In the month of January 2021, The Media Ant conducted Indian SMEs Advertising Survey 2021. The survey focused on the advertising preferences and challenges faced by the Indian SMEs who are often restricted by the budget and resources.

The top two findings of the survey were:

- 79% of respondents across categories are planning to advertise on digital platforms in 2021.

- 60% of respondents across categories want to advertise on more than one media.

As the world is battling the worst health crisis in centuries, businesses are working hard to cope up with the absence of humans at the forefront and minimize the dependency on physical touchpoints.

We are amid a digital revolution and as a manpower-heavy industry, there’s a lot we have to learn and improve upon to guarantee a seamless experience for our advertisers and vendors.

One of the several steps that we have taken in the direction of “flattening the ad world” apart from offering an online platform to explore and compare advertising rates, book and execute campaigns, is the introduction of calculators and tools to help advertisers plan their campaigns without depending on the planners.

MASH – Media Ant Self Help is our latest offering that is powered by the historical data of campaigns run by The Media Ant across platforms and geographies.

Hence, the data presented in the graphs is an actual representation of digital platforms preferred by SMEs.

While the tool continues to be populated with relevant information, we thought why not show you the power of MASH through this article.

In this article, we will pick our top 20 client categories and determine the best media mix selected by our past clients.

Some of these media exhibit different platform preferences according to online and offline sales channels in which case we have also presented top media for online and offline brands.

But that’s not all! Using the MASH tool, you can answer the following questions too:

- Preferred Media

- Minimum, Maximum, and Average Budget

- Minimum, Maximum, and Average Campaign Period

Across the following:

- Product Category

- Geography

- Consumer Type (B2B, B2C)

- Sales Channel (Offline, Online, App, Omni)

In case you would like to know more about how MASH works, check this video out:

Education

The education category covers a wide range of offline education institutions- schools, colleges, coaching centers for competitive exams as well as online edutech brands.

Some of our popular past education clients are Lead School, Coding Ninjas, Callido, Centa, AhaGuru, KJ Somaiya Institute of Management Studies & Research, Uable, MICA, NMIMS, Masai School, OP Jindal Global University, and Amrita Vishwa Vidhyapeetham.

Education ads are mostly targeted towards young audiences (students, young professionals) as well as parents of students.

Hence, digital finds the top place in terms of ad platform choice followed by non-traditional platforms which are very popular among local institutions for hyperlocal targeting.

Newspapers being the most trusted advertising media are also very popular as they are read by students as well as parents.

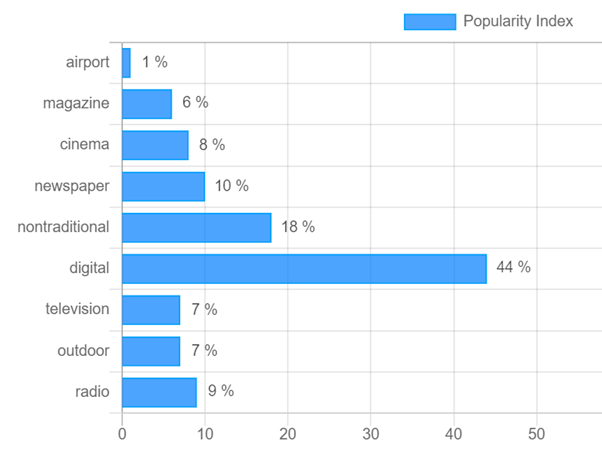

Education- Top preferred media overall

The top 3 advertising platforms for education brands are:

- Digital- Added to 44% campaigns

- Non-traditional- Added to 18% campaigns

- Newspaper- Added to 10% campaigns

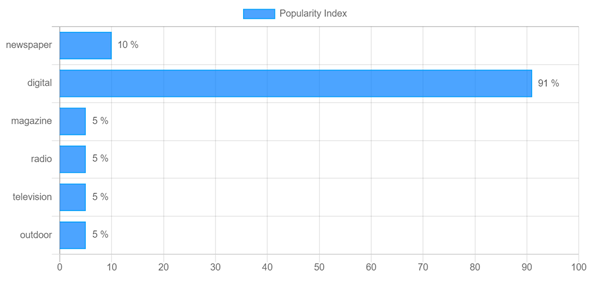

Education – Top preferred media by Online brands

The top 3 advertising platforms for online education brands are:

- Digital – Added to 91% campaigns

- Newspaper – Added to 10% campaigns

- Radio, TV & Outdoor – Added to 5% campaigns

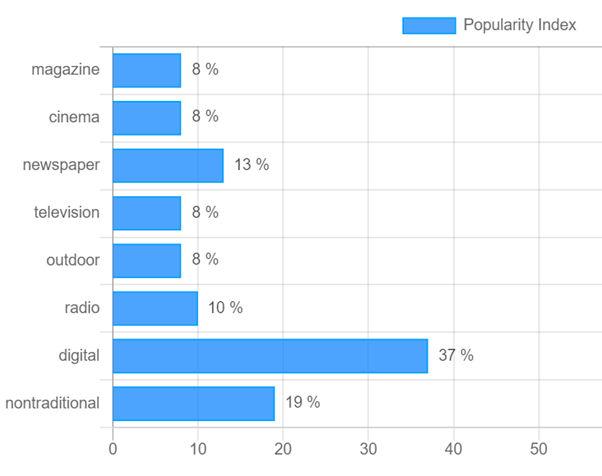

Education – Top preferred media by Offline brands

The top 3 advertising platforms for offline education brands are:

- Digital – Added to 37% campaigns

- Non-traditional – Added to 19% campaigns

- Newspaper – Added to 13% campaigns

Food & Restaurants

The food and restaurants category covers restaurants, foodtech brands, and a variety of food brands. Some of our popular past food & restaurant clients are Slurrp Farm, Granton Whiskey, The Organic World, Charcoal Eats, Suguna Chicken, Dineout, The Belgian Waffle Co, and Apsara Ice Creams.

Restaurant ads are mostly hyperlocal in nature hence, non-traditional and cinema as advertising platforms work the best for them.

Restaurants and cinema ads work the best since people love eating out after a movie. Radio too is a good platform for offline brands.

For food tech brands and restaurants selling direct to consumers, digital is the top preferred media.

Food & Restaurants – Top preferred media overall

The top 3 advertising platforms for food & restaurants brands are:

- Non-traditional – Added to 38% campaigns

- Digital – Added to 26% campaigns

- Cinema – Added to 19% campaigns

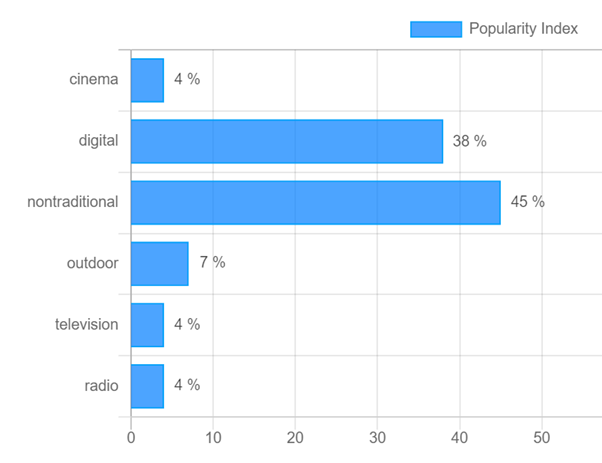

Food & Restaurants – Top preferred media by Online brands

The top 3 advertising platforms for online food & restaurant brands are:

- Non-traditional – Added to 45% campaigns

- Digital – Added to 38% campaigns

- Outdoor – Added to 7% campaigns

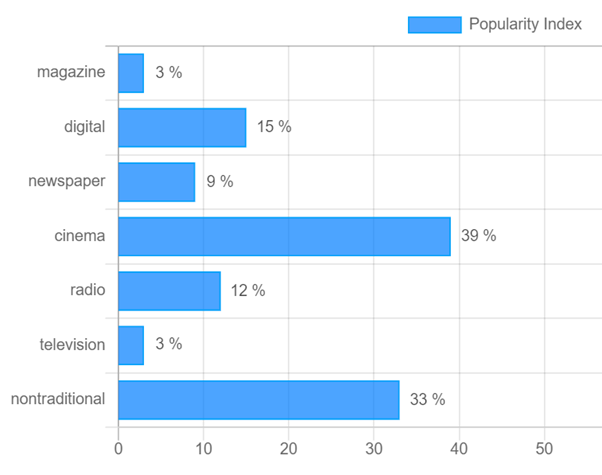

Food & Restaurants- Top preferred media by Offline brands

The top 3 advertising platforms for offline food & restaurants brands are:

- Cinema – Added to 39% campaigns

- Non-traditional – Added to 33% campaigns

- Digital – Added to 15% campaigns

Finance

The finance category covers various banking institutions and NBFCs along with fintech brands, payment apps, investment, and tax consulting brands.

Some of our popular past finance clients are Groww, Bajaj Finserv, Muthoot Finance, Wazirx, Money Tap, Fisdom, Loan Suvidha, Navi, Greater Bank, Open Financial Technologies, and RapiPay.

Finance brands mostly target educated working professionals who are most likely to have surplus money for saving and investments.

While the banking industry overall has a preference for digital medium for advertising, newspaper and radio are also top runners when it comes to advertising financial products Newspaper is mostly read by the top NCCS as well as is the most trusted medium while the radio is mostly listened to by people while commuting to and from work.

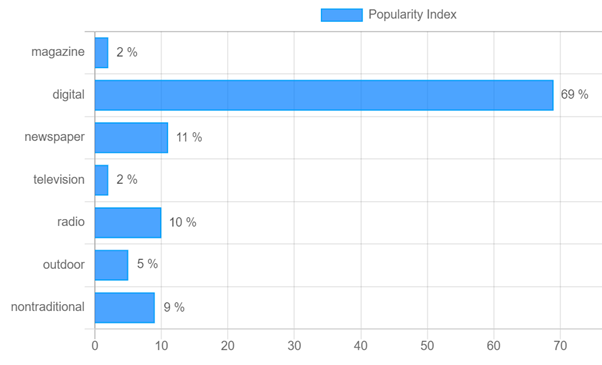

Finance- Top preferred media overall

The top 3 advertising platforms for finance brands are:

- Digital- Added to 69% campaigns

- Newspaper- Added to 11% campaigns

- Radio- Added to 10% campaigns

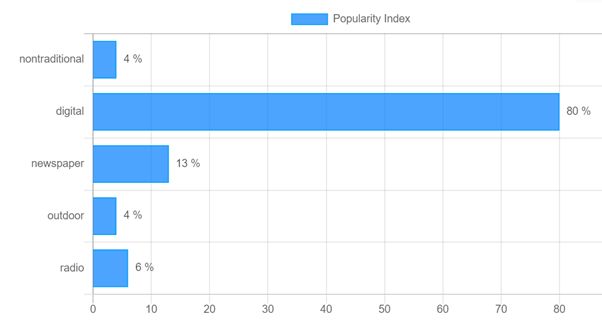

Finance – Top preferred media by Online brands

The top 3 advertising platforms for online finance brands are:

- Digital- Added to 80% campaigns

- Newspaper- Added to 13% campaigns

- Radio- Added to 6% campaigns

Finance – Top preferred media by Offline brands

The top 3 advertising platforms for offline finance brands are:

- Digital- Added to 43% campaigns

- Radio- Added to 29% campaigns

- Non-traditional, Magazine, TV- Added to 15% campaigns

Services

The services category covers brands offering various types of services. Some of our popular past services clients are Zomato, Dunzo, Lokal App, Jugnoo, Astrotalk, ShopG, UTubeGood, Tatkshana Ayurveda, and Le Salon Café.

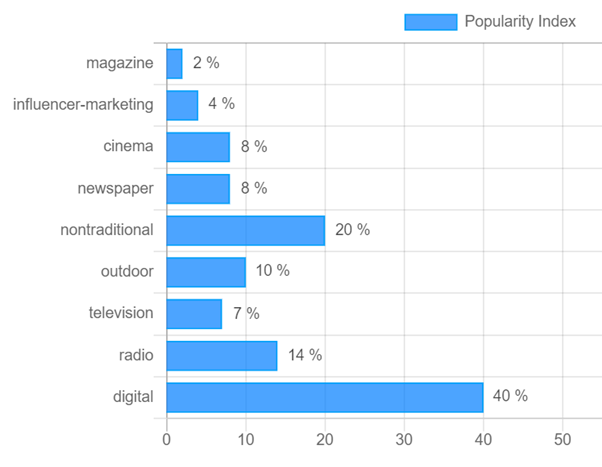

Services – Top preferred media overall

The top 3 advertising platforms for services brands are:

- Digital- Added to 40% campaigns

- Non-traditional- Added to 20% campaigns

- Radio- Added to 14% campaigns

Services – Top preferred media by Online brands

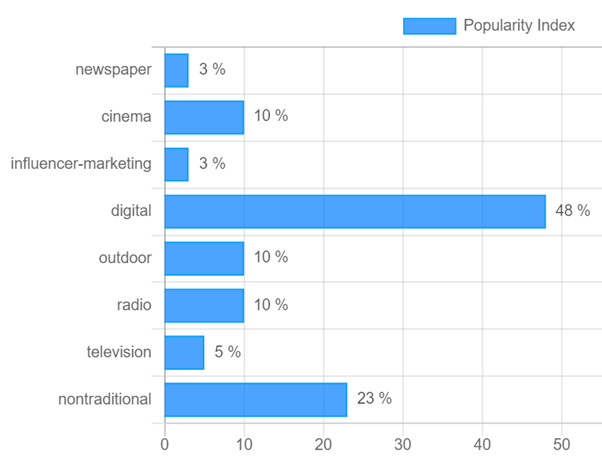

The top 3 advertising platforms for online services brands are:

- Digital- Added to 48% campaigns

- Non-traditional- Added to 23% campaigns

- Radio, Outdoor, Cinema- Added to 10% campaigns

Services – Top preferred media by Offline brands

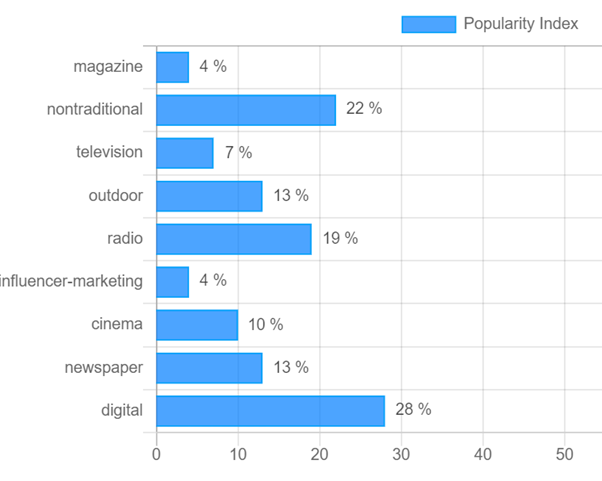

The top 3 advertising platforms for offline services brands are:

- Digital- Added to 28% campaigns

- Non-traditional- Added to 22% campaigns

- Radio- Added to 19% campaigns

Healthcare

The Healthcare category covers health-tech brands like healthcare apps, healthcare equipment, hospitals, healthcare retail chains, healthcare testing labs, and medicine brands, etc.

Some of our popular past services clients are Johnson & Johnson, Abbott, 1MG, Tata Health, MedFin, Omron, Medgenome, Thyrocare, Brihans Natural Products, Novo Nordisk, Carl Zeiss India.

Healthcare brands predominately healthcare apps and hospitals heavily rely on local and hyperlocal level advertising hence radio and non-traditional are the top two preferred media platforms.

Digital is preferred by apps and other health-tech brands.

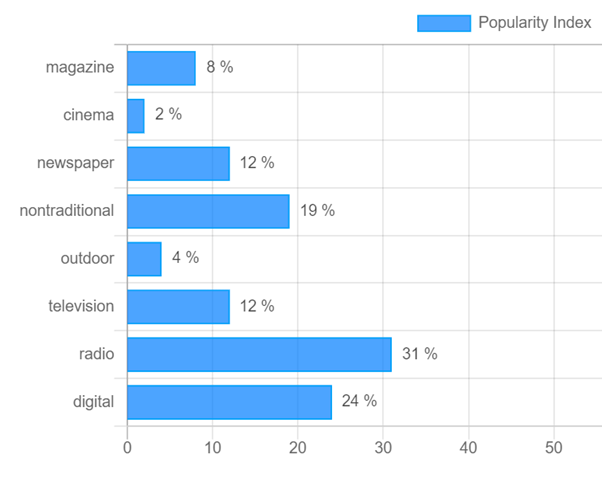

Healthcare – Top preferred media overall

The top 3 advertising platforms for healthcare brands are:

- Radio- Added to 31% campaigns

- Digital- Added to 24% campaigns

- Non-traditional- Added to 19% campaigns

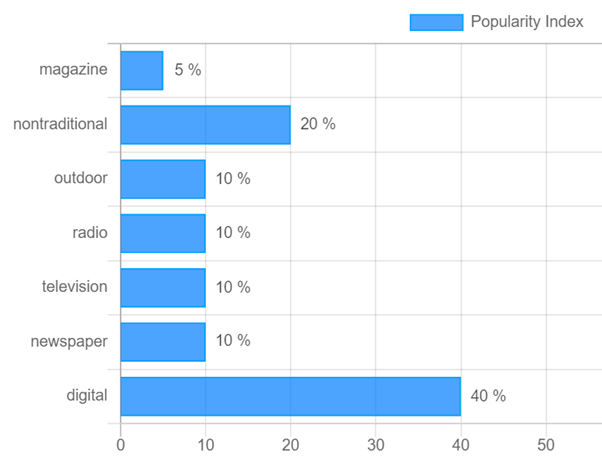

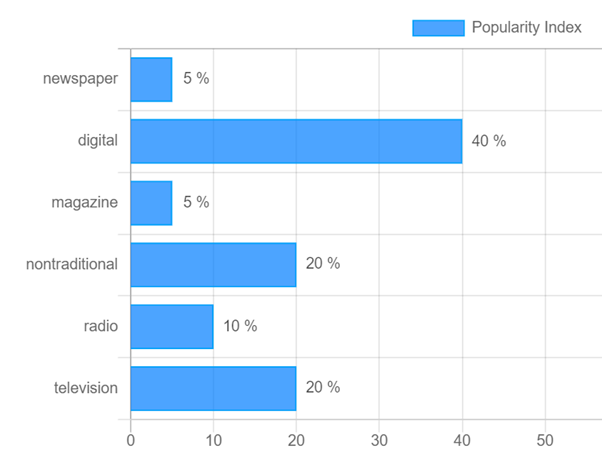

Healthcare – Top preferred media by Online brands

The top 3 advertising platforms for online healthcare brands are:

- Digital- Added to 40% campaigns

- Non-traditional- Added to 20% campaigns

- Outdoor, radio, TV, newspaper- Added to 10% campaigns

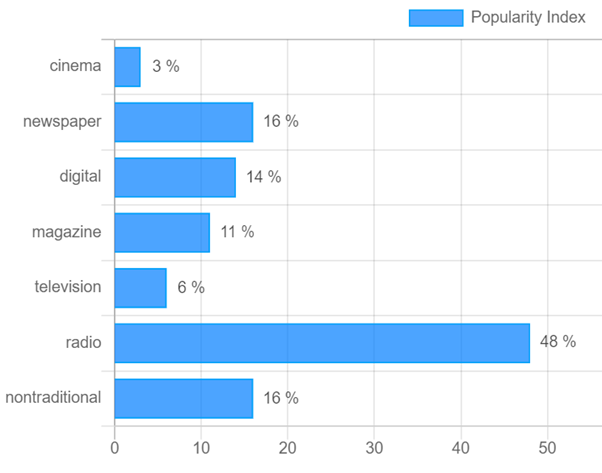

Healthcare – Top preferred media by Offline brands

The top 3 advertising platforms for offline healthcare brands are:

- Radio- Added to 48% campaigns

- Non-traditional & Newspaper- Added to 16% campaigns

- Digital- Added to 14% campaigns

IT Products & Services

IT Products & Services cover brands offering hardware and software products, consultancies, etc.

Some of our popular past service clients are HP, Avita, Cisco, Team Viewer, Salesforce, Nasscom, Exotel.

This category has a variety of product offerings ranging from B2C to B2B hence, one can see a different mix of platforms opted by the advertisers.

While online brands prefer digital for promotions, for offline brands mostly hardware retail shops went for outdoor, radio, TV, and digital.

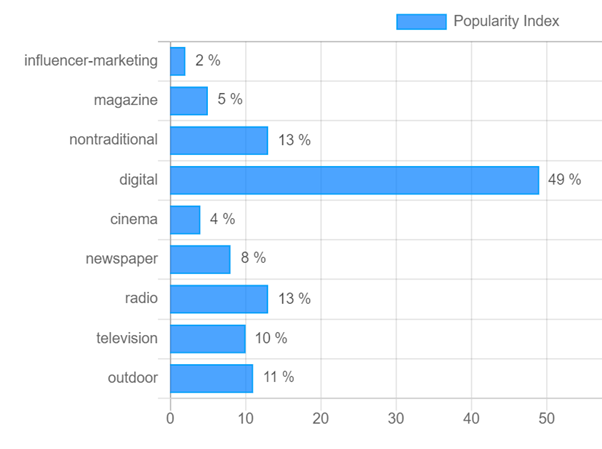

IT Products & Services- Top preferred media overall

The top 3 advertising platforms for IT Products & Services brands are:

- Digital- Added to 49% campaigns

- Non-traditional & Radio- Added to 13% campaigns

- Outdoor- Added to 11% campaigns

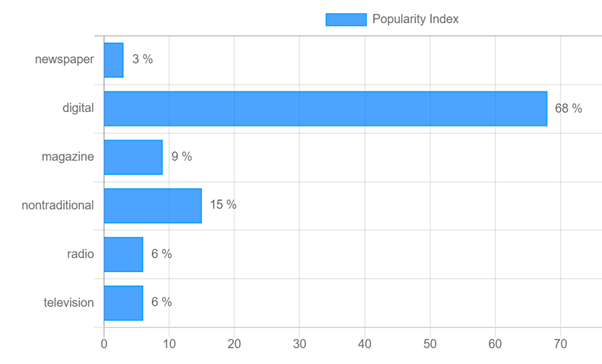

IT Products & Services – Top preferred media by Online brands

The top 3 advertising platforms for online IT products & Services brands are:

- Digital- Added to 68% campaigns

- Non-traditional- Added to 15% campaigns

- Magazine- Added to 9% campaigns

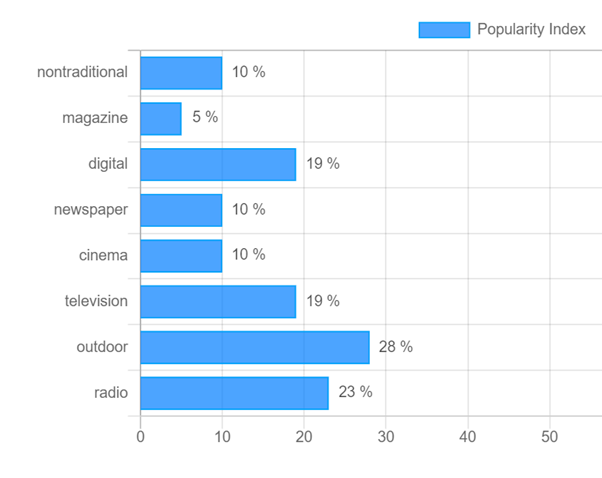

IT Products & Services – Top preferred media by Offline brands

The top 3 advertising platforms for offline IT Products & Services brands are:

- Outdoor- Added to 28% campaigns

- Radio- Added to 23% campaigns

- Digital & TV- Added to 19% campaigns

Transportation & Logistics

Transportation & logistics category covers brands that are into the transport of light and heavy goods, courier services, ride-hailing apps, pick up and drop services, etc.

Some of our popular past transportation & logistics clients are Dunzo, Uber, Essar, Tora Cabs, Namma Auto, Quick Ride, etc.

We can see a different trend in terms of media preference for online and offline transportation and logistics brands.

For online brands that mostly include delivery and ride-hailing apps, hyperlocal advertising is the preferred mode of ads hence, a prevalence of non-traditional advertising is there while for offline brands digital takes the top spot.

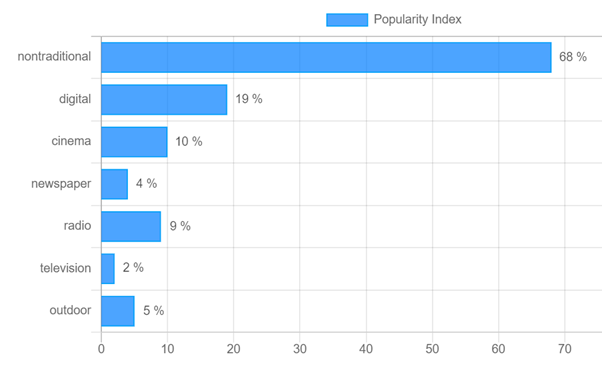

Transportation & Logistics – Top preferred media overall

The top 3 advertising platforms for transportation & logistics brands are:

- Non-traditional – Added to 68% campaigns

- Digital- Added to 19% campaigns

- Cinema- Added to 10% campaigns

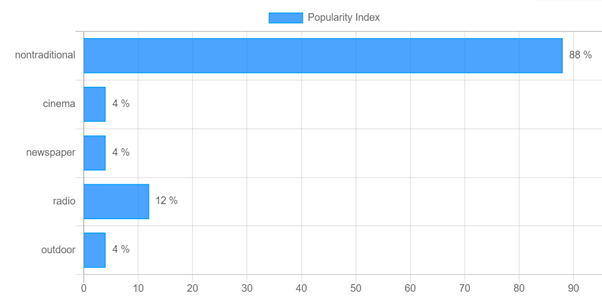

Transportation & Logistics – Top preferred media by Online brands

The top 3 advertising platforms for online transportation & logistics brands are:

- Non-traditional- Added to 88% campaigns

- Radio- Added to 12% campaigns

- Cinema, Newspaper & Outdoor- Added to 4% campaigns

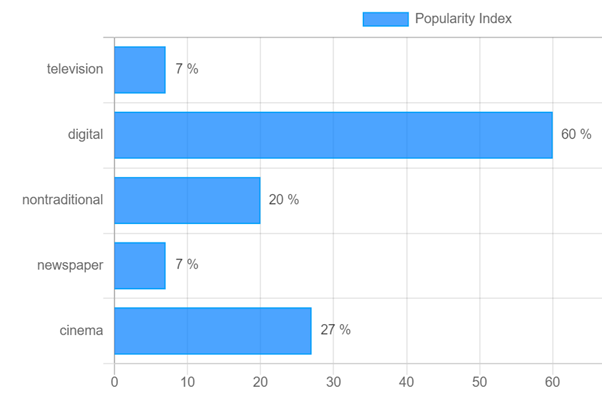

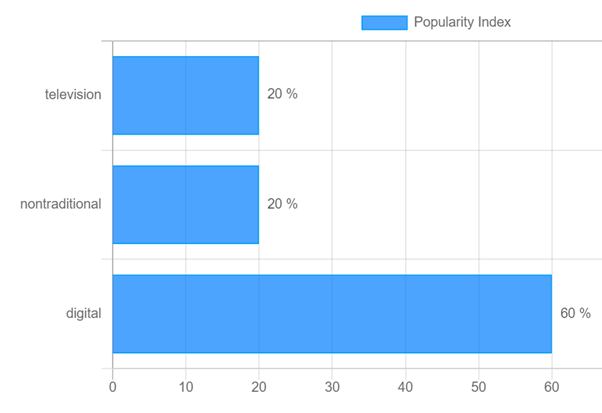

Transportation & Logistics – Top preferred media by Offline brands

The top 3 advertising platforms for offline Transportation & Logistics brands are:

- Digital- Added to 60% campaigns

- Cinema- Added to 27% campaigns

- Non-traditional- Added to 20% campaigns

Shopping & Retail

The shopping & Retail category covers a number of retail brands both offline and online.

Some of our popular past shopping & retail clients are Amazon Business, Miniso, Ample, Itsy Bitsy, GKB Opticals, Cello, Biba, Celio, Furlenco.

While advertising for online brands is driven largely by digital media, offline brands that have physical stores, rely on local and hyperlocal media for promotions.

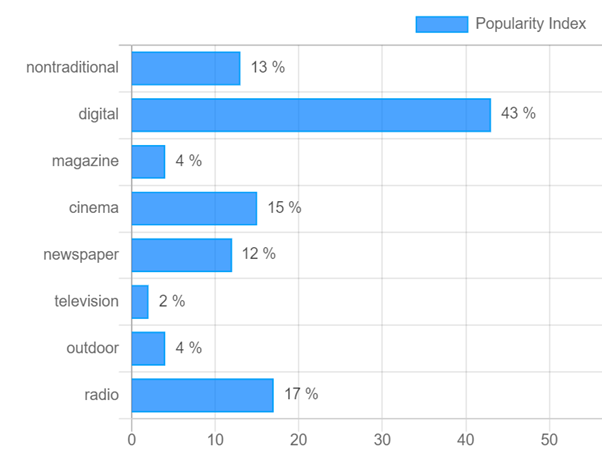

Shopping & Retail – Top preferred media overall

The top 3 advertising platforms for shopping & retail brands are:

- Digital – Added to 43% campaigns

- Radio- Added to 17% campaigns

- Cinema- Added to 15% campaigns

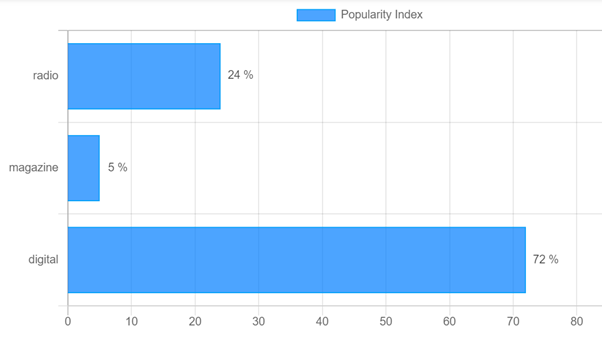

Shopping & Retail – Top preferred media by Online brands

The top 3 advertising platforms for online shopping & retail brands are:

- Digital- Added to 72% campaigns

- Radio- Added to 24% campaigns

- Magazine- Added to 5% campaigns

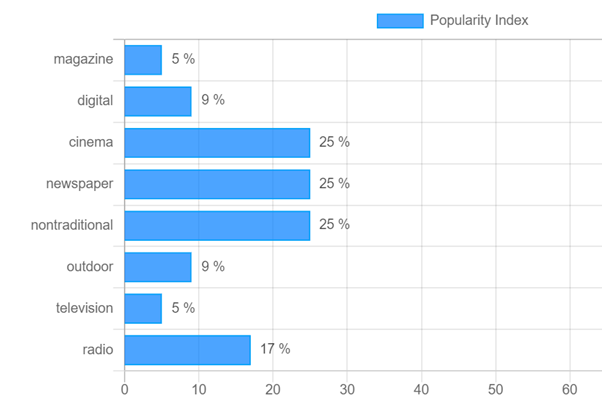

Shopping & Retail – Top preferred media by Offline brands

The top 3 advertising platforms for offline Shopping & Retail brands are:

- Cinema, Non-traditional & Newspaper- Added to 25% campaigns

- Radio- Added to 17% campaigns

- Digital & Outdoor- Added to 9% campaigns

Fashion & Lifestyle

The fashion & lifestyle category covers a number of fashion and lifestyle brands both online and offline.

Some of our popular past fashion & lifestyle clients are GAP, Inorbit Mall, Decathlon, Etsy, Meesho, Blackberrys, Phoenix Marketcity, Dixcy Scott, Casio, John Jacobs, and Bewakoof.com.

While digital brands primarily focus on digital platforms for ads, for offline brands selling through local stores, local and hyperlocal level advertising is important.

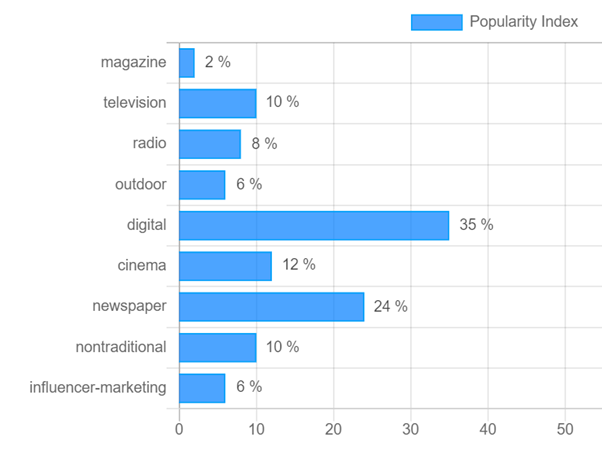

Fashion & Lifestyle- Top preferred media overall

The top 3 advertising platforms for Fashion & Lifestyle brands are:

- Digital – Added to 35% campaigns

- Newspaper- Added to 24% campaigns

- Cinema- Added to 12% campaigns

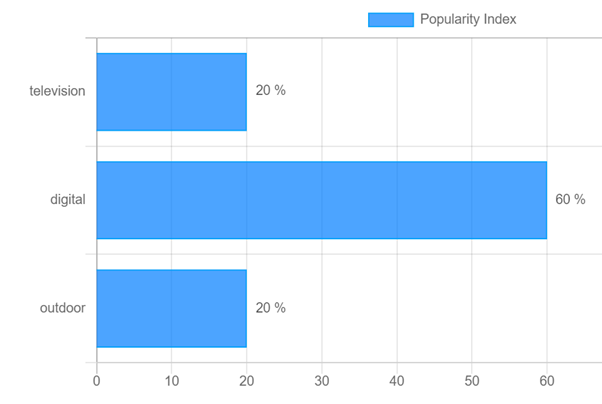

Fashion & Lifestyle – Top preferred media by Online brands

The top 3 advertising platforms for online fashion & lifestyle brands are:

- Digital- Added to 60% campaigns

- TV & Outdoor- Added to 20% campaigns

Fashion & Lifestyle – Top preferred media by Offline brands

The top 3 advertising platforms for offline fashion & lifestyle brands are:

- Newspaper- Added to 33% campaigns

- Digital- Added to 19% campaigns

- Non-traditional, cinema, radio & TV- Added to 11% campaigns

Engineering

The engineering category covers brands in engineering goods and machinery.

Some of our popular past engineering clients are Jindal Stainless Steel, Perkins, Tata Industries, Astral Pipes, Kohler Power India, and SEW Eurodrive.

Most of these brands are offline and rely heavily on industry-specific magazines for ads as can be seen in the chart below.

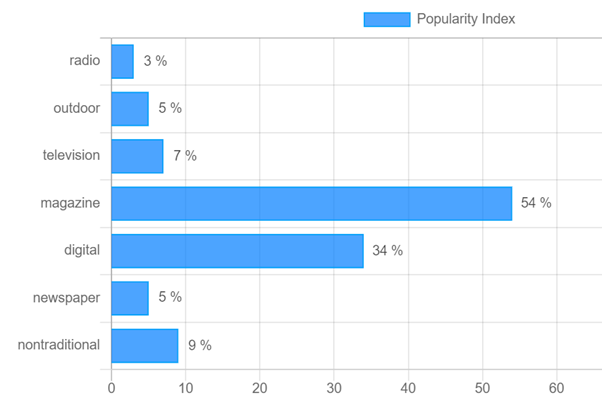

Engineering – Top preferred media overall

The top 3 advertising platforms for engineering brands are:

- Magazine – Added to 54% campaigns

- Digital- Added to 34% campaigns

- Non-traditional- Added to 9% campaigns

Entertainment

The entertainment category covers gaming brands, entertainment platforms, entertainment companies as well as specific content like movies and music videos, etc.

Some of our popular past entertainment clients are League11, Pocket Ludo, Teamplay 11, PayTM Insider, Comic Con India, Ludo King, Adda 52, Teen Patti Life, Reliance ADA, Vinayak Entertainment.

Television is an important medium for entertainment brands for advertising due to its mass appeal and reach.

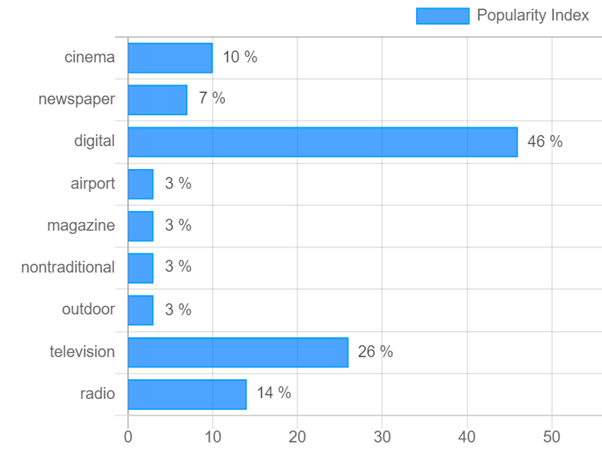

Entertainment – Top preferred media overall

The top 3 advertising platforms for entertainment brands are:

- Digital – Added to 46% campaigns

- TV- Added to 26% campaigns

- Radio- Added to 14% campaigns

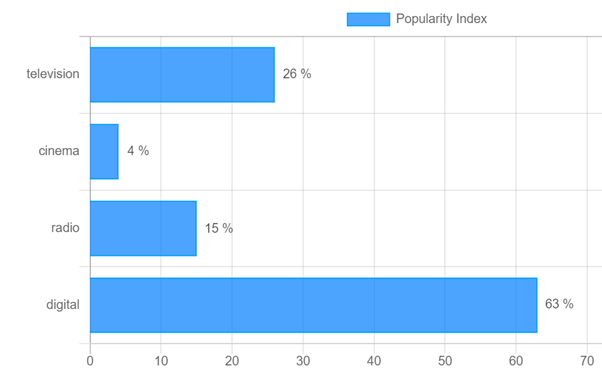

Entertainment – Top preferred media by Online brands

The top 3 advertising platforms for online entertainment brands are:

- Digital- Added to 63% campaigns

- TV – Added to 26% campaigns

- Radio- Added to 15% campaigns

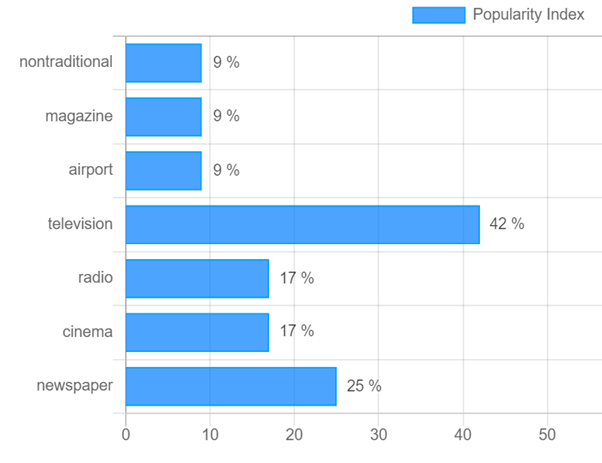

Entertainment – Top preferred media by Offline brands

The top 3 advertising platforms for offline entertainment brands are:

- TV- Added to 42% campaigns

- Newspaper- Added to 25% campaigns

- Radio & Cinema- Added to 17% campaigns

Real Estate

The real Estate category covers real estate brands. Some of our popular past real estate clients are L&T Realty, NCC Urban, Raheja Group, Mahaveer Group, Rohan Builders, Sunteck Realty.

Since most real estate brands promote individual projects local and hyperlocal platforms are preferred.

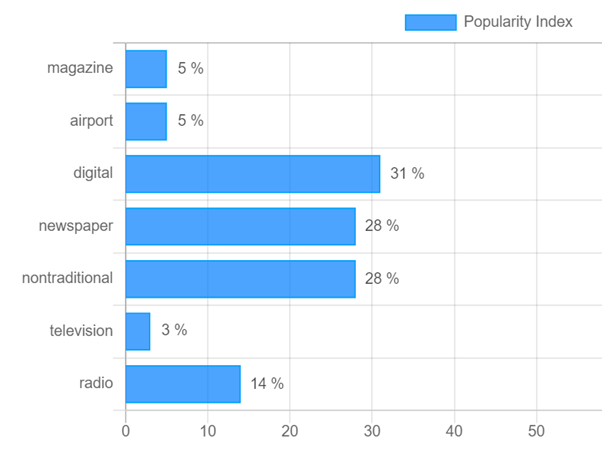

Real Estate – Top preferred media overall

The top 3 advertising platforms for real estate brands are:

- Digital – Added to 31% campaigns

- Newspaper & Non-traditional- Added to 28% campaigns

- Radio- Added to 14% campaigns

Home Decor & Construction

The home Décor & Construction category covers brands that offer building materials, furniture as well as other home décor items.

Some of our popular past home décor and construction clients are Royal Oak, Somany Tiles, Orient Electric, Maharaja Whiteline, Godrej Interio, Urban Ladder.

Digital, non-traditional, and magazines are popular mediums for advertising for home décor & construction categories.

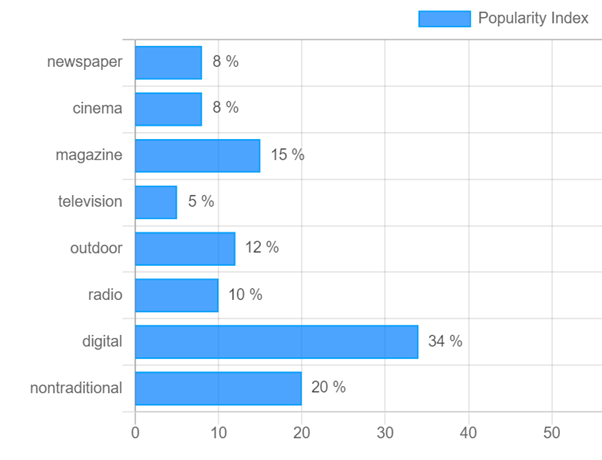

Home decor & Construction – Top preferred media overall

The top 3 advertising platforms for home décor & construction brands are:

- Digital – Added to 34% campaigns

- Non-traditional- Added to 20% campaigns

- Magazine- Added to 15% campaigns

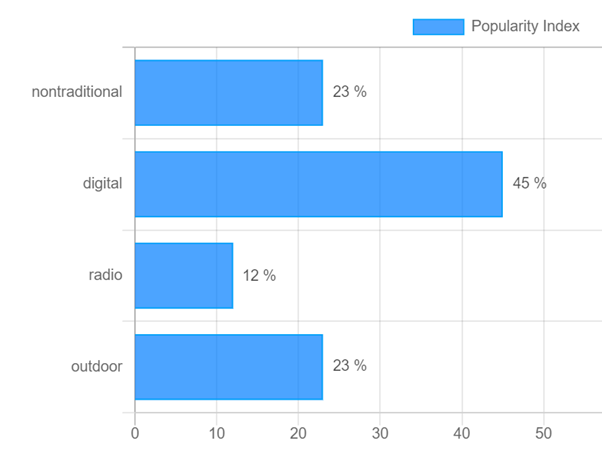

Home Decor & Construction – Top preferred media by Online brands

The top 3 advertising platforms for online home décor & construction brands are:

- Digital- Added to 45% campaigns

- Non-traditional & Outdoor – Added to 23% campaigns

- Radio- Added to 12% campaigns

Home Decor & Construction – Top preferred media by Offline brands

The top 3 advertising platforms for offline home décor & construction brands are:

- Digital & Magazine- Added to 30% campaigns

- Newspaper & Cinema- Added to 18% campaigns

- TV- Added to 12% campaigns

Electronics & Gadgets

Electronics & Gadgets category covers brands that offer electronic goods like mobile, headphones, retailers of electronics & gadgets, etc.

Some of our popular past electronics & gadgets clients are Zebronics, WD, Toshiba, Sony, Sandisk, LG Electronics, Dyson, Logitech, Futureworld, GK Vale & Co.

The electronics and gadgets advertising can be segregated into two types- branding ads for which national media like television and digital are preferred and performance ads for sale as well ads placed by local dealers which are local and hyperlocal in nature.

Electronics & Gadgets – Top preferred media overall

The top 3 advertising platforms for electronics & gadgets brands are:

- Digital – Added to 45% campaigns

- Non-traditional- Added to 22% campaigns

- TV & Radio- Added to 14% campaigns

Electronics & Gadgets – Top preferred media by Online brands

The top 3 advertising platforms for online electronics & gadgets brands are:

- Digital- Added to 60% campaigns

- Non-traditional & TV – Added to 20% campaigns

Electronics & Gadgets – Top preferred media by Offline brands

The top 3 advertising platforms for offline electronics & gadgets brands are:

- Non-traditional & TV- Added to 34% campaigns

- Radio- Added to 25% campaigns

- Digital- Added to 17% campaigns

Fitness & Health

Fitness & Health category refers to wellness brands that are into wellness products, health supplements, gyms, yoga, etc. Some of our past fitness & health clients are Hair & Skin Factory, Ayur Alpha, My Protein, Anytime Fitness.

The top 3 advertising platforms for fitness & health are:

- Non-traditional – Added to 33% campaigns

- Digital- Added to 28% campaigns

- TV & Radio- Added to 14% campaigns

Fitness & Health – Top preferred media by Online brands

The top 3 advertising platforms for online fitness & health brands are:

- Digital- Added to 40% campaigns

- Non-traditional & TV – Added to 20% campaigns

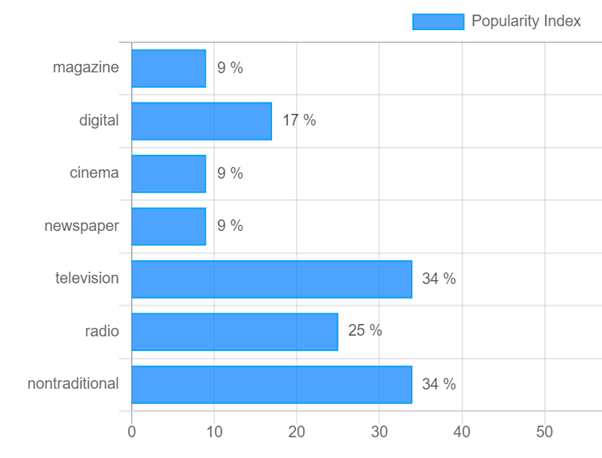

Fitness & Health – Top preferred media by Offline brands

The top 3 advertising platforms for offline fitness & health brands are:

- Non-traditional- Added to 43% campaigns

- Radio- Added to 22% campaigns

- Digital & Cinema- Added to 15% campaigns

FMCG

FMCG category covers food and other consumer brands. Some of our past FMCG clients are Fortune, Havmor, Haldiram’s, Unibic, Mc Cain, Parrys, Akshayakalpa, Anmol Biscuits, Tulips.

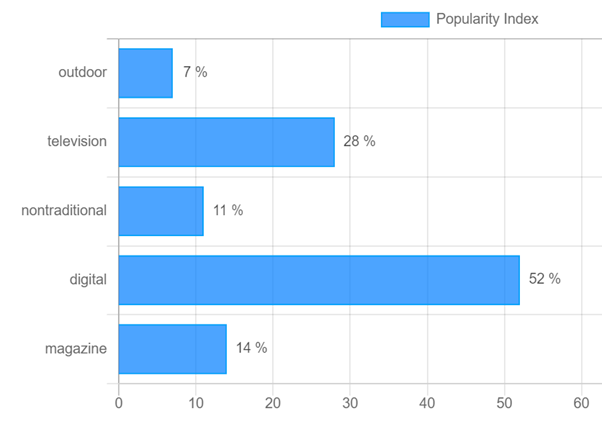

FMCG – Top preferred media overall

The top 3 advertising platforms for FMCG are:

- Digital – Added to 52% campaigns

- TV- Added to 28% campaigns

- Magazine- Added to 14% campaigns

Hospitality

The hospitality category covers hotels and resorts brands. Some of our popular past hospitality clients are Sheraton, Bloom Rooms, Imperial Grand Palace Hotel.

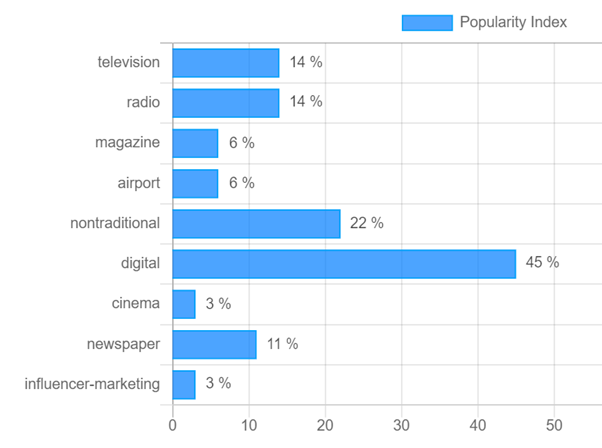

Hospitality – Top preferred media overall

The top 3 advertising platforms for hospitality brands are:

- Digital – Added to 24% campaigns

- Non-traditional- Added to 20% campaigns

- Magazine, Newspaper & Influencer Marketing- Added to 16% campaigns

Social Enterprises & Trusts

Social Enterprises & Trusts refer to NGOs and organizations working towards social welfare. Some of our past social enterprises & trusts are Peta India, Centre for Peace, India Fellow.

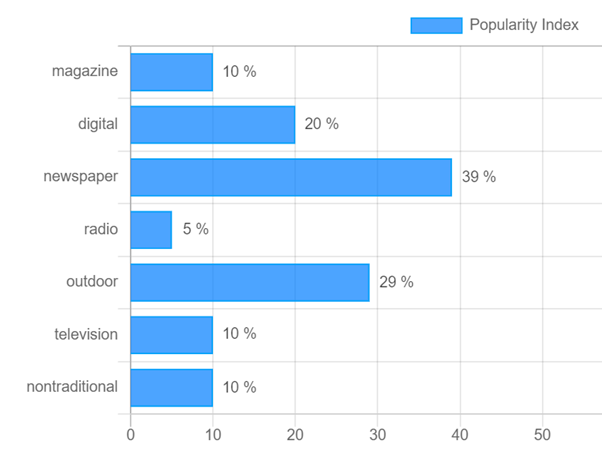

Social Enterprises & Trusts – Top preferred media Overall

The top 3 advertising platforms for social enterprise & trust brands are:

- Newspaper – Added to 39% campaigns

- Outdoor- Added to 29% campaigns

- Digital- Added to 20% campaigns

Automobile

The automobile category covers brands and dealer agencies selling brand new and used vehicles, brands that deal with tyres, and other automobile accessories. Some of our popular past automobile clients are Nine Star Suzuki, Tata Motors, TVS Motor Company, Ralco Tyres, Hyundai, Regent Honda.

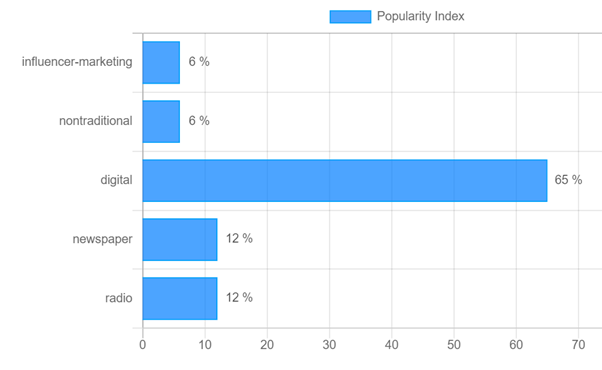

Automobile – Top preferred media overall

The top 3 advertising platforms for automobile brands are:

- Digital – Added to 65% campaigns

- Newspaper & Radio- Added to 12% campaigns

- Non-traditional & Influencer Marketing- Added to 6% campaigns

Travel & Tourism

The travel & Tourism category covers official tourism departments of tourist spots, travel agencies, and other travel-related companies.

Some of our popular past travel & tourism clients are TUI India, Chhattisgarh Tourism Board, Mizoram Tourism Board, Red Bus.

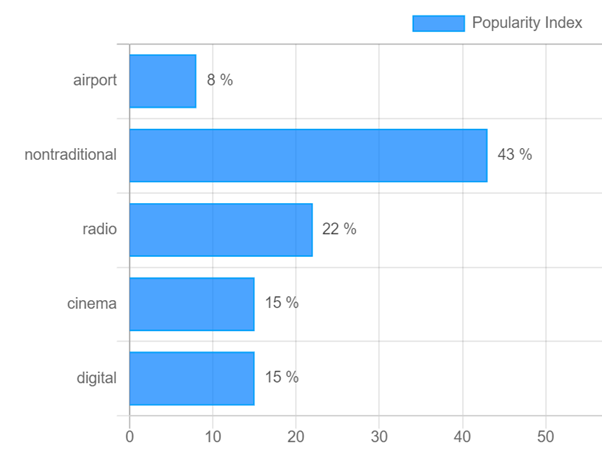

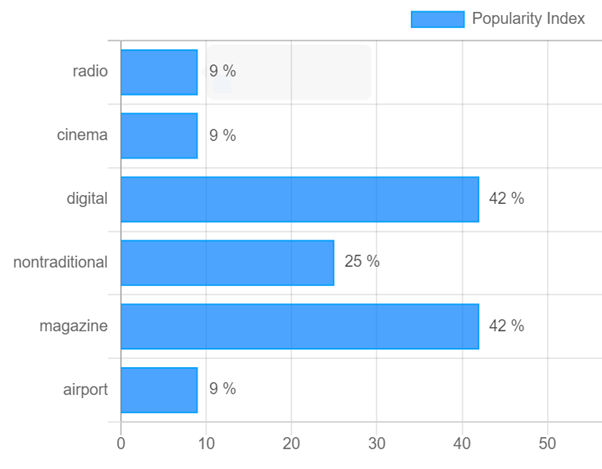

Travel & Tourism – Top preferred media overall

The top 3 advertising platforms for Travel & Tourism brands are:

- Digital & Magazine – Added to 42% campaigns

- Non-traditional- Added to 25% campaigns

- Airport, Radio & Cinema- Added to 9% campaigns

Hope you find our tool MASH useful. Do let us know in the comments or write to us at Help@TheMediaAnt.com with queries and suggestions.