In the series TV advertising for first time advertisers, we have covered the following topics:

- TV Advertising Facts & Figures: Useful facts and figures about television viewership and advertising in India, curated from reports by leading bodies like BARC, TAM, and EY.

- TV Campaign Measurement Terms Explained: How TV programs and campaign viewership are measured in India and some relevant terms that can help advertisers know more about the TV viewership measurement.

- Data-driven Television Campaign Planning: The process of television advertising planning in brief and also explore how data obtained from authentic bodies like BARC can help us in making the right choice about television campaign planning

- How a post-evaluation report can help brands optimize their TV campaigns: A case study

- In this article, we would try to understand how a competitor analysis report can help brands understand the advertising strategy followed by the top players in the category.

What is a competitor analysis report?

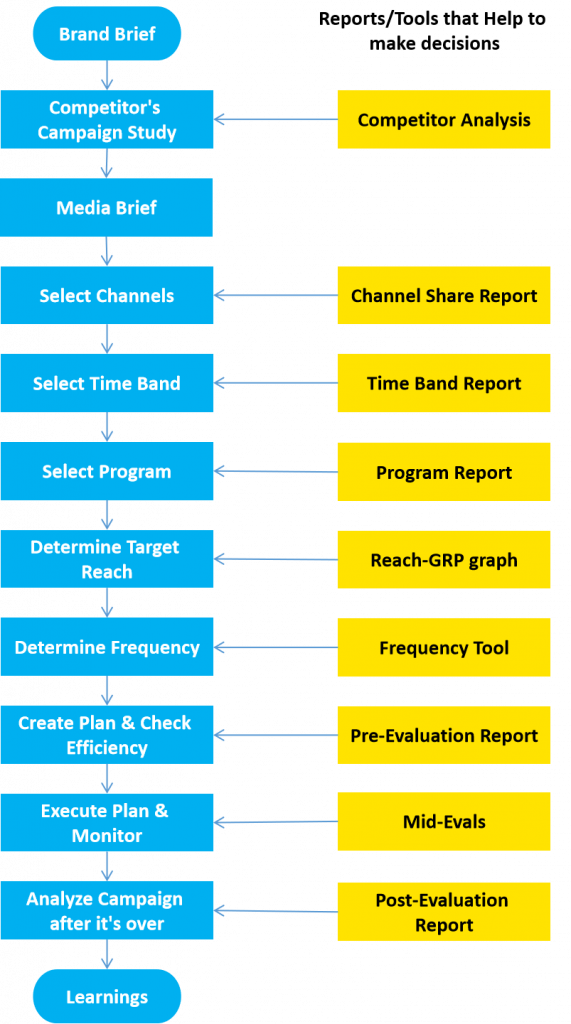

In the last article, we discussed the various steps in TV campaign planning. Following is a flowchart with all the underlying steps.

If you remember our last article, the TV campaign planning process started with the brand sharing a brief description of the brand/product, the core target group, the target market, the message that they would like to convey and the campaign objective. The media agency works on the brand brief and comes up with a media brief that contains the following:

- Media goals to achieve the marketing objective: This would translate into expected reach and frequency for the campaign.

- Campaign Approach: Now that we have the media goals, the accompanying question is what would be the campaign approach while selecting the right channel mix for the campaign. Few of the very popular campaign approach strategies are:

- Maximize Reach

- Minimize Spillage

- Maximize Impact

- Maximize Cost Efficiency

- Recommended Budget: Based on the suggested media goal or competitor analysis.

In a number of scenarios, especially in the case of advertising on TV for the first time or a new product, brands do not have a clear idea of details like reach and frequency, etc. The media agency, in this case, can do a competitor analysis to find details about how other brands in the same categories advertise on TV. This provides the brands with insights about the competitor’s advertising campaign strategy and may include some or all the following information:

- SOE (Share of Expenditure): Brand spend in value as a percentage of the total adex of the category.

- SOV (Share of Voice): The brand’s GRPs as a percentage of the total GRPs delivered by the category.

- Channel mix: Which channels and genres did the brands select to run their ads

- Scheduling: How were the spots distributed across the days and time bands

- Time Band Mix: Distribution between Prime Time and Non-Prime Time Bands

- Program Mix: The top programs included in the plan

- Reach & Frequency: On average, what type of reach and frequency do the brands in the same category have achieved in the past campaigns

- Campaign objective and creative: What has been the most common campaign objective across brands and what message their creatives carry.

We also discussed about BARC tool that provides the most authentic historical TV viewership data. For this article, we will use data from BARC tool.

Understanding Competitor Analysis Report through an example

To understand a Competitor Analysis Report in a better way, we have an example. Brand E is a new entrant in the edtech category and wants to know how other players in the category advertise on television. We have pulled a report on all the edtech brands that have advertised in the last one month and in this article, we will understand trough various analysis, how TV advertising in the category works. Although the data presented in the article is real, the name and some details have not been included. We identified there were four brands that were active last month and for convenience, we would identify them as brand A, brand B, brand C and brand D.

The report contains data for four weeks from week 27 to week 31. The TG is 2+ All NCCS and market is all India. All analyses have been done on GRPs.

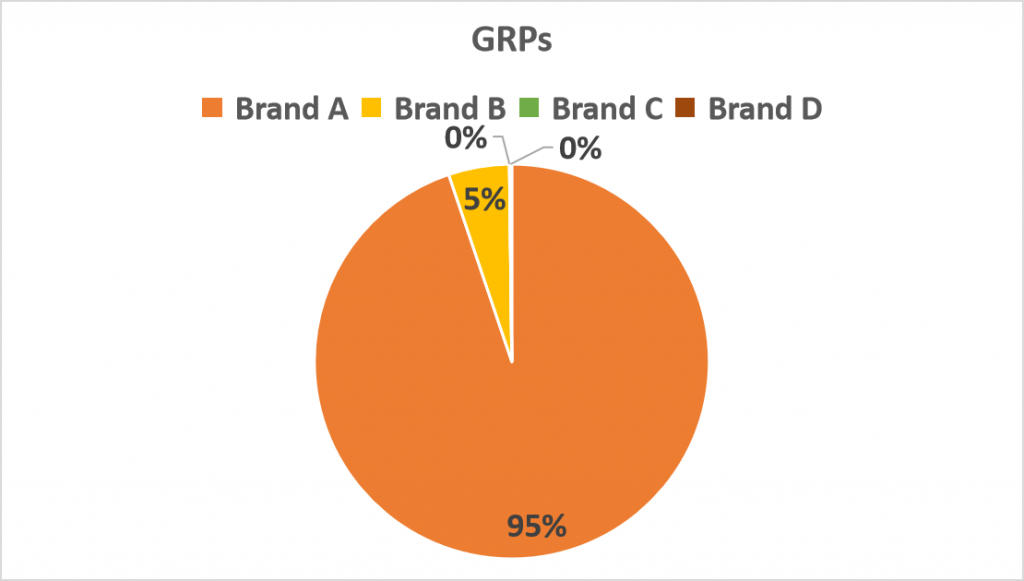

Share of Voice (SoV)

As we can see in the chart above, brand A seems to be the leader in terms of TV advertising with 95% SOV followed by brand B with only 5% share. Brand C and brand D have negligible presence.

SOV would give brands a rough idea of the platform- whether it is dominated by a single brand or if there is a fierce competition among brands for SOV. In this case, it’s clear that TV advertising in edtech category is owned by brand A.

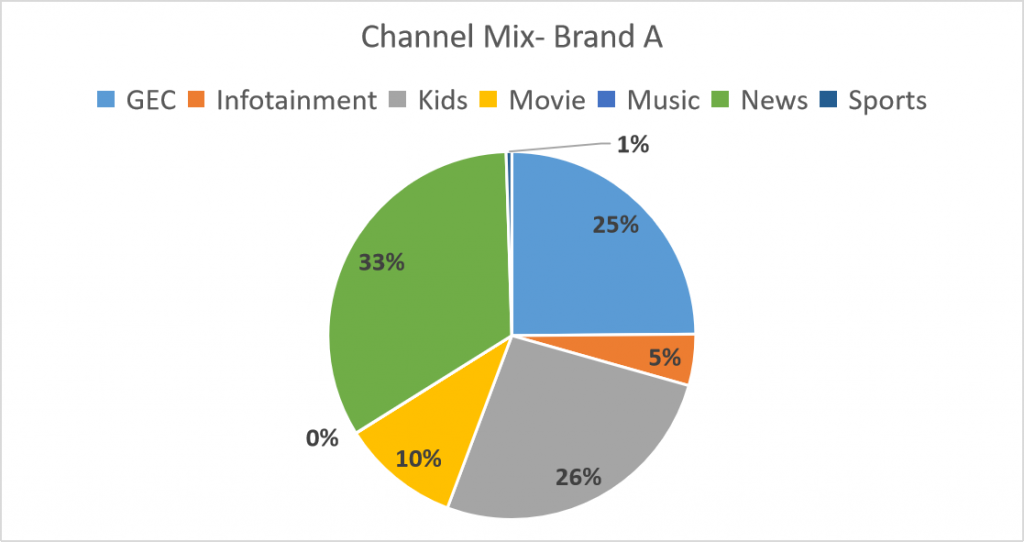

Channel Mix Strategy

Brand A: Brand A has advertised in various genres ranging from reach genres like GECs and movies to niche genres like infotainment. The top 3 genres for brand A are News, Kids and GECs.

Others: Brand B has advertised only in Movies and News channels. Brand C and brand D have only advertised in News and Infotainment genres respectively.

This analysis gave us a clear picture of what kind of channels do these brands prefer to target their audience. However, relying on this data only might not give you a complete picture. You might want to additionally look for the following data too:

- Brands’ product mix- for example, brand A has offerings for kids too which justifies it’s presence on kids channels.

- If there’s a factor that is affecting the time period for which analysis has been carried out. In this case it would be Covid-19 that has made news genre popular as compared to GECs that are still grappling with delay in producing fresh content.

- The objective of the marketing campaigns- whether it is a generic branding ad or a new product launch etc.

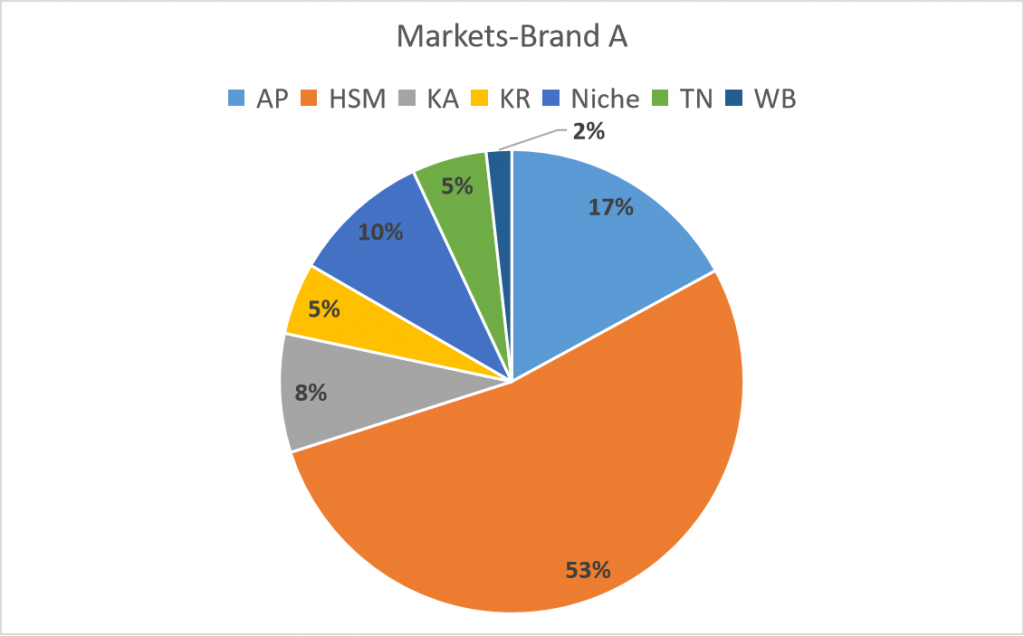

Top Markets

Brand A: Brand A has a mass reach and is present across all the markets including Hindi-speaking, English-speaking, Southern states and West Bengal. The top 3 markets identified for brand A are HSM, AP/Telangana and English-speaking markets.

Others: Brand B has a focus on HSM market while Brand C and D focus on niche markets (English speaking audience).

Among all the brands, English-speaking audience emerge out as the most common market. This is owing to the fact that English speaking audience is assumed to be more tech-savy and hence more willing to try out edtech services.

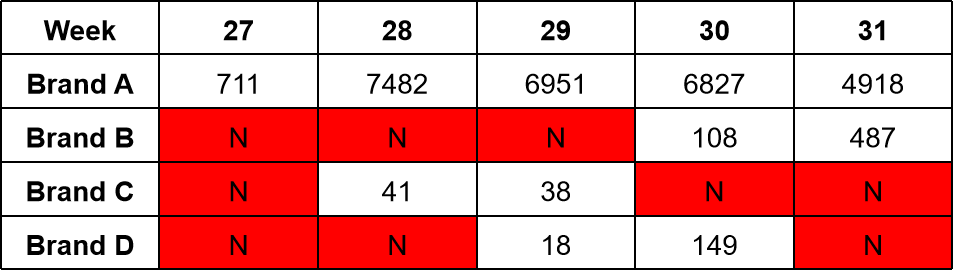

Scheduling

In the table above, we can see the week-wise split of ad spots for the brands. Brand A is the only brand with continuous advertising with decreasing number of spots every week while Brand B, C and D follow intermittent advertising. However, in order to determine ad scheduling, 5 weeks is a very small period hence, it’s not a good idea to come to a conclusion yet without looking at the data for a longer period.

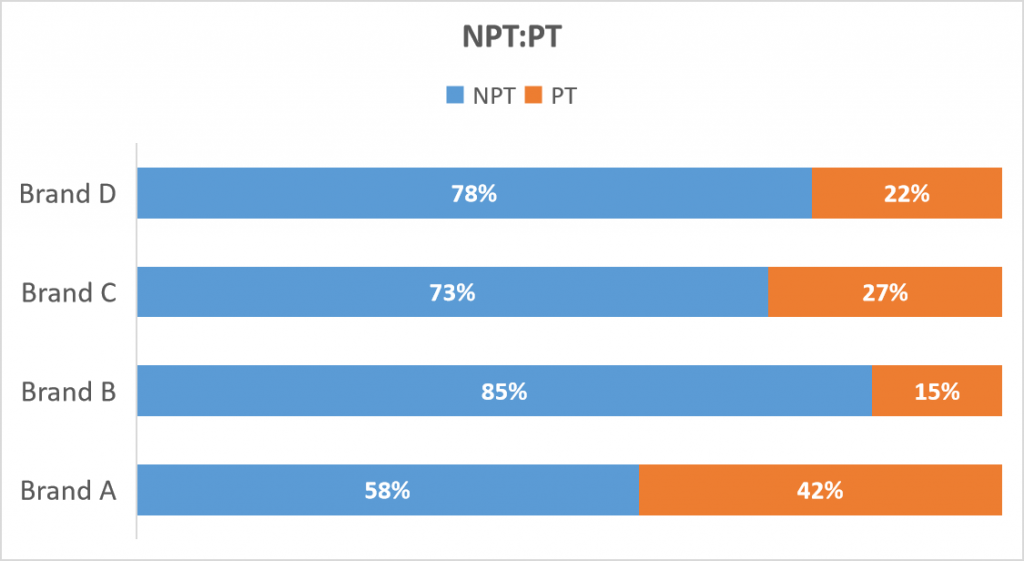

Time Band Mix Strategy

The chart above represents the time band split between Prime Time and Non Prime Time bands. Prime Time bands are particular hours in a day when the viewership is higher than the rest of the day. The prime time bands mostly coincide with the non-office hours. Usually, on weekdays, for most channels, prime time is from 6 pm to 12 am except for news and music channels for which 7 am to 10 am is also prime time band. For weekends, the prime time band covers the entire day from 6 am to 12 am.

Brands prefer advertising during prime time because advertising in prime time means higher viewership and higher engagement. However, there is a premium brands have to pay for advertising during the prime time band. Hence, even though brands would love to have 100% prime time spots, it’s always a mix of prime time and non prime time band spots.

Brand A has maintained a ratio of 60:40 between non prime time band and prime time band advertising. The ratio however is heavily skewed towards non prime time band advertising for brand B, C and D.

Creative Duration

During a campaign, brands usually run a number of creative edits i.e. the same creative (same message) presented through videos of various length. This analysis helps brands to understand which ad length brands prefer and which one works the best. As we can see in the chart above, 30-sec edit was the most common edit for brand A. For brand B and D also, 30-sec creative was the most common while brand C used 20-sec edits the most.

There are few other details that can be obtained under competitor analysis report like campaign spends, reach and frequency, creative types etc.

In the next articles in the series, we will discuss more reports. In case you are interested in TV advertising and would want a detailed report for your business, let us know at Help@TheMediaAnt.com or visit www.themediaant.com/television.