lockdown, the avg time spent per day on smartphone increased to 3 hrs 54 mins from 3 hours 22 mins in the pre-Covid period but later came to the Pre-Covid levels. With top apps like TikTok and PubG facing ban, this figure fell to 3 hours 14 mins in the weeks following the ban.

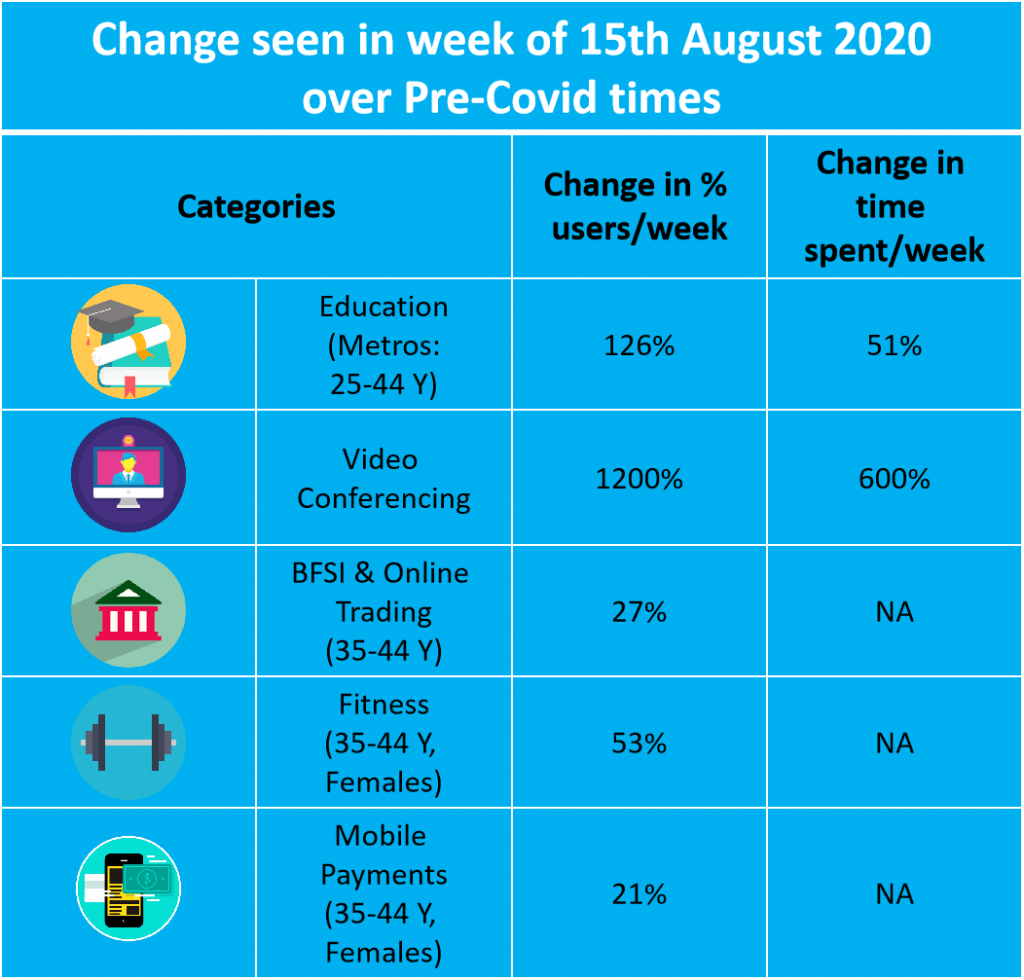

With more people staying home even after the lockdowns were eased, there was a greater inclination of certain cohorts towards digital activities. (Shown in the table below)

One can also see in the graph below that online shopping in the post-lockdown period has not only reached the pre-Covid level but has also surpassed it.

In the charts and tables above, we saw how digital consumption in India changed during and after the lockdown. Now we would see how this data shaped the digital advertising in India in the first half of the year 2020.

According to The Pitch Madison Advertising Mid-Year Report 2020, digital advertising suffered a minor contraction of 7% only in H1’20 over H1’19.

Not only this, digital was the only medium that witnessed a growth of 16% (over Q1’19) in Q1’20 while other media had a double-digit fall. However, the dip was substantial in Q2’20 at about 35% though it was significantly better than other media.

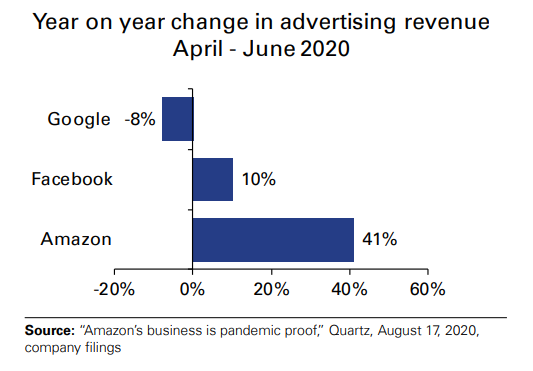

In terms of top digital ad types, video advertising and social media advertising made the highest contribution to the total digital adex in H1’20- 56%. There was a jump in social media advertising during Q2’20 as brands were trying hard to maintain saliency in absence of other media. This was followed by search advertising and display advertising which took a hit during the lockdown. However, this was the period when e-commerce advertising platforms made a mark.

As per the latest KPMG Media and Entertainment Report, digital advertising is expected to have a muted growth of 12% in the year 2020 but experience a normal growth the next year.

Television Advertising

Despite the growth of digital video in India, television remains the primary source of entertainment in the country. Covid-19 induced lockdowns had a deep impact on television viewership as well as television advertising. Following were some of factors that shaped the fate of television during the lockdown:

- Due to the lockdown, there was a halt on productions and shootings which affected the programs running on the channels and the television struggled with the lack of fresh content.

- Although there was no fresh content on TV, the viewership witnessed a major jump as several classic shows like Ramayan, Mahabharat etc were retelecast and people were forced to stay home.

- At the same time, television advertising dropped to an unprecedented low level as most categories except the essentials were struggling to stay afloat and minimized their advertising activities.

- Some genres like news marked a significant growth owing to significant events taking place in the last six months.

- As OTT platforms marked their presence, already ailing English and niche channels faced a tough challenge with many channels like AXN and FYI TV18 closing shop.

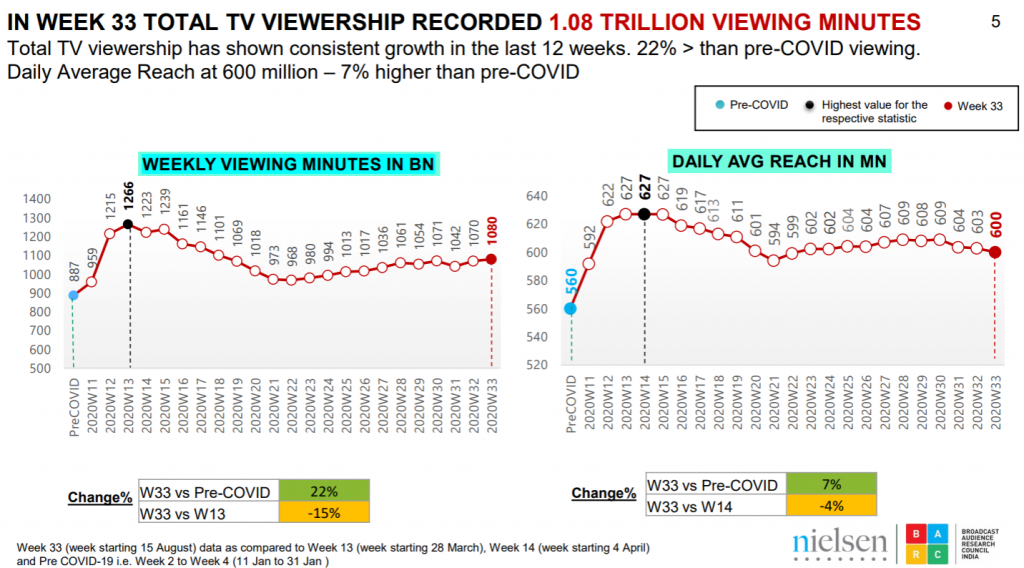

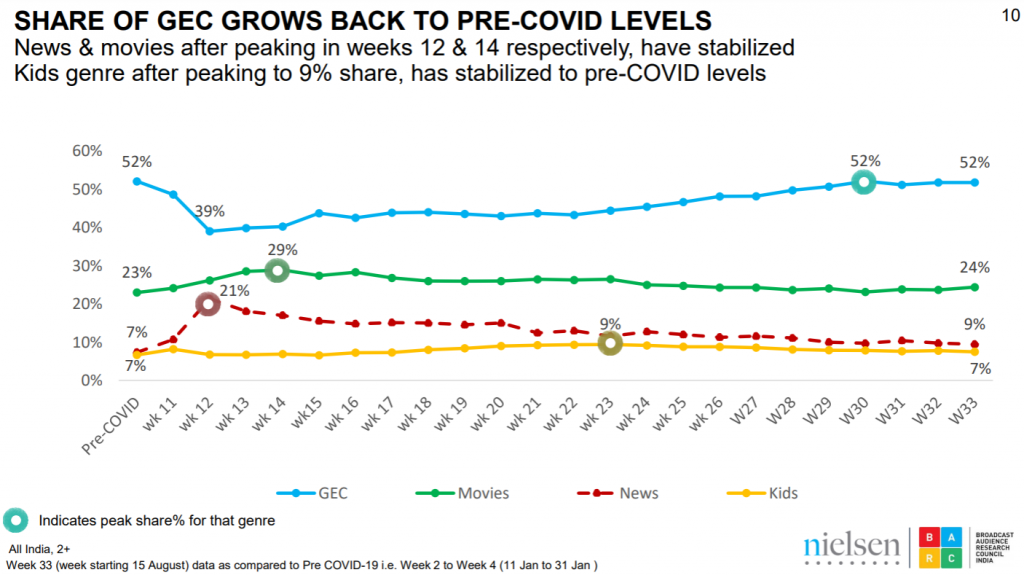

With lockdowns being lifted in phases, fresh content has already made its way to television. With people able to go out for work and other purposes, TV viewership has also neared the pre-Covid levels. Following are some snapshots from the 11th Edition of BARC-Nielsen report Deep Dive Into Content & Advertising Consumption As Originals Return On TV that throw some insights into the TV viewership pattern from lockdown to the week of Aug 15th.

- The daily average reach of television that was about 560 million in the Pre-Covid-19 time rose to 627 million during the lockdown and was at 600 million in week 33, 7% above the pre-Covid 19 levels.

- The average daily time spent which was about 3 hours 46 minutes in the Pre-Covid 19 time rose to 4 hours 48 minutes during the lockdown and now stands at 4 hours 17 minutes, 13% higher than the Pre-Covid levels

- Share of GEC channels that fell during the lockdown due to lack of fresh content, reached to the Pre-Covid 19 level.

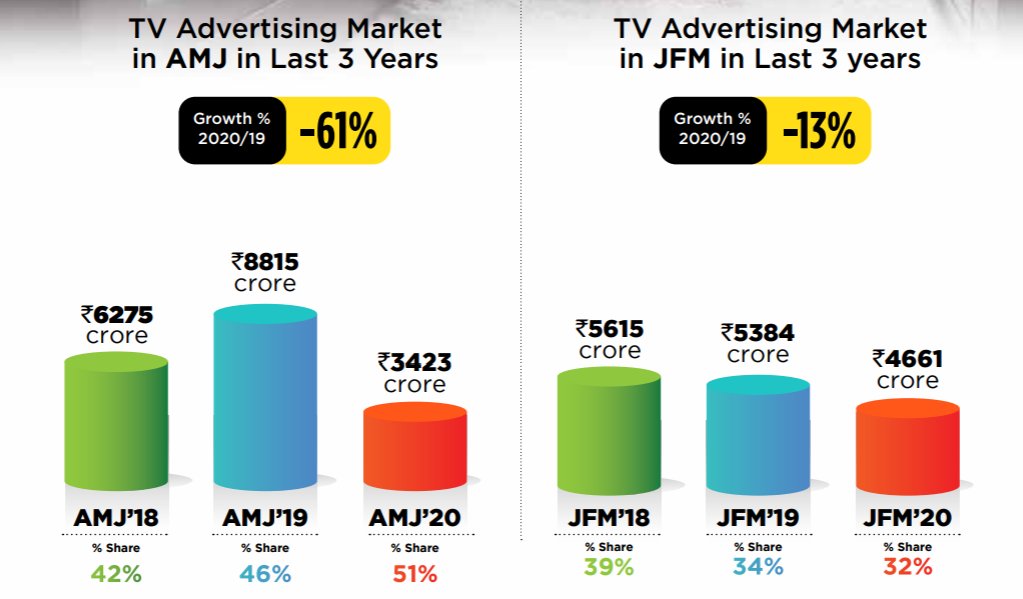

In the charts above, we saw that television witnessed a sudden jump in the viewership during the lockdown. However, when it comes to advertising, the spike in viewership wasn’t of any help. The primary reason behind this is the halt in the economy brought by the lockdown that forced most brands to either stop advertising altogether or cut down on their advertising budgets. Although there was no major dip in number of FCTs due to heavy discounts offered by television channels. However, adex was aversely affected. During the first half of the year 2020, the TV adex degrew by 43%. Also, postponement of major events like IPL also affected the adex deeply.

If analyzed category-wise, all categories showed a degrowth during H1’2020 with the highest dip witnessed in travel & tourism, telecom, beverages and auto & durables.

In terms of genre, FCT analysis shows that all genres exhibited a de-growth of at least 10-20% in H1’20 while there was a steep drop in genres like music (44%), English movies (41%), and Kannada, Tamil, and Telugu languages (16-25%).

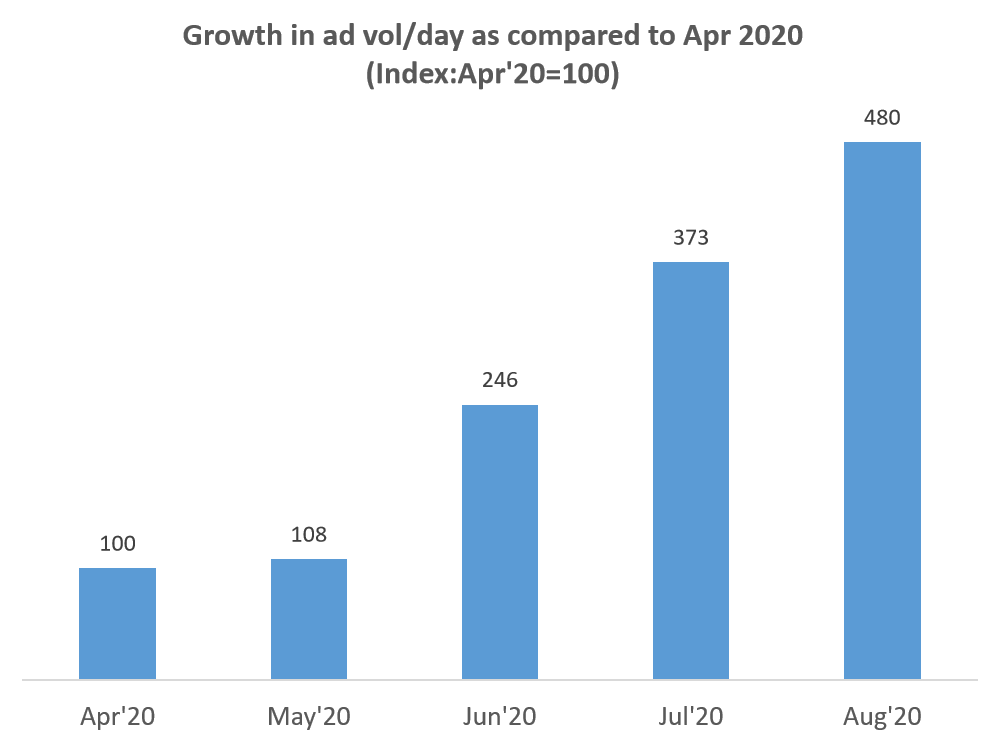

Though television was badly hit during the lockdown, it’s also one of the media to bounce back as soon as lockdowns were lifted off. Following is a graph showing TV ad volumes/day (in hours) for the months March to Sep (till 19th Sep only) that shows how television bounced swiftly after the lockdowns. (Source: TAM Reports)

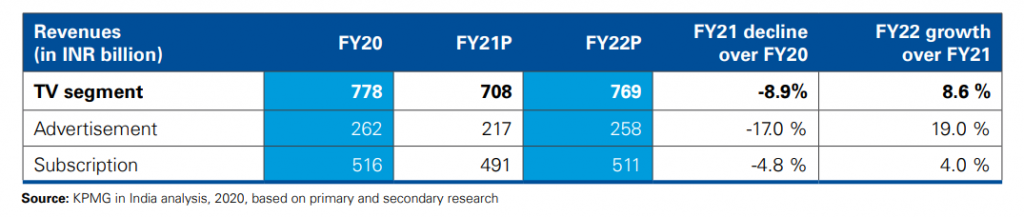

According to the Media and Entertainment Report 2020, television advertising is expected to witness a fall of 17% this year and would return to normal next year only with an estimated growth of 19%.

Radio Advertising

Similar to other advertising media, radio also faced the music during the pandemic induced lockdown. Due to the lockdown and the resulting slowdown in the economy, businesses had to cut down on advertising costs that affected radio advertising revenue severely. However, unlike television and print, radio didn’t face many operational issues as the transition from studio recording to work from home happened smoothly that led to radio producing fresh and innovative content. And although the outdoor movement was almost nil for more than two months that resulted in a drop in in-transit listenership, home listenership grew significantly during the lockdown period.

Here are some of the insights about Radio listenership during the lockdown based on a survey conducted by AZ Research PPL, Bangalore- Impact on Media Consumption in Urban India.

As seen in the infographic above, we can conclude the following:

There was a marginal growth in the radio listenership in the top six cities of India.

This growth can be majorly attributed to increased consumption of radio in SEC B, C, and D/E. This can be due to a lack of access to other modes of entertainment like television, the internet, and newspaper.

Most of the radio consumption has happened in-home and on mobile as compared to the pre-lockdown period when a considerable share of listenership comes from people traveling by car.

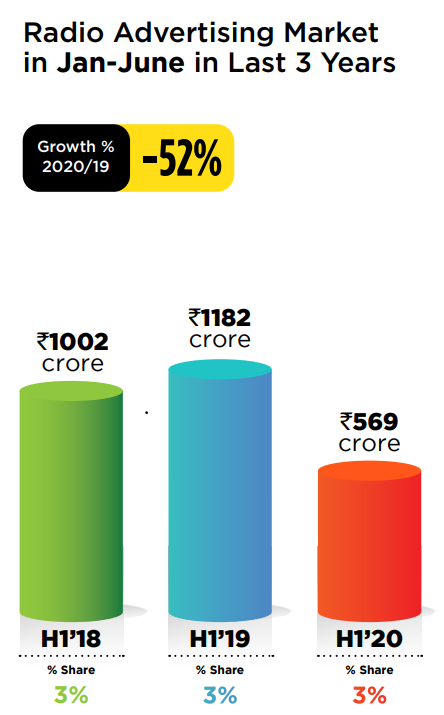

In terms of advertising, radio too faced challenges as radio advertising collapsed during Q2 after having a bad Q1. Almost every category on the radio was adversely affected. Amongst all, BFSI and E-commerce seem to be facing the lowest degrowth. (Source: PMAR Mid-Year Review 2020)

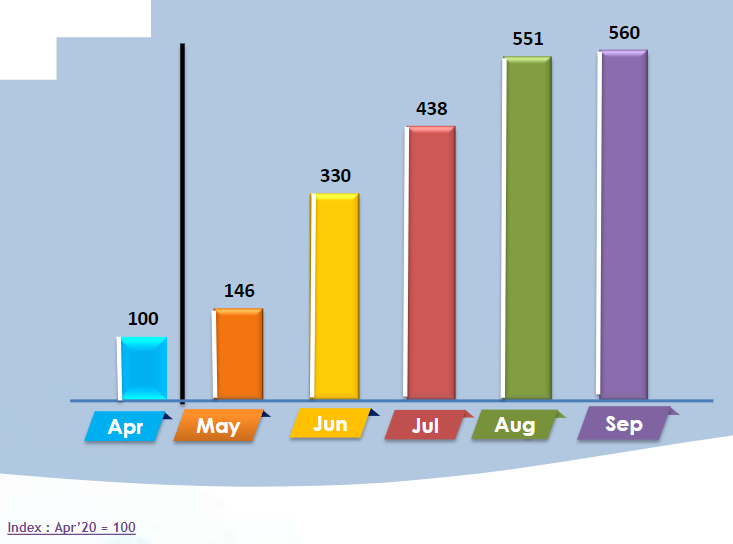

However, once the lockdowns were being lifted, radio advertising picked up. Following graph from TAM Adex report for Radio Advertising (Jun-Aug 2020) shows that average ad volume/day in Aug 2020 surged by 4.8 times compared to Apr 2020.

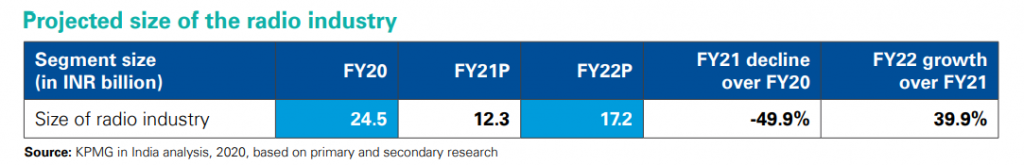

In terms of future outlook, according to The Media and Entertainment Report by KPMG, despite the jump in advertising in post lockdown period, radio would not recover completely this year and the next year as well. Following are the radio industry size projections for this financial year and the next.

Print Advertising

Like radio, print also suffered a major setback during the series of lockdowns. It wasn’t advertising revenue only but also the subscription revenue that was affected as several areas in the country were affected due to lockdown and newspaper distribution was disrupted. According to PMAR Mid Year Review 2020, In terms of volume as well as space consumed, there was a decline in H1’20 of 53% and a decline of 77% in Q2’20. Categories like FMCG, Auto and Education were the top contributing categories with almost 45% contribution to Print adex in H1’20 (as compared to 38% in H1’19).

Following are some of the developments that took place during the lockdown in the print advertising sector (Source: KPMG Media And Entertainment Report 2020):

- English newspapers suffered a significant dip during Q1’20. One of the major reasons for this shift was the diversion of revenue to digital media.

- Lockdown extensions in metros and tier 1 cities especially markets like Mumbai, Delhi, and Bengaluru led to a further dip in English print ads.

- Compared to English language print media, Hindi and other regional language print media did better as they enjoyed a better circulation in tier 2 and tier 3 cities as well as advertisements from local brands as well. Also, local language newspapers carried hyperlocal news which was difficult to obtain from digital media which made regional newspapers irreplaceable.

- Education was one of the categories that was away from advertising during this period due to a delay in the commencement of the new academic year.

- The industry responded to the crisis by taking some measures like

- Consolidation of small-town edition with nearby city edition.

- Reducing the number of pages along with the advertising inventory.

- Converting monthly subscribers to annual subscribers by offering attractive discounts.

Although this year was not a good one for print advertising till date, the festive season is expected to bring back some respite to the industry as print advertising has been an integral part of festive advertising plan of most brands. According to a latest article on Print advertising published in Economic Times dated 19th Oct 2020 titled Brands Return to Print Media this Festive Season.

- Newspapers that witnessed a steep fall ~80% during the lockdown have experienced a steady growth since July 2020 with each month being better than the previous one as said by media experts.

- Local to local ad volumes that were less than 10% in April are now at 80% of last year’s volumes. As per some sources, ad volumes this festive season has already reached 75% of the 2019 festive season.

- Categories like retail, real estate, auto and education have started spending on advertising in print at a level similar to last year.

- Print media has been the preferred media for brands during the festive season due to the quick response time and short shelf period print offers when compared to other popular media like television.

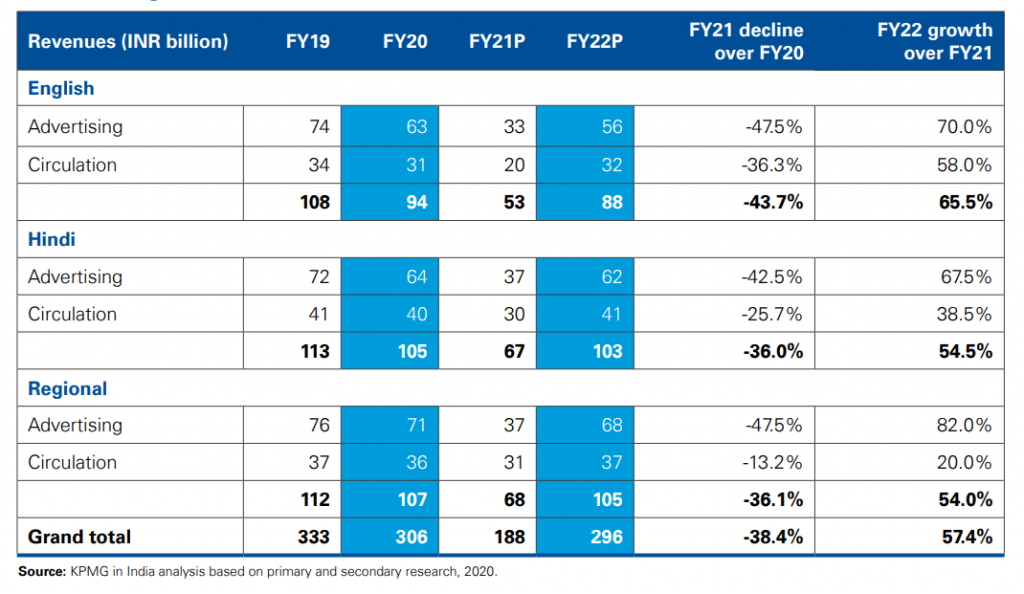

While print advertising is improving month on month, as per the industry experts (as discussed in the KPMG Media and Entertainment Report 2020), it would take print industry more than two years to reach year 2018 levels by 2022 only. Following is a table published in the report that talks about the projections of Hindi, English and regional prints for this year and the next year.

Outdoor Advertising

Outdoor was one of the worst affected media this year. With the Covid-19 induced lockdowns restricting people from moving outside for several months, outdoor advertising found itself in deep water. According to the PMAR Mid Year Report 2020, while the dip in the outdoor advertising market during Q1’20 was only 13%, in Q2’20 it was at 99%.

A recently published report by Laqshya Group- The world is moving again compares the traffic in the top cities of India- Delhi, Mumbai, and Bangalore at the end of Aug 2020 to Jan 2020, when traffic on roads was normal. As per the report, the following was the traffic level in Delhi, Mumbai, and Bangalore:

- Delhi: ~75%

- Mumbai: Between ~77% and ~84%

- Bengaluru: ~80%

As per the latest article on Exchange4Media.com dated 14th Oct 2020, titled: Will festive season bring the shine back for OOH sector, following are some of the developments in the OOH sector for this festive season:

- With the traffic coming back to normal, several prominent brands like ZEEL, Muthoot Finance and Cadbury have made a comeback to OOH advertising. Also, a number of outdoor media owners are offering attractive deals and discounts to encourage brands to include OOH to their media planning.

- The ongoing IPL season as well as reopening of restaurants, malls, etc have also resulted in increase in traffic on roads.

- Non-metro markets are the first ones to show the signs of recovery though metro cities are following suit too led by categories like Auto, BFSI, Pharma, FMCG, Mobile handset, OTT and e-commerce etc.

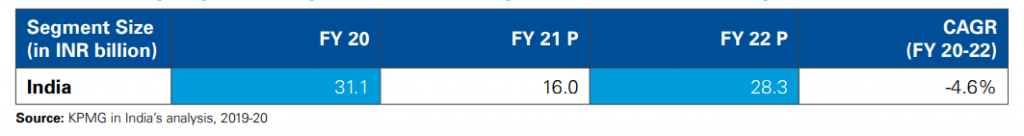

Despite the positive sentiments around the recovery of outdoor media and advertising, KPMG Media & Entertainment Report 2020 states that the growth of outdoor would be muted this year and the next year as well.

Cinema Advertising

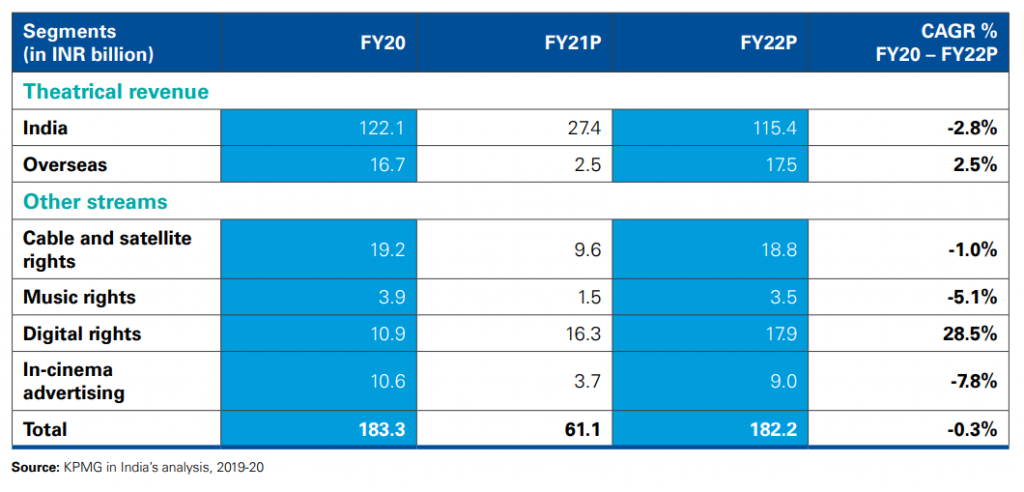

Cinema advertising has been the worst hit division undoubtedly. Cinema halls have been shit down during the lockdown and have been allowed to reopen with limited capacity in October only. As per the PMAR Mid Year 2020 report, Cinema advertising registered zero revenue during Q2’20.

As per an article published in Afaqs on 16th Oct titled: Halls have opened, but in-cinema advertising is still some time away, cinema hall owners are battling with low consumer sentiment and lack of fresh content and believe that it would take another four to six weeks to recover.

According to KPMG Media and Entertainment Report, the road to recovery for in-cinema advertising is the most difficult.

Hence, in this article, we went through various reports and tried to understand the journey of various media during and after the lockdown. We hope this article is useful for advertisers and brands. We would love to know your feedback. In case of any comments and queries, you can write to us at Help@TheMediaAnt.com.