In a groundbreaking move that has left all of India raving, Viacom18 and Disney Star have merged and are now known as the “New Titan” of the entertainment industry. Following the unparalleled cinematic flourish of Viacom18 and Disney Star’s merger is an amazing skill in storytelling, this new arrangement is reconstituting the scene. Through our living rooms and producers’ spaces, the whole nation has an intense feeling of excitement. Questions are flying: What will surprise us on the screen? How will our favorite series change that way? There won’t only be a merger but the start of an exciting story leading to a whole new expanded, richer, and diversified viewer experience everywhere.

In this article, we will delve into the intricate details of this monumental merger and explore its anticipated outcomes. From the perspective of consumers, advertisers, and the wider entertainment ecosystem, we will examine the transformative effects this union is expected to bring. From enhanced content offerings to innovative advertising strategies, and the broader implications for competition and market dynamics, the merger between Reliance Jio and Disney is poised to leave an indelible mark on the industry.

The Merger: Details and Analysis

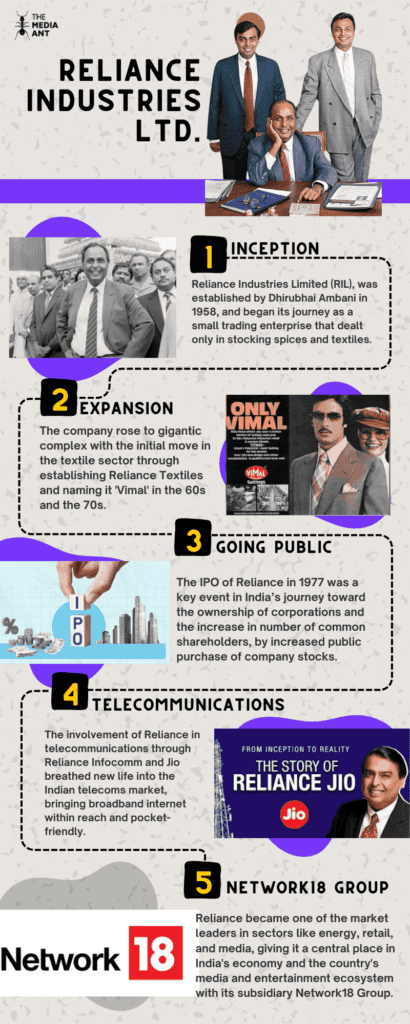

The venture of Reliance Industries Limited (RIL) with Disney Star in India is not only a business deal but also marking a significant shift on media and entertainment scenes in the country. This strategic alliance of supreme power resulted in the helm of the industry conglomerate, and is preserved approximately at ₹70,352 crore ($8.5 billion), which shows the immense growth in the industry’s evolution. This hands-on account examines the complexities of the deal, the implications of the merger on the Indian media realm and redraws the boundaries for competition between media houses.

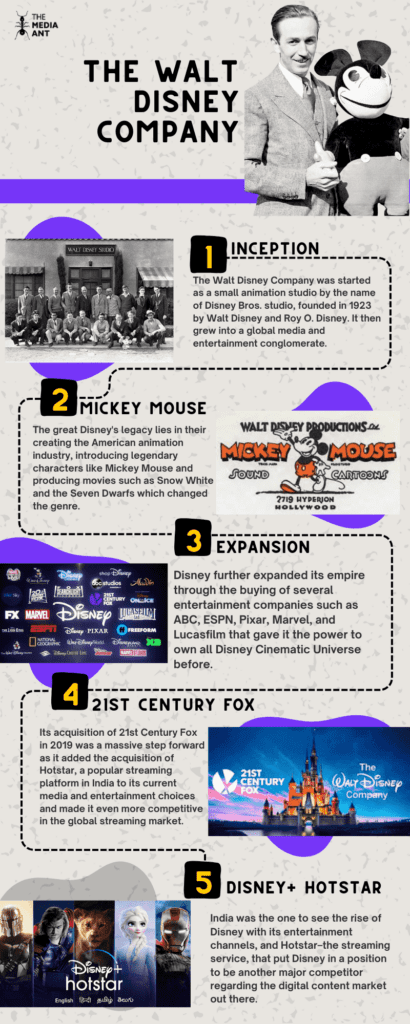

Global Media Powerhouse: The merger between Walt Disney Company and Reliance Jio, with Reliance holding majority control (63.16%), combines their global media influence and market knowledge to create a hybrid entity poised to compete and expand its presence in the market.

Market Dominance Reinforced: The Reliance Jio and Disney merger strategically strengthens their market position, poised to reshape and dominate India’s broadcasting and digital streaming sectors.

Content Synergy Unleashed: The merger will leverage Viacom18’s diverse content portfolio and Star India’s broadcasting and streaming expertise, overseeing 100+ TV channels spanning languages and genres, as well as major OTT platforms like Hotstar and JioCinema, to engage an audience of 750 million nationwide through entertainment, sports, and news.

Media Market Disruption: The merger reshapes the Indian media landscape, particularly the streaming sector, as the combined company emerges as a formidable competitor to platforms like Netflix and Amazon Prime Video, boasting a 30% market share and leveraging its extensive content library and nationwide distribution network to assert dominance in the Indian OTT market.

Industry Shake-Up Ahead: The merger is poised to trigger a wave of strategic realignments in the industry, prompting competitors to adapt their approaches and possibly pursue similar consolidations to maintain market positions. This market concentration could empower the merged entity in negotiations with content providers, advertising, and subscription fees.

A New Era of Entertainment: Impact on Consumers

The merger between Reliance Industries Limited (RIL) and Disney marks a significant transformation in India’s media landscape. This strategic joint venture aims to create a leading platform for Television and digital streaming in India, bringing together a vast array of content from both entities. The collaboration is set to enhance the availability and diversity of entertainment and sports content for Indian viewers.

Strategic Significance:

The partnership between RIL and Disney is not merely a business transaction; it represents a pivotal shift in the media and entertainment sector in India. By pooling their resources, these industry giants are poised to offer an unprecedented range of content, blending international Disney favorites with RIL’s stronghold on Indian media through Viacom18 and other channels. This amalgamation promises to cater to the varied tastes and preferences of India’s vast and diverse audience.

Impact on Consumers:

For Indian consumers, the merger means access to a richer and more diverse portfolio of content, including movies, TV shows, sports, and digital content across various platforms. The joint venture is expected to leverage the advanced digital infrastructure of Jio, RIL’s telecommunications arm, to deliver content more efficiently and affordably. This could lead to more competitive pricing and better service offerings, enhancing the overall viewer experience in India.

Consumers will benefit from a broader range of content choices and improved viewing experiences. For example, the merger could lead to the availability of Disney+ content on Jio platforms, providing Jio users with easy access to Disney’s extensive catalog of movies, series, and exclusive Disney+ originals, all within a single service.

Digital Transformation:

The RIL-Disney merger is set to accelerate the digital transformation of India’s media landscape. With the growing penetration of internet services and the increasing consumption of digital content in India, the joint venture is well-positioned to tap into this burgeoning market. It aims to provide a comprehensive digital entertainment experience, making high-quality content accessible across different digital platforms and devices.

The digital transformation aspect of the merger could be exemplified by the enhancement of streaming services with advanced technology, like 5G. RIL’s Jio, with its 5G infrastructure, combined with Disney’s streaming services, can offer high-definition, low-latency streaming experiences, even in remote areas of India, thus democratizing access to premium content.

Market Dynamics:

This collaboration will significantly influence market dynamics, potentially leading to increased competition and innovation in the sector. Other players in the Indian media and entertainment industry may need to strategize to compete effectively with this new powerhouse. The merger could drive improvements in content quality, viewer engagement, and technological advancements, setting new standards in the industry.

The merger is likely to intensify competition in the Indian entertainment market. For instance, existing players like Netflix and Amazon Prime might respond by investing more in local content and improving their service offerings to retain and grow their user base in India, leading to a more vibrant and competitive market.

TMA TALKS :

Do you think consumer consumption might change in response to the merger?

Certainly, new developments will emerge, without a doubt. Sports, which already holds a prominent position, may witness an increase in non-cricketing events, as profitability in cricket remains a challenge. Expectations for change are high in this area. On the entertainment front, there will be a significant push towards OTT platforms. Currently, popular formats such as KBC and Shark Tank are licensed, but with the integration of Jio and Disney, they’ll face competition from the content offered by Netflix and Amazon Prime. Consequently, viewers can anticipate the arrival and subsequent popularity of a variety of international shows in India.

What other genres or media options do you think will gain prominence as a result of this merger and why ?

Already, we are seeing digital streaming gaining prominence for news, infotainment, and music. The same trend will likely extend to live sports and movies, with wider penetration of connected TV and lower streaming costs, enabling viewers to access engaging content such as sports and movies on-demand rather than via DTH.

Consumers’ Gain, Advertisers’ Loss? The Impact on Advertiser

The merger between Reliance Industries Limited (RIL) and Disney is not just reshaping the media landscape; it’s poised to revolutionize advertising strategies in India. With the combined reach and diverse content offerings of both entities, advertisers stand to benefit from unparalleled opportunities to engage with a vast and varied audience.

Expanded Reach and Targeting

The merger creates a platform with extensive reach across TV and digital streaming, allowing advertisers to access a larger audience base than ever before. Moreover, the diverse content portfolio enables precise targeting, ensuring that advertisers can tailor their messages to specific demographics and interests, thereby maximizing the impact of their campaigns.

Innovative Advertising Solutions

The synergy between RIL and Disney opens doors to innovative advertising solutions that seamlessly integrate into the viewing experience. Whether through product placements, interactive ads, or branded content, advertisers can leverage the immersive nature of the content to create memorable and engaging brand experiences for consumers.

Negotiating Power and Competition

With the merger consolidating market share and influence, advertisers may find themselves negotiating with a stronger and more dominant entity. This could lead to changes in pricing, terms, and overall strategies as advertisers adapt to the new landscape. Additionally, increased competition from the merged entity may spur other media companies to innovate and enhance their advertising offerings to remain competitive.

TMA TALKS :

How might the merger influence the advertising and marketing strategies of other players in the industry?

With a combined market share of almost 50% in the advertising pie, it will create a lot of disruption for sure, we can’t predict but there may be a shake-up among other TV and digital publishers. There would also likely be some rationalization in content costs as well, leading to industry-level margin improvement, but advertisers having to shell out more.

Confronting Competitors in the Evolving Media Landscape

The merger of Viacom18 and Disney Star signifies a seismic shift in the Indian media ecosystem, heralding a new era marked by intensified competition, evolving consumer preferences, and regulatory challenges. This union not only creates a behemoth in the media and entertainment sector but also redefines the contours of content consumption, distribution, and monetization in a market teeming with over a billion potential viewers.

The combined entity, with its vast array of channels, digital platforms, and content libraries, is poised to command a significant market share. Prior to the merger, both Disney’s Hotstar and Reliance’s JioCinema and JioTV were pivotal in capturing the audience’s attention, particularly through cricket broadcasting. The merger escalates this influence, giving the new entity a dominant position, especially in the streaming of premium sports content like the Indian Premier League (IPL) and international cricket events.

The dominance extends beyond sports, encapsulating a wide genre of entertainment and news content. With control over a substantial portion of the media landscape, the merged entity could potentially reshape market dynamics, influencing everything from content creation and pricing strategies to the advertising model and consumer engagement.

TMA TALKS :

What strategic advantage do you think that this merger between Reliance and Disney could bring in context to the media market ?

I believe that in the overall media market, it will evolve into a two-polar strength market. On one side, there’s Sony, and on the other side, Jio and Disney are now unified. This consolidation presents a significant advantage, offering a clearer path for increased investment in the market. Specifically examining Jio and Disney’s merger, Jio has previously focused on news, successfully acquiring certain companies in that sector, along with a presence in entertainment, particularly sports. Conversely, Disney has a dominant position in the entertainment industry. With this merger, Jio’s offerings become more comprehensive. These are the two primary advantages this consolidation will bring to the media market, allowing the unified entity to capture a significant portion of the market share. For instance, in negotiations with Hindustan Unilever, the unified Jio-Disney entity presents a more formidable counterpart.

Effect of the merger on the OTT platforms in India

Indian audiences may face a permanent loss of privacy once Hotstar and Jio Cinema, the competitors, try to dominate the sport streaming rights. This shows the potential merger future which will see Indian audiences with access to all sport events centralization. Like elsewhere, these platforms hold audiences with their entertainment content IPs, while Zee5 and SonyLiv attract viewers respectively. We’ve drawn insights from the “COMSCORE Whitepaper – The State of Streaming – OTT Landscape in India” to enrich our discussion.

Growth of the OTT Universe in India

Over the span from January 2020 to January 2024, the OTT market in India has seen exponential growth. According to MMX Multi-Platform data, the market size has expanded to an impressive 460 million, with OTT penetration reaching 87.8% of the digital universe. This rapid growth not only reflects the increasing preference for digital streaming over traditional media but also indicates the vast potential for new entrants and existing players to innovate and expand their services to cater to the digitally savvy population.

Seasonal Trends Influenced by Sporting Events

The Indian Premier League (IPL) of 2023 marked a significant surge in viewership for Jio Cinema, with the platform achieving a remarkable peak of 151 million unique visitors. This trend was echoed later in the year by the ICC Cricket World Cup, which propelled Hotstar’s reach to an impressive peak of 191 million unique visitors in November 2023. These statistics underscore the considerable impact major sporting events have on driving audience engagement and expanding the reach of OTT platforms in India.

Insights on Market Consolidation

Industrial OTT in India shows exponential growth in the period starting from January 2020 to January 2024, In accordance with MMX Multi-Platform index, the area of the market has overcome the obstacle of 460 million, with the penetration of OTT in the digital universe cover almost 87,8% of the digital universe. Such an impressive growth rate points not only to the rise in popularity for streaming services versus conventional types of media but also illustrates the immense opportunities for newcomers and existing players to stir the market and develop their business by offering innovative communication solutions aimed at a continuously growing number of savvy digital users.

Competitive Challenges

During the year 2023 the popular JioCinema Platform achieved another milestone as it had recorded a remarkable viewership of over 151 million unique visitors which was considered as the peak moment. This achieved a similar result when the ICC Cricket World Cup arrived, the visitation hour of Hotstar came to a peak of 181 million visitors in the month of November 2023. Such numbers further illustrate the massive influence of these events on broadening the audience of OTT platforms, and enlarging the outreach of the streaming media in India.

Regulatory and Antitrust Concerns

The trend of convergence of the top players in the OTT sector of India is seen to be emerging in the ceaselessly changing competitive market of the country. The Curated data bullet points 160 million and one unique visitor to some of the platforms that represents a certain degree of saturation in the market. While still behind such top platforms in the consolidated reach in terms of the unique visitors which equals 76 million, some websites are able to offer a more segmented market distribution. This tit-for-tat movement of the OTT industry platforms depicts the strategic movements wherein they continually work to cater the audience and provide them with the entertaining content in order to gain hold in their mindset and sustain the viewership.

Predicting the Media Giants’ Path Forward

The RIL-Disney merger is shaping up to be a transformative event in the media industry, combining the strengths of two media behemoths to redefine the entertainment and sports broadcasting landscape in India and potentially globally. The merger between Reliance Industries Limited’s Viacom18 and Walt Disney’s Star India is poised to create an $8.5 billion media powerhouse. This union is strategic, enhancing RIL’s dominance in the Indian market while allowing Disney to recalibrate its business strategy in the region. The merged entity will command an impressive array of over 100 TV channels and two major OTT platforms, reaching a vast audience base of 750 million viewers across India.

- A closer look at the merger reveals a strategic play by RIL to bolster its telecommunications arm, Jio, by integrating premium media content and distribution. This move not only enhances Jio’s market offering but also positions the joint venture to tackle the competition from global tech giants like Google and Meta more effectively.

- The joint venture gains control of key sports broadcasting rights, including the IPL, ICC, and BCCI. This consolidation of sports content under one umbrella can significantly impact viewer engagement and advertising revenue, setting new standards for sports broadcasting in India and beyond.

- The merger’s financial undertones highlight RIL’s investment commitment and the financial recalibrations for Disney, reflecting the strategic importance of this venture for both parties. RIL’s planned investment of $1.4 billion underscores the venture’s growth prospects, while Disney’s impairment loss indicates the financial adjustments involved.

It is indeed a real game-changer and we are looking at it as the big one, aren’t we? When mediamen combine Viacom18 of Reliance with Star India of Disney, then it is a $8.5 billion superstar not just for reshaping the Indian media world, but also has the potential to become a new global standard. They have more than a hundred TV channels and two prominent OTT pages, and they’re telecasting to a hugely impressive 750 million viewership in India.

Together with Jio expanding its arsenal through this acquisition, and the assumption of the position as the main player in Indian sports and the development of rights agreements, it becomes evident that they are getting ready to compete on the global arena. Obviously, it indicates their intention for new development and involvement in the dynamic environment. For sure, yes, exciting times are coming!